Valuation Techniques and Financial Modeling Skills for Investment Roles

Valuation Techniques and Financial Modeling Skills for Investment Roles

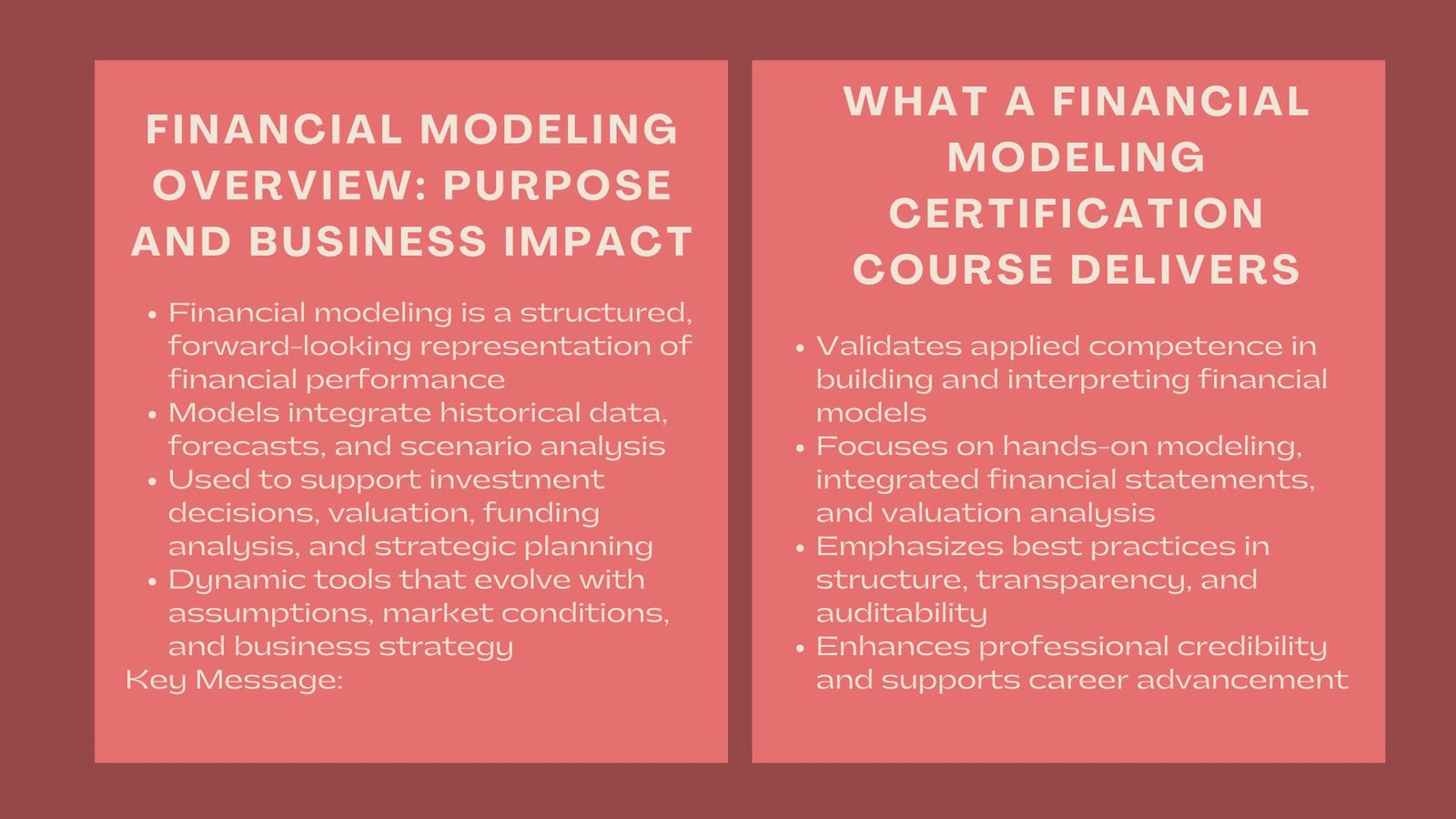

Introduction to Valuation Techniques and Financial Modeling Skills for Investment Roles

