Key Components of a Financial Model Revenue Expenses and Career Relevant Skills

Key Components of a Financial Model: Revenue, Expenses, and Career-Relevant Skills

Introduction to Key Components of a Financial Model Revenue Expenses and Career Relevant Skills

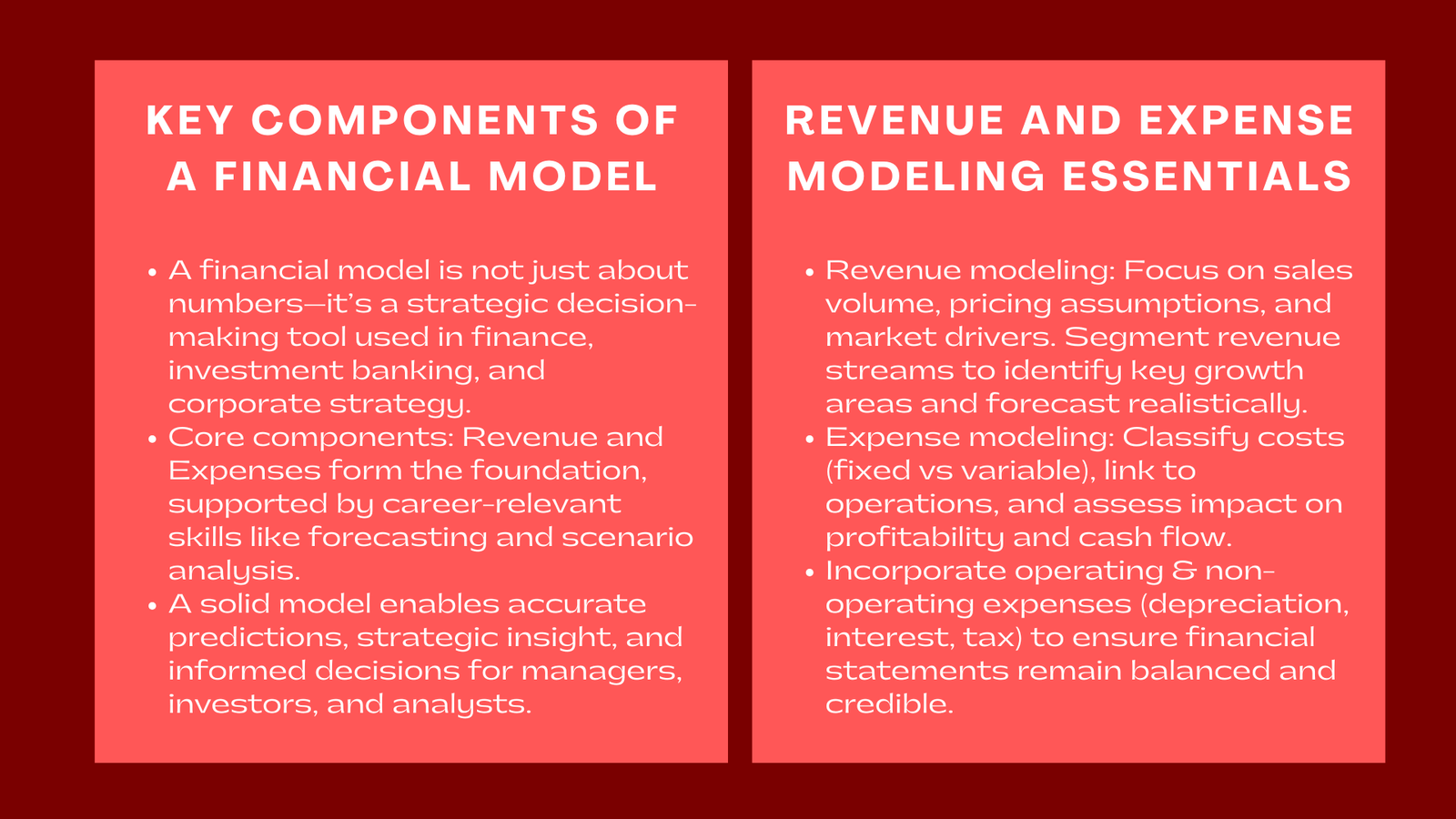

In high-profile finance, the ability to develop correct and valuable financial models is a fundamental attribute of an analyst, an investment banker, a specialist in corporate finance, and a future leader. Financial modeling might not seem at first sight a technical exercise – a question of keying numbers, formulas and projections into Excel. Nevertheless, a good model of the financial system is one which is both accurate and strategic. As a decision-making instrument, it can assist managers, investors and other stakeholders in accumulating information on how a company is performing at the time, make predictions of such occurrences in future and gauge the effects of business decisions.

Being aware about the main elements of a financial model is the most important both to a novice or an experienced user. These elements include revenue and expenses as their basis, whereas such skills that are relevant to the career, including predicting, situational assessment, and attention to detail help the analysts to build models that are not only sound technically but potentially also permanent in strategic terms. Learning these aspects through financial modeling skills development in Singapore will prepare the professionals of the finance industry to make decisions, present useful insights and excel in careers full of competition.

