Learn Remote Financial Modeling Jobs

Financial Modeling Careers Explained: Hourly Rates, Remote Opportunities, and Job Market Insights

Introduction to Learn Remote Financial Modeling Jobs

Financial modeling is no longer a specific technical expertise and it is now a central professional skill-set in the finance, consulting, investment, and corporate strategy fields. The necessity to develop, interpret, and stress-test financial models by professionals is on the rise as companies require decisions that are more rapid and data-driven. This necessity has transformed the nature of remuneration as well as the nature of employment so that the issues of financial modeling hourly rate and flexible employment becomes a more and more topical problem.

This article dwells on a particular field, the professional environment of work in financial modeling. It analyses the process of determining hourly rates, the growth, and expansion rate of the market of financial modeling jobs remote and what the applicants should consider when comparing financial modeling jobs near me and global financial modeling remote jobs. It is a discussion that provides a realistic, market-oriented point of view to finance professionals, freelancers, employers, and career switchers.

1. Financial Modeling as a Professional Skillset

1.1 The Role of Financial Modeling in Modern Finance

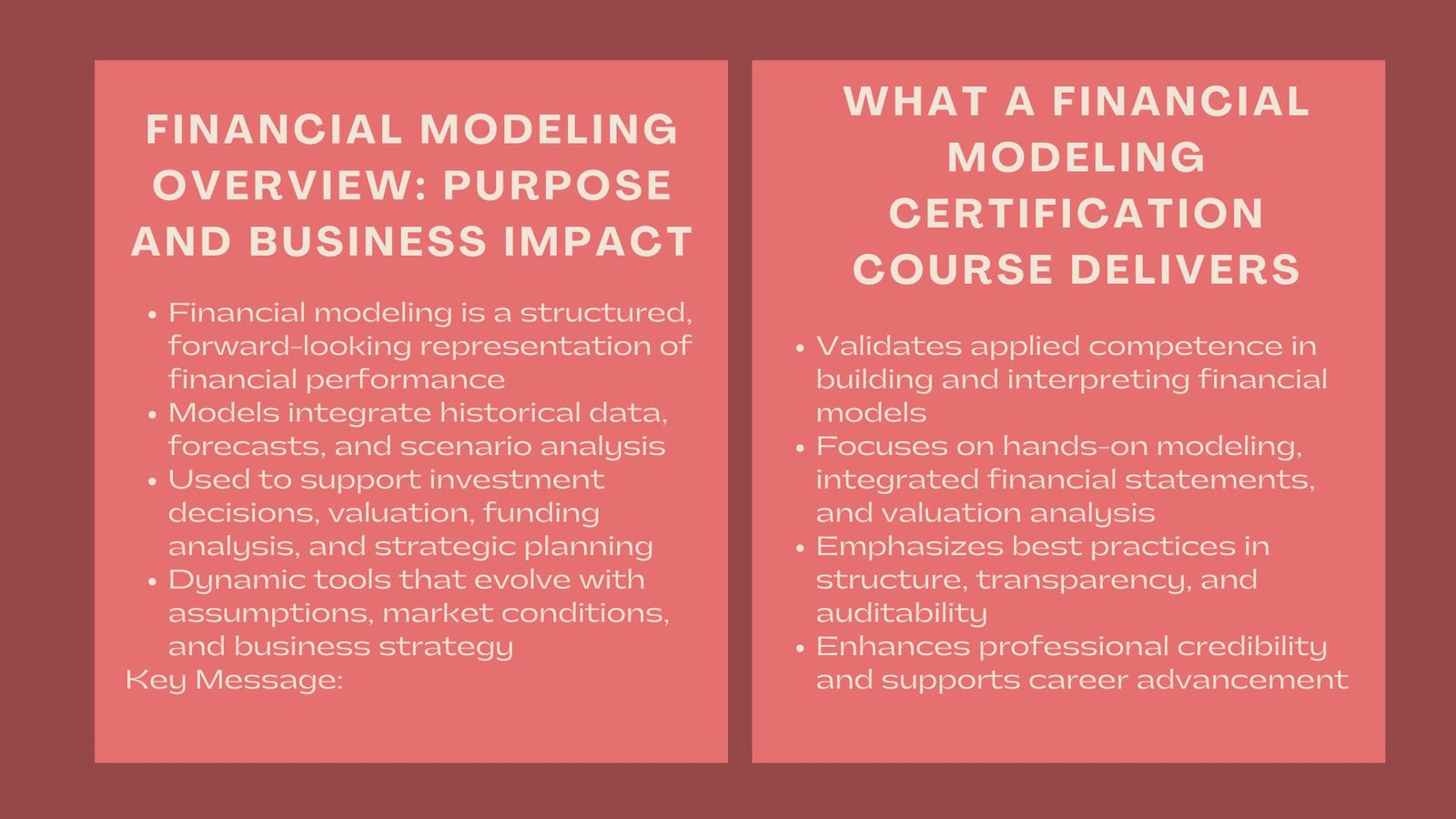

Financial modeling entails the construction of formalised depictions of a company financial performance to aid valuation, projection, investment choices as well as strategic planning. The common application of models in mergers and acquisitions, private equity, project finance, corporate budgeting and fundraising. The fact that these models have a direct impact on high-stakes decisions makes accuracy, logic, and professional judgment valuable to the employer.

The growing applications of the financial models in industries, besides full-time analysts, have necessitated the demand of contract-based and distance professionals as they are able to provide specialized knowledge with efficiency.

1.2 Why Financial Modeling Skills Command Premium Pay

The complexity and burden of financial modeling is the reason why compensation is usually more detailed than general finance positions. The professionals will be supposed to integrate accounting knowledge, corporate finance theory, Excel competence, and business intuition. This combination is the immediate impact on the financial modeling hourly rate which is evident in freelance and contract markets.

2. Understanding Financial Modeling Hourly Rate Structures

2.1 What Determines a Financial Modeling Hourly Rate