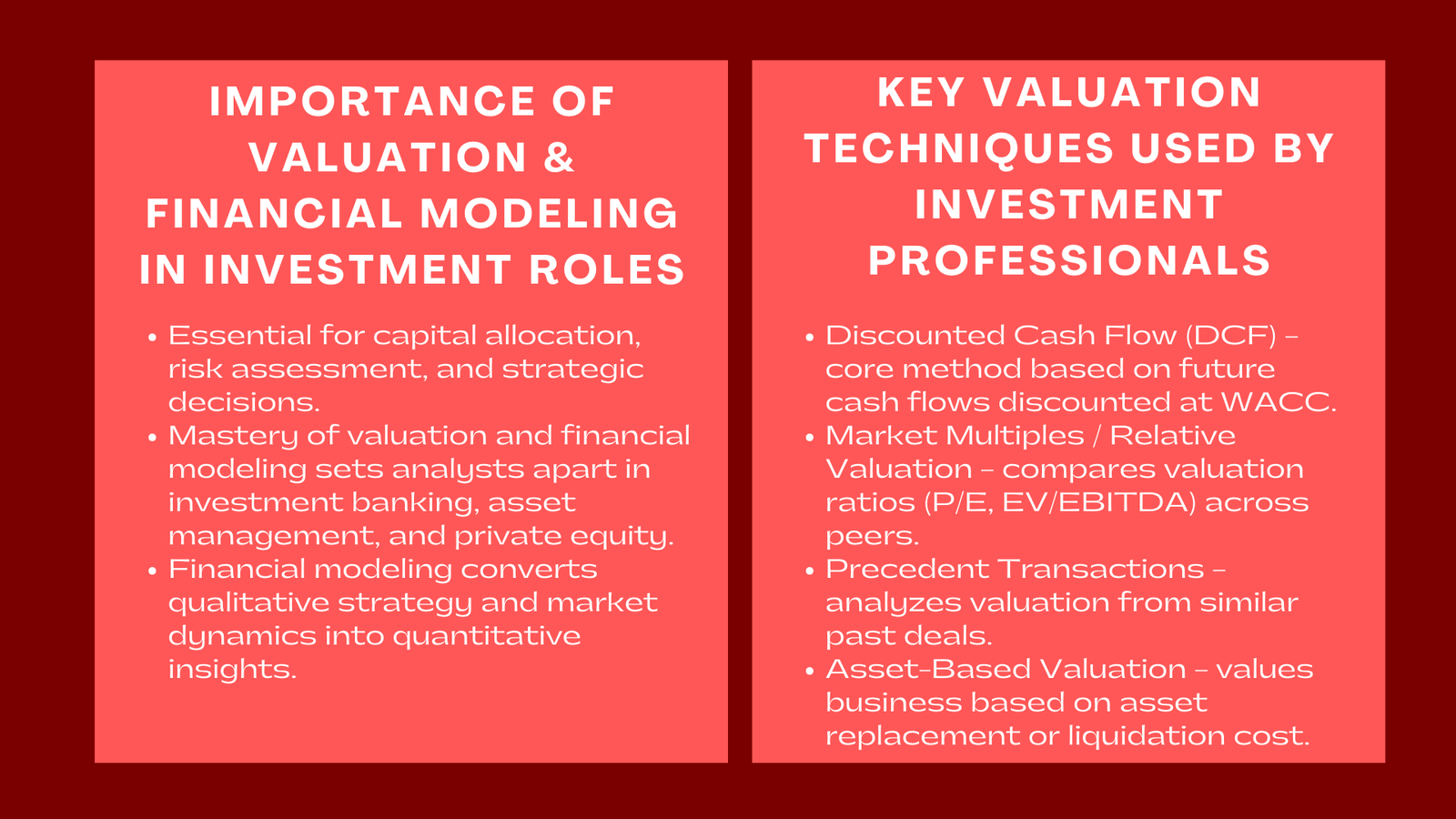

Underlining every investment decision is the value. One may be contemplating a start-up, a listed company, or a multi-billion-dollar infrastructure asset, but the core question will still be the same, what is it worth and why? Proper valuation forms the basis of capital allocation, assessment of risks and strategic decision-making. Within the challenging environment of investment banking, asset management and private equity, which requires an individual to excel at financial modelling and valuation techniques, an individual who can perform valuation tasks and financial modelling tasks at a high level will stand out as a high-quality analyst amongst the competent ones.