The article discusses the fundamental elements of a financial model with emphasis on how the revenue, expenses, and analytical proficiency intersect with each other producing trustworthy, insightful, and career advancing financial analyses. Devoting the aspects and clarifying their applicability in professional setting, the guide enables future and current analysts to enhance their technical proficiency and expertise in addition to their professional standing.

Revenue: The Foundation of Financial Modeling

The most important financial model is the one that depends on revenue. It is an indicator of the cash flow that a company generates as a result of its usual business, which is used to predict the performance of a business, future growth, and asset appropriateness of the enterprise. The money will not allow the rest of the financial model to be dependable, however right the calculations are, without the right understanding of the revenue.

In the modeling of revenue, analysts have to put into consideration the volume of the sales as well as the pricing assumption. The level of sales usually relies on the size of the market, the past season and the strategic projects like marketing campaigns or geographic diversification. Pricing assumptions encompass unit prices, discounts and possible variations based on competition exert as well as the cost inflation. Putting these together enables analysts to give a projection of the total revenue in a way that is realistic as well as exploits the strategic opportunities.

Moreover, the segmentation is frequent in the case of revenue modeling. The companies cannot be monoliths, they are selling multiple products or services, addressing various audiences or covering various regions. Revenue streams can be segmented to help the analysts determine what drives their growth and measure their contribution to the whole performance. As one example, a software company might be earning revenue through subscription services, professional services and product licensing and each will have different growth patterns, margin profiles as well as risk factors. By modeling these streams, it is possible to analyze them and forecast more correctly.

In terms of the career, revenue modeling sharpens the thinking of an analyst towards the business performance. It involves quantitative rigor and qualitative judgment, which encourages the professionals to endeavor in the aspects of market research, industry benchmarks and management assumptions. The revenue forecasters who have thrived in mastering their craft exhibit the awareness of how businesses create value, thus they prove to be extremely useful in the processes of strategy and decision-making on investments. Enrolling in a financial modeling core principles course Singapore can further strengthen these analytical capabilities and strategic insights.

Expenses: Understanding Costs and Profitability

Although revenue is the inflows, expenses are the outflows and are essential in the interpretation of profitability and cash flow as well as financial sustainability. To model the expenses, after proper classification of costs, identification of drivers as well as differentiating between variable and fixed costs, the analysts should model the expenses accurately.

There are fixed costs that are constant like the rent, insurance and wages, which do not change much in terms of the level of sales. Variable costs are expenses that vary with the state of business activity like raw materials or commissions or cost of production. Proper determination of these patterns can enable analysts to predict the operating margins, break-even situation and utilize the possible savings in cost.

In addition, it has some operating costs as well as non operating expenses, including depreciation, amortization, interest and taxes. Depreciation and amortization have an indirect effect on the cash flow in that they record the use of the assets and any capital investments made whereas interest and tax have a direct influence on the net income. It is the correct classification and association of these costs within a financial model that will allow the consistency and reliability of profitability, cash flow and balance sheet projections.

Expense modeling also gives us an idea of improvements which can be made in the operation. Through the cost structure analysis, analysts would be able to determine areas through which efficiency can be improved, processes can be improved, or a strategic investment is possible to improve profitability. As an illustration, production can be automated and labor costs can be minimized and renegotiating the contract with the suppliers can minimise the costs of raw material. Incorporating such scenarios in the model enables the finance professionals to measure any potential saving and recommend on the opportunity of value creation to the management.

Career wise, the experience in expense modeling reflects competence in an analyst in their capacity to bridge the gap between financial performance and operations. Those professionals that have knowledge of the cost drivers as well as the levers to drive efficiency can also have an impact on strategy, assist in making the management decisions and offer practical information that cannot just be obtained through reporting. Technical skill and strategic awareness combined is a highly sought-after quality in the financial and consulting fields, as well as at the top management of a company.

Although revenue is an inflow of information, expense is an outflow of information and plays an important role in comprehending profitability, cash flow and financial sustainability. The correct modelling of the expenses involves the categorization of the costs, their identification as drivers, and differentiation of fixed and variable costs by the analysts.

There are fixed charges, which include rents, insurance and salaries, which do not fluctuate much with change in sales volumes. Variable costs, like raw material, commissions, costs of production, etc. vary with the scale of business operations. Proper identification of these trends can enable the analysts to predict the operating margins, break-even, and take advantage of possible cost savings.

Besides, both operating costs and non-operating expenses are involved i.e. depreciation, amortization, interests and taxes. Depreciation and amortization has an indirect effect on cash flow since it agrees on the use of assets and capital investments, whereas interest and taxes produce a direct effect on the net income. By classifying and connecting these costs adequately in a financial model, the resilience and consistency of the projections of profitability, cash-flow and balance sheets are guaranteed.

