Financial Modeling Programs for CFA Candidates

Financial Modeling Programs for CFA Candidates

Know Financial Modeling Programs for CFA Candidates

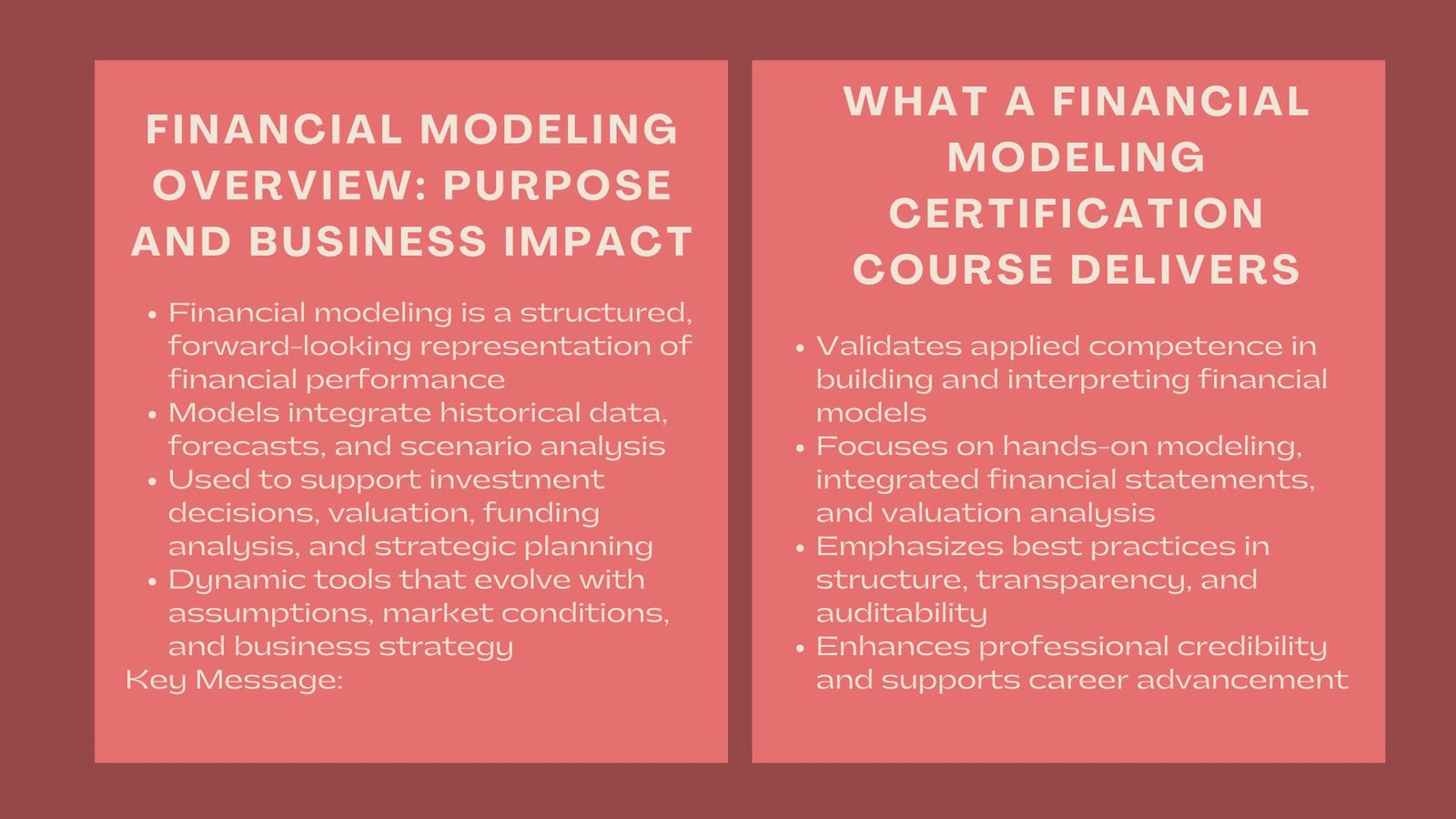

With the current competitive business in the world of finance, every practitioner in the field is finding means to develop and enhance his field and distinguish him in the very competitive market. This capacity to acquire the financial modeling and analytical skills of advanced finance can be the key to success among the chartered financial analyst (CFA) candidates as well as experienced financial practitioners. To extend these skills, the Financial Modeling Institute (FMI) provides internationally accepted training initiatives that help individuals equipped with technical exactness, strategy and intelligent application to the contemporary financial world.

Although CFA offers in-depth preparation in the study of investment analysis, ethics and portfolio management, FMI programs enhance the same by preparing them with a practical-applied approach to financial modeling and decision making in real life.

The article discusses the fit between FMI programs and the requirements of CFA candidates and financial professionals, how the FMI certification pathway is structured, advantages of the synergy between CFA expertise and FMI expertise and how those programs can assist in the transition between theory and practice.

The Intersection of CFA Knowledge and FMI Skills