Monetary modeling converts valuation theory to action information. It converts qualitative measures on strategy with valuation techniques and financial modeling skills for investment roles Singapore competition and market dynamics into quantitative forecasts and measures. Investment models are applied by investment professionals to estimate value, as well as to convey logic, warrant assumptions, and experiment with possible alternatives. Valuation modeling in a sense is the lingo of investment decisions.

This paper discusses the most applicable valuation techniques in investment professions as well as the way financial modeling enhances their use. It also serves to criticize analytical mentality, technical skills and professionalism needed to succeed in valuation-based environments.

Understanding Valuation in the Context of Investment Roles

The Purpose of Valuation

The information and investment action come together through valuation as the line of analytical activity. It is the price that investors are ready to pay; it is the information on which capital budgeting, financing and strategy decisions of corporate managers are made. With a good valuation model, investors can be able to determine whether an asset is underpriced, fairly priced, or over priced based on its intrinsic value.

Valuation forms the foundation of mergers and acquisitions (M&A) advisory, fairness opinion and financing transactions in the investment banking industry. It is used to screen investments in private equity and venture capital and to plan an exit. Valuation in asset management leads to the allocation of portfolios and risk management. In all settings, valuation is art and science, a scientific procedure of converting imperfect information into acceptable financial opinions.

Integrating Financial Modeling and Valuation

Valuation is operationalised in financial modeling. As much as valuation theory offers conceptual models of discounted cash flow (DCF) or market multiples, modeling is a process of converting them into dynamic instruments which reflect the interactions of revenues, costs, capital and risk that are inherent in the real world.

Investment models are used by investment professionals in an attempt to measure expectations, sensitivities, and expected returns in different situations. How financial modeling supports business and investment decision-making is no longer merely about numbers being generated by a well-built model; it is a financial story; how a business creates a value and how this value can be redistributed among stakeholders and how external forces may change this trend. A strong and robust model is as significant in valuation as a strong and sound assumption.

Core Valuation Techniques Used in Investment Analysis

Discounted Cash Flow (DCF) Valuation

DFS is still considered as the foundation of valuation. It is based on the fact that the value of an asset is equal to the present value of future cash flow expected to be received about it. Analysts make forecasts of the free cash flows within a definite period of time, make forecasts of a terminal value which represents cash flows after the expiry of that period and discounts the flows at a rate which indicates the risk profile of the assets- usually the weighted average cost of capital (WACC). In practice, this approach is also widely applied in financial modeling Singapore for finance and investment, especially when assessing long-term value creation.

DCF analysis requires profound knowledge of financial reports, functioning forces and macroeconomics. The precision of findings relies on realistic forecasts of development, margins, as well as capital expenditures. The scenario analysis is also of great significance as shown by the sensitivity of valuation to discount rates and terminal growth assumptions. Technical competence and economic intuition have been shown to be fundamental traits of good investment positions in which one must possess DCF modeling skills.

Market Multiples and Relative Valuation

Relative valuation is a companion of DCF, which involves comparison of a target company with a peer group or similar dealings. The common ones are price-to-earnings (P/E), enterprise value-to-EBITDA (EV/EBITDA), and price-to-book (P/B) ratios. These multiples give the market valuation on similar assets and gives us an idea on a company whether it is overvalued or undervalued.

Investment analysts need to choose the right comparables, standardize data of non-recurring items, and correct in growth variations and capital structure, or in the market environment. As relative valuation is straightforward and fast, it needs a high level of judgment to prevent inappropriate comparisons. The most appropriate analysts apply relative valuation not as the alternative of DCF but as a check and balance that the intrinsic valuations are either confirmed or a challenge.

