Leveraged Buyout LBO Modeling Explained for Private Equity Careers

Leveraged Buyout (LBO) Modeling Explained for Private Equity Careers

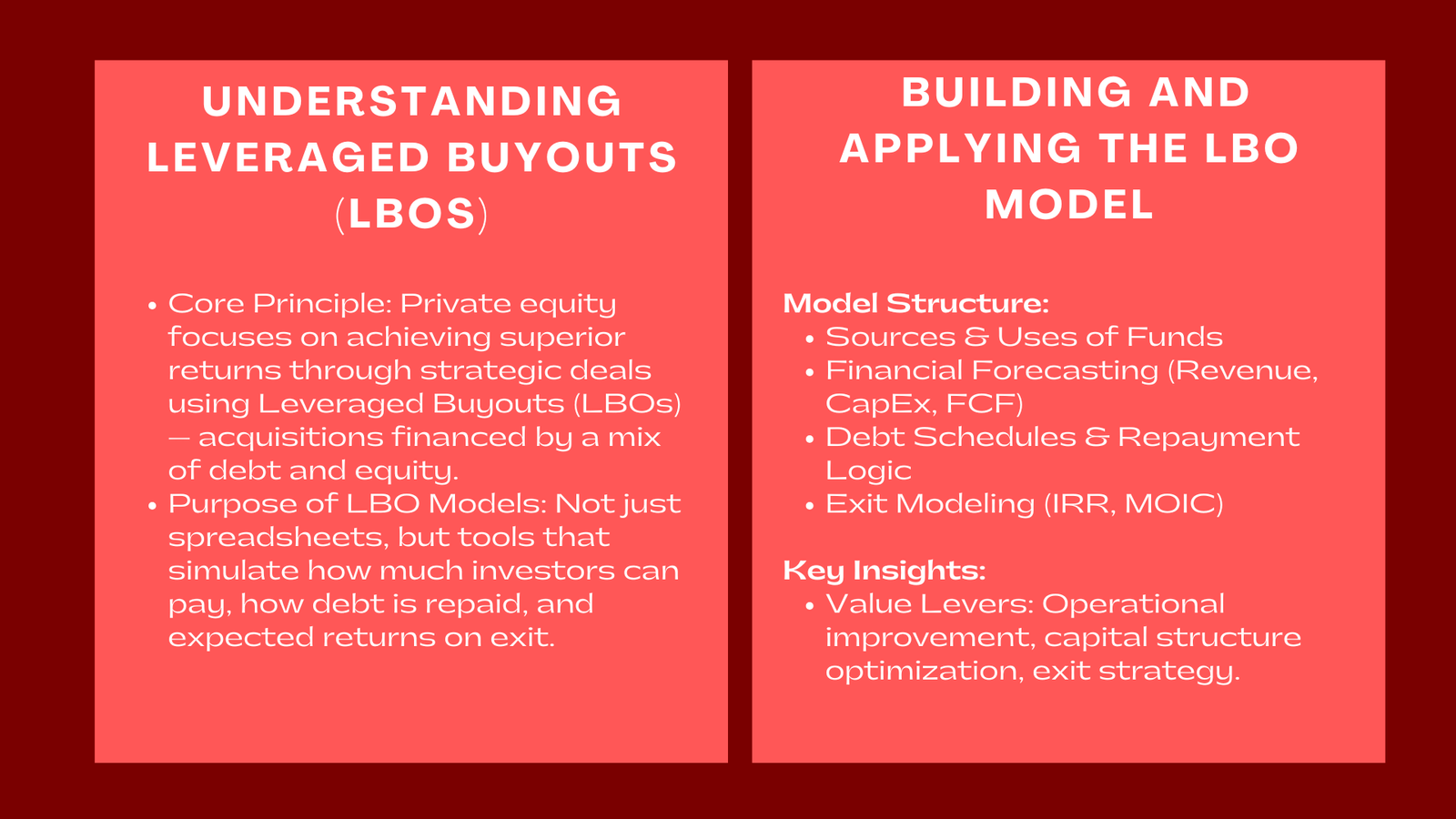

The world of private equity really does come down to a single principle, an overriding principle, namely, producing outstanding returns by making strategic deals. At the center of this process is the Leveraged Buyout (LBO) – a complex financial structure which uses a mix of debt and equity to purchase companies and earn high returns for the investor. Understanding how to build and interpret an LBO model is one of the most relevant skills to be learned for a finance professional seeking a career in private equity, investment banking or corporate development.

An LBO model is much, much more than a spreadsheet exercise. It’s a financial story-telling tool that enables analysts to simulate how much investors can pay for a target company, how the debt will be repaid over time and what returns investors can expect to receive when they exit. This model captures the essence of private equity strategy – that of balancing risk, leverage and value creation during a specific investment horizon, usually five to seven years. Mastering these techniques is a key component of any financial modeling training course in Singapore, where professionals learn to build models that reflect real-world deal dynamics and investment strategies.

For would-be analysts and associates, being equipped with LBO modeling represents preparation to be part of the decision-making process that drives the billion dollar investments. It shows not only technical fluency, but also commercial understanding – ability to detect the importance of operational improvements, capital structure optimization or timing on the results of investors. The sections below deconstruct the structure, mechanics and strategic insight to leveraged buyout modelling in a pro world.

Understanding the Mechanics of a Leveraged Buyout

At its most basic form, a leveraged buyout is the purchase of a company with a substantial amount of debt. This sort of debt financing is used by private equity firms to increase their potential returns on the equity investment. The main idea is that debt amplifies results – if the acquired company succeeds and its value goes up, then the equity owners get excessive returns for their capital. On the other hand, if performance is poor, then losses can be amplified in terms of magnitude through leverage.

The LBO process starts with the identification of a target company that is attractive in terms of possessing stable cash flows, strong market position, and run the risk of being operationally improved. The acquiring PE firm sets a purchase price by using valuation methods that include the use of comparable company analysis, precedent transactions, discounted cash flow (DCF) modeling, and how to interpret financial ratios for business performance. Once the price is determined, the firm will determine the mix of financing, that is, the amount of equity to be raised and the amount of debt to be raised. In a typical LBO, debt can represent 60% to 80% of the purchase value which will vary depending on the conditions and limitations of the market and the appetite of the lender.

The financing itself can have various levels of debt stack, the first being secured senior debt, the second being subordinated or mezzanine debt, and the third sometimes being leveraged by high-yield bonds. Each echelon comes with varying risk and return profiles, interest rates and payback order of preference. Senior lenders are paid interest and principal before mezzanine lenders and then the mezzanine lenders have more risk and get bigger returns. The equity investors (typically the PE firm and occasionally management) have the claim on the remaining proceeds that is the least likely to be paid first, but if the business does well, they will benefit the most.

An LBO model represents all of these elements financially. It projecting repayment of the debt out of the cash flows of the company and computes the source and manner of payment of the acquisition, and the amounts the equity holders will get when they exit the investment. The model is usually for a multi-year duration covering both operating performance and capital structure dynamics.

Building the LBO Model: Structure and Logic

In addition, an LBO model must be constructed in a precise order as each stage relies on the other. It starts with the sources (funding) and uses of funds – a schedule detailing where and how the funds are allocated to fund the deal; Sources can include different tranches of debt and the contribution from equity and there can be different uses which broadly comprise purchase price, transaction costs and refinancing of debt. The first test of structural validity will be to make sure that sources and uses are balanced.

Then, the analyst forecasts the financial statements of the target company during the investment period. This includes predicting revenues, expenses, capital expenditures as well as working capital adjustments to figure out free cash flow – the lifeblood of an LBO. Because cash generation will determine whether you are able to repay your debt it is imperative that profitability and reinvestment assumptions should be reasonable and defensible. An aggressive forecast can make the deal appear on paper, but risky in reality.

The LBO model is built on debt schedules. These schedules show the time-related debt service payments (of both principal and interest) for each layer of debt. The model has to reflect various repayment profiles – amortizing loans with scheduled repayments on the one hand and bullet loans with lump sum payable on maturity on the other. The relationship between cash flow supply and debt responsibility will establish if the company can maintain its leverage without being in financial distress.

The next important element is exit modeling. Private equity funds are not permanent investments, however, and once the firm is sold to another buyer, goes public, or merges with another firm, they are effectively liquidated. The model provides an estimate of the company’s value at exit, normally drawn from an EBITDA multiple. By dividing this final exit value by the remaining debt and the original equity invested, analysts can come up with key return numbers like the Internal Rate of Return (IRR) and the Multiple on Invested Capital (MOIC).

Sensitivity analysis is also part of LBO modeling. Give Analysts the ability to stress investor return sensitivity to key assumptions, such as revenue growth, exit multiple or leverage ratio. This enables the private equity team to understand the resilience of the deal across various scenarios as well as what the key sources of value and risk are.

Key Insights: Value Creation, Leverage, and Risk Management

An LBO model is not like a financial template; it’s a strategic model for understanding how private equity firms deliver value creation. There are three primary value levers in an LBO: performance improvement, capital structure optimization, and exit strategy (i.e., exit in a tactful way to a great outcome). All these levers are in close contact with the assumptions and the conclusions of the model.

Operational improvement is the first controllable lever and is the most controllable lever. Private equity firms tend to buy companies that they feel are inefficient or underperforming. Whether it be through margin improvement, cost reduction or better operational efficiency, they can improve the company’s earnings before interest, taxes, depreciation, and amortization (EBITDA). Since valuation multiples are usually applied to EBITDA, even small increases can result in a large increase in the enterprise valuation of the company. The LBO model quantifies the impact of the operational changes all the way through to increased cash flow and stronger debt repayment capacity.

The second lever is related to capital structure optimization. The skill of the LBO is finding the right debt/equity balance. While increased leverage produces greater potential returns, increased leverage brings greater financial risk. The model helps analysts try various leverages to reach the optimal leverage when the returns are maximized without risking the bank’s liquidity. Private equity professionals closely track certain metrics such as debt to EBITDA ratios, interest coverage, and minimum cash balances among other requirements to ensure financial sustainability.

The third lever, the exit strategy is where the private equity investor finally takes value. Location plays a critical role too – certain kinds of exit may shut away upside while staying too late may subject the investment to the vagaries of a market fell. The LBO model is a good tool that shows the development of the company’s valuation over time, giving a sense for the best holding period and exit parameters. By combining the actual financial performance projections with a market valuation assumption, an analyst is able to estimate both the base-case and optimal IRRs.

Risk management is the basis of all phases of the LBO. Debt increases returns but also increases risk. If the cash flows of the company are insufficient, then it may fail to comply with the debt covenants or to make payments. The sensitivity analysis and scenario analysis of the LBO model is used to determine which are the variables most likely to affect returns negatively. Analysts make up for downside scenarios – lower growth in EBITDA or higher interest rates, for example, to test the company’s ability to make its payments and chain of reflections. A robust LBO model is one that can survive the less than favorable environments, and mastering such techniques is a core part of financial analysis and modeling training Singapore.

Excess of Financial RISK – LBO Modeling needs to incorporate Strategic as well as Operational uncertainties. For instance, if the investment thesis is based on a turnaround strategy, the analyst should consider whether management will be capable of implementing operational improvements in the manner in which the business case is based. Also, in case the company operates a business in a cyclical industry, the model should account for possible downturns. Successful PE professionals don’t just look at the results of the model – they analyze them in the context of the business strategy, markets, and execution capability.

Professional Application and Career Relevance

For aspiring private equity professionals, mastering LBO modeling is more than gaining the technical skill set; it gives one a deep understanding of how investors think and make decisions. The ability to build an LBO model from scratch – to structure financing, project returns and test scenarios – is often the focal point of interviews and case studies for employment in private equity and investment banking. Employers harness modelling tests to test analysing rigour, attention to detail and commercial wisdom.

LBO modeling is also critical to real world deal execution. Analysts and associates use these models to prepare investment memos and help them negotiate with lenders and present scenarios with investment committees. Senior professionals use the outputs of models to support valuations, as well as capital allocation. Therefore, precision, openness and logic are of utmost importance. A model with too complex or in a bad organization can give a wrong impression to a decision-maker, while a clean and well-documented model increases the confidence level for an analysis.

From a career perspective, being well versed in LBO modeling is a signal of being ready for higher responsibilities. It indicates that an analyst has the ability to deal with complex financing structures, assess risk-reward ratios, and communicate their findings easily to their stakeholders. Moreover, the skills acquired through the modeling of LBO deal structures, such as structuring, forecasting and valuation, are transferrable between finance positions such as corporate strategy, M&A advisory and credit analysis.

Conclusion to Leveraged Buyout LBO Modeling Explained for Private Equity Careers

Leveraged buyout modeling is an intersection between finance, strategy and value creation. It captures the essence of private equity investing – Intelligent use of leverage, effecting operational improvements and exiting transactions at the right time to deliver superior returns. For those professionals who seek to establish careers in private equity, learning the logic and structure of the LBO model is indispensable.

A well-built LBO model does not merely calculate returns, it is a tale of transformation. It teaches what can be accomplished by a company undergoing disciplined ownership, efficient management and strategic financial structuring. The best analysts know that behind every number there is a business decision — some kind of judgment about execution of performance, timing and potential. In an industry where precision and vision meet, being able to model and interpret leveraged buyouts is what defines not only deal success, but professional excellence.