Expense modeling as well gives an understanding of the possible improvement of operations. Through the studies of cost structures, analysts are able to determine possible areas on which efficiency or process improvement, or strategic investment would increase profitability. As an illustration, production can be automated to help with the labor expenses, and raw materials expenses can be lowered through renegotiations with a supplier. These scenarios implementation into the model will enable the finance professionals to measure the possible savings and recommend the management on creating values, applying frameworks similar to intangibles valuation methods Singapore cost income market approaches to ensure analytical depth and strategic accuracy.

Career-wise, experience in the field of expense modeling shows that an analyst can relate financial performance to the reality of operations. The professionals who are aware of the cost drivers and the efficiency levers can affect the strategy, assist management decision making, as well as giving actionable insights that do not restrict to reporting. This is a very desirable technical expertise and substantive strategic thinking that is very sought after in the financial sector, consulting area, and in corporate leadership.

Career-Relevant Skills: Forecasting, Analysis, and Communication

In addition to revenue and expenses, the construction of a high-quality financial model will require a set of career-relevant skills that will allow distinguishing between the ordinary and the highly qualified analysts. These are forecasting, analysis of scenarios and sensitivity, attention to details and clear communication.

The skill of forecasting is central and has the ability to tie the past performance with the future expectations. To generate realistic predictions, analysts need to evaluate financial trends of the past, industry standards and macroeconomic status. Badging, that is forecasting is quantitative and qualitative, it has to know the market forces, competition and operational strategies. Analysts who make sound predictions always get relied upon in budgeting, making investment decisions, and strategizing.

Scenario and sensitivity analysis would allow analysts to have an idea about the effect of various changes in assumptions on results. Through experimentation of varying revenues growth rates, cost structures or macroeconomics, analysts are able to determine risks, measure the possible variations, and also give advice to the management as to how such variations can be mitigated. In this case a sensitivity analysis may indicate that profitability is very sensitive to prices of commodities or exchange rates and therefore proactive hedging or strategic changes would be made.

It is necessary to pay attention to the details when forming accurate and reliable models. Minor mistakes in formulae, cell references or assumptions have the ability to spread and skew the whole of the analysis. Analysts with a high level of documentation, formatting, and checking errors minimize the risk of errors and improve the level of confidence in their results. Professionalism and reliability which can only be portended by this habit are also essential to career promotion.

Good communication skills are very crucial as well. Secondly, even a perfect model can arrive at sluggish results unless the results are presented in a clear manner, the stakeholders may fail to understand the findings or even fail to notice important information. Good analysts have the ability of breaking down complex financial information and presenting them in a way that other users can understand by use of pictures, charts and executive summaries to facilitate decision-making. Combining the skills in modeling with the high level of communication skills, practitioners will be able to impact the strategic discussion, have better prepared speeches in front of senior management, and be able to prove oneself as a reliable advisor.

A combination of these skills relevant to their career could make sure that a financial model is not the standstill instrument but the versatile one that helps to make analysis, make decisions, and make an impact. With such skills, the related analysts build up their professional names and open up a career path to headship in finance/investment banking/private equity and corporate strategy.

Integration of Revenue, Expenses, and Skills in Modeling Practice

Analytical skills that are seamlessly merged with the revenue, expenses, and financial models make it the most powerful one. The projections of revenues and expenses give the basis of the core outputs, such as profitability, cash flow, and valuation. In the meantime, the career-relevant skills make the projections realistic, sound and practical.

In fact, cash flow is used in the valuation of a company, in which the assumptions of revenue and expenses are directly transferred to the free cash flow. Scenario analysis and sensitivity testing enable the analyst to evaluate the up-side and down-side possibilities whereas the documentation and visualizations make it easy to put an insight into it by the stakeholders. By doing so, both technical precision and professional expertise are integrated to create a model that is helpful in making informed and strategic decisions.

Continuous professional growth is also achieved with the support of the areas integrated. Both analysts who construct, update, and test financial models on a regular basis acquire a better perception of the forces at work, financial statements, and logic of valuation. They learn to recognize risks, measure the opportunities and share the knowledge in a well-structured and professional way. With time, the experience in the field becomes a major competitor in the career of competitive finance, where professionals are able to assume a high-level responsibility and advisory role.

Conclusion

Financial modeling is a very complex art that is not just entering numbers in excel. The three important elements being revenue, expenses and career relevant skills make the basis in the construction of models that are truthful, insightful and professionally valuable. Revenue modeling enables the analysts to summarize the growth forces, whereas expense modeling highlights cost frameworks and profitability leverages. The relevance of the career-related skills, such as forecasting, sensitivity analysis, attention to detail, and communication, make sure that the model is not only valid but can be implemented as well as be trustworthy.

To the professionals in the field of finance, learning how to master these components is a technicality and a boost to their careers. Quality models build credibility and facilitate strategic decision-making as well as develop trust between models and the managers, investors, and clients. They are also a convenient avenue of applying analytical rigor, business insight, and professional compassion.

Conclusively, gathering technical and strategic knowledge can help the practice of financial modeling to be regarded as both an instrument of career development. Trainers who are knowledgeable about revenue, expenses, and abilities necessary to associate them, in the most effective way, place themselves in the role of essential participants. This mastery is not only an advantage but also one of the factors that define professional success in a competitive finance situation.