Precedent Transactions and Deal Comparables

Use of precedent transaction analysis in acquisition transactions is quite common in the evaluation of acquisition premiums and the implied range of valuation in mergers and acquisitions. This method analyzes the price of comparable transactions in the same sector and modifies it in terms of size, time and strategic reason.

Development of the precedent transaction model entails an evaluation of enterprise value multiples that have been paid in previous deals, interpretation of the synergies and the motivation behind deal premiums. In the case of investment bankers and corporate finance subjects, the method offers a realistic understanding of the behavior in the market and negotiation processes.

Asset-Based and Replacement Cost Valuation

Asset-based methods of valuation use estimates on the replacement cost or the liquidation cost of assets of a company in estimating the value of a company absorbing any liabilities of the company. These methods are applicable, though less often, in going-concern analysis, but they apply to asset-intensive industries (real estate, infrastructure, and natural resources).

The asset-based valuation modeling requires critical consideration of all physical and intangible assets taking into consideration depreciation and obsolescence and the market factors. These models are frequently combined with income-based techniques to cross validate findings by investors especially when cash flows are uncertain or volatile.

Building and Applying Valuation Models

Model Architecture and Logical Flow

The credibility of a valuation model is based on its structure. The model should be rationally ordered, that is, input assumptions, calculation modules, and output summaries. There are the parameters of macroeconomic indicators that are accepted; operational drivers; and the parameter of capital structure. The calculation modules obtain revenues, costs, financing flows, and cash generation whereas the outputs summarize the valuation results, important ratios, and sensitivity analysis.

An accurate model architecture is also achieved by maintaining discipline which is convenient in providing transparency. Models are frequently passed on or shared among teams and it is this aspect of models that makes readability and documentation a necessary process among investment professionals. An organized model makes it look professional and creates trust in the clients, co-workers, and investors.

Integrating Financial Statements and Forecasts

Sophisticated models of valuation bring together income statement, balance sheet and cash flow. It is internally consistent with this integration — changes in revenue assumptions should have an impact on working capital, capital expenditures should have an impact on both depreciation and financing decisions should have an impact on the cash flow and the equity value.

Advanced modeling skill is the process of constructing this three statement integration. It allows the analysts to analyze the financial stability of a company as a whole and not independently. Such models are used by investors to determine whether the projected performance is made in line with funding requirements and strategic objectives.

Scenario and Sensitivity Analysis

There is ambiguity in valuation. Scenario and sensitivity analysis enable analysts to know impacts of important assumptions on the result of valuation. Analysts can determine what factors are most important by changing the level of inputs, e.g. sale growth, margins or discount rates.

This is an analytical skill of high importance to investment professionals. It can assist them to express not just point estimates of value but also a range of the possible outcomes and can make them make safe decisions. Sensitivity analysis also exhibits the soundness of the assumptions and enhances the believability of the recommendations that appear in the committee of investment or clients.

Valuation in Different Investment Contexts

Investment Banking and Mergers & Acquisitions

Valuation modeling is the foundation of the deal structuring and advisory business in investment banking. Analysts construct DCF, precedent transaction, and similar company models to recommend clients on the acquisition, divestiture or the first offering (IPOs). Pricing, negotiation strategy, and fairness opinion are guided by such outputs of valuation.

The fact that there is always a pressure to provide good, defendable valuations within tight deadlines requires a combination of technical expertise and judgment. The banker needs to understand how to interpret model outputs in strategic, regulatory, and market conditions and this requires one to be able to make action recommendations in the form of numbers.

Private Equity and Venture Capital

The use of valuation models is dependent on private equity and venture capital professionals in order to assess their potential investments as well as predicting the outcomes of exiting. Leveraged buyouts (LBO) models Complicated leverage financing Structures and their effect on equity returns In private equity, leveraged buyouts (LBO) models, or LBOs, are complex financial structures that mimic debt financing structures. Valuation in venture capital is used to rely on future events (depending on a multiple of the revenue) or probability-based scenarios.

Such models have to be flexible and contain uncertainty and the aspect of iterative nature of deal evaluation. Portfolio management and investor bargaining in the negotiation process are the decisive elements given by the capability of developing dynamic models that will facilitate accommodation of new information.