The hourly rate of the financial modeling is highly differentiated and it depends on the experience, industry specialization, geographical market, the nature of the project, among others. The rates of entry-level analysts that deal with standardized models can be lower, whereas experienced professionals that deal with transactions, valuations, or complicated infrastructure models can charge a lot more.

Urgency, confidentiality, and support of the work to investment decisions or regulatory reporting are also other influencing factors. Clients will normally be willing to pay a higher price to professionals who are able to work within strict deadlines under very little supervision.

2.2 Hourly Rates Versus Fixed Project Fees

Although hourly billing is the most used, fixed project fees are also quoted by many professionals. In such instances, the implied financial modeling hourly price is still used as a reference point in pricing. Value is measured on the basis of efficiency, robustness of a model and the concept of clarity in communicating assumptions by the professional employed by employers and clients.

3. Financial Modeling Jobs Remote: A Growing Global Trend

3.1 Why Financial Modeling Adapts Well to Remote Work

Financial modeling work that has emerged remotely is prompted by the fact that the task is digital in nature. Software tools can be used to create models that can be shared safely, discussed together and presented in an electronic format. Financial modeling may be available as an independent task with deliverables as opposed to the roles that may need physical presence or engagement with clients.

It is this flexibility that has seen financial modeling as one of the most appropriate disciplines in finance within remote and hybrid arrangement of work.

3.2 Employers’ Perspective on Remote Financial Modeling

According to the employer, financial modeling job recruiting remote increases talent pooling beyond the local markets. Businesses acquire expert knowledge without having permanent headcount obligations. It is especially useful in project-based requirements including acquisitions, fundraising rounds or even strategic review.

Consequently, distant financial modeling functions are now prevalent in startups, private equity companies, advisory boutiques and multinational corporations.

4. Financial Modeling Remote Jobs and Career Flexibility

4.1 Types of Financial Modeling Remote Jobs

The remote jobs in financial modeling can be in the form of a freelance job or the permanent employment contract in remote working. Freelancers can be used to help with valuation work, financial projections or investor pitches, whereas remote workers can be members of distributed finance, distributed strategy teams.

Such positions demand not only the competence in the technical field but also the effective communication skills because assumptions and outputs need to be presented in a straightforward manner over the virtual channels.

4.2 Benefits and Trade-Offs of Remote Modeling Work

Remote work provides flexibility, geographic freedom and worldwide opportunities. Financial modeling remote jobs, however, also require high self-discipline and responsibility. When no physical supervision is involved, professionals have to handle timeframes and quality of documentation as well as version control themselves.

To those modelers that are experienced, the incentives usually surpass the difficulties especially when remote jobs are provided with good remunerations that are consistent with the global market rates.

5. Financial Modeling Jobs Near Me: Local Market Considerations

5.1 Why Local Financial Modeling Roles Still Matter

Although remote working is increasing, financial modeling opportunities are considered viable in my local area, particularly in financial centres and where there is a high concentration of corporates or investments. Locally based positions tend to be more associated with closer management teams, access to confidential information and strategic matters.

Local jobs are a good experience, mentorship, and learning on the job that can be difficult to reproduce in a remote setting and would benefit early-career professionals.

5.2 Comparing Local and Remote Opportunities

In the comparison between financial modeling opportunities in my area and remote ones, practitioners need to think of educational opportunities, career advancement, and salary package. Local jobs can have stability and a more organized development and remote jobs can have flexibility and potentially a higher earning potential due to diversified clients.

6. How Employers Price Financial Modeling Talent

6.1 Matching Rates to Business Impact

Employers do not evaluate the financial modeling hourly rate based on time that is spent, but on the value provided. An effective model that facilitates a successful acquisition or capital raise can be used to justify much more compensation than the usual forecasting work.

This value-based approach is one of the reasons why some of the best financial modelers tend to attract high fees irrespective of the location.

6.2 Cost Efficiency Through Remote Hiring

To employers, remote financial modeling can save money and yet ensure quality. Office space and relocation can provide savings that are frequently diverted to competitive compensation which is beneficial to both sides.

7. Skills That Improve Access to Financial Modeling Remote Jobs

7.1 Technical and Analytical Competence

In order to succeed in financial modeling remote jobs, the professionals are required to have advanced skills in Excel or modeling software, have a good background in accounting and be able to organize models in a logical manner. Workers working remotely are supposed to provide work of standard quality of the institutions without having to be guided a lot.

7.2 Communication and Documentation

Effective communication is critical in a distant setting. The professionals are required to clarify assumptions, emphasize risks, and communicate outputs in a manner that can easily be understood by the decision-makers. The skills have a direct effect on employability and long term success on financial modeling remote jobs.

8. Career Outlook for Financial Modeling Professionals

8.1 Market Demand and Long-Term Prospects

Financial modeling skills will always be in demand because companies are uncertain, short of capital, and more scrutinized by their investors. Such a tendency promotes the increasing standards of financial modeling hourly rates and the ongoing growth of remote positions.

8.2 Positioning for Career Growth

There are professionals with a blend of modeling skills and industry experience, e.g. technology, infrastructure or healthcare, who are in a good position. Specialization would make me more credible and better paid regardless of whether I am seeking a financial modeling job locally or working in a financial modeling job that is located overseas.

Conclusion

Financial modeling remains one of the most valuable and versatile skills in modern finance. Understanding the dynamics behind the financial modeling hourly rate helps professionals price their expertise realistically, while awareness of financial modeling jobs remote and financial modeling remote jobs opens access to a global employment market. At the same time, financial modeling jobs near me continue to offer structured development and close strategic exposure.

Financial modeling is one of the most useful and diverse skills of modern finance. The knowledge of the dynamics in the financial modeling hourly rate can assist the professionals to price their expertise in a realistic way and the knowledge of financial modeling jobs remote and financial modeling remote jobs can provide access to the global employment market. Simultaneously, financial modelling positions in my locality are still providing systematic progression and intimate tactical exposure.

Financial insight is rapidly becoming a key determinant of critical decisions in organizations, and therefore, competent financial modelers (local or remote) will remain at the center of business performance and career progression.