Asset Management and Portfolio Analysis

Valuation modeling is of value to the asset managers in making portfolio allocation and risk management. The portfolio managers would be able to determine the mispriced securities, risk exposure and optimize on investment strategies by valuing the securities under varying conditions.

Continued monitoring can also be done through modeling. With changing markets, necessary valuation models can assist managers to make appropriate changes in a timely manner, so that the portfolios can be kept in tune with the desired risk-return profiles.

Developing Financial Modeling Skills for Investment Careers

Technical Foundations

Technical knowledge of financial modeling programs and Excel is the basis of investment analysis. To operate as an analyst, the employee should learn to handle data manipulation functions, forecasting functions and valuation functions. In addition to mechanics, Financial theory (cost of capital, risk premia, and capital structure) will assure that the reasoning behind the model is consistent with financial theory.

Ideally, the ideal modelers integrate the understanding of ideas as well as technical expertise. They acknowledge that a model can only be as sound as reasoning, which supports it.

Analytical Mindset and Business Understanding

Valuation modeling is not about calculation skills, it needs business skills. The analysts should be in a position to comprehend the value drivers of an industry, competition forces as well as macroeconomic factors. The contextual awareness enables them to build real forecasting and meaningful results.

The judgement of the investment is done by professionals with good analytical minds able to bridge numbers to stories as to why value changes and not the amount of value changes. This is the interpretive ability which is different between strategic thinkers and technicians.

Professional Discipline and Quality Assurance

High stakes valuation brings accuracy, transparency, and consistency. Professional modelers do write down assumptions, test formulas as well as version control. In the majority of the most reputable investment institutions, peer reviewing and model auditing are the norms.

Ethical responsibility goes further to discipline. Since the decisions taken by the analysts on the valuation have an impact on investment decisions and valuation in the market, the analysts have to exercise integrity in making assumptions and avoiding the temptation to manipulate outcomes to reach the desired conclusions. These professional standards are important because they determine the reliability of the model as well as the modeler.

Career Impact of Valuation and Modeling Mastery

Credibility and Influence

On the investment side, analytical competence is used to create credibility. Those who can create, analyze and justify valuation models are rewarded a lot of confidence by clients, other employees as well as top management. They have their views entertained in negotiation, investment committees, and strategic talks.

Exceptional modeling capabilities can help analysts become advisors: people who could influence decisions as opposed to just being their supporters. Such credibility enhances the career pace and the leadership opportunities.

Mobility Across Investment Disciplines

The expertise in valuation and modeling can be cross-moved in the areas of investments. Analysts are able to transfer to the equity research part of the firm, then to the project finance part, a private equity part since the principles of analysis are the same. This cross-functional mobility is the factor that strengthens each career within the increasingly interconnected financial environment, causing global employability.

Continuous Learning and Adaptation

The sphere of valuation advances and advances as novel data analytics and machine learning technologies emphasize and enhance automation. The new technologies have resulted in new valuation tools which require integration with the traditional valuation tools in order to keep up with the competition. Nevertheless, the basic reasoning of the financial modeling of the organization, prediction, and discounts of the cash flows cannot be disregarded.

There are professionals who remain career-relevant and influential in the long-run by constantly enhancing their capabilities and keeping up with new approaches.

Conclusion

The intellectual and practical base of investment analysis is made up of valuation techniques and financial modeling skills. They equip the professionals to convert uncertainty to insight, intuition to structure and data into decisions. Some techniques include DCF to market multiples, scenario modelling to deal valuation, and these techniques define how the investment world perceives and creates value.

To future and current professionals in the investment field, valuation modeling proficiency is not only a weapon, as a technical tool, but a language of authority, trust as well as power in tactics. People that are able to model value with precision and interpret them with insight not only justify investment decisions, but they also determine them.

In an age where capital flows fast and competitions are very high, valuation mastery is a difference between the followers and the leaders. It is the gateway to financial theory and practical success – a set of skills that does not only define the consequences of investments, but also predetermines careers in the most starring spheres of global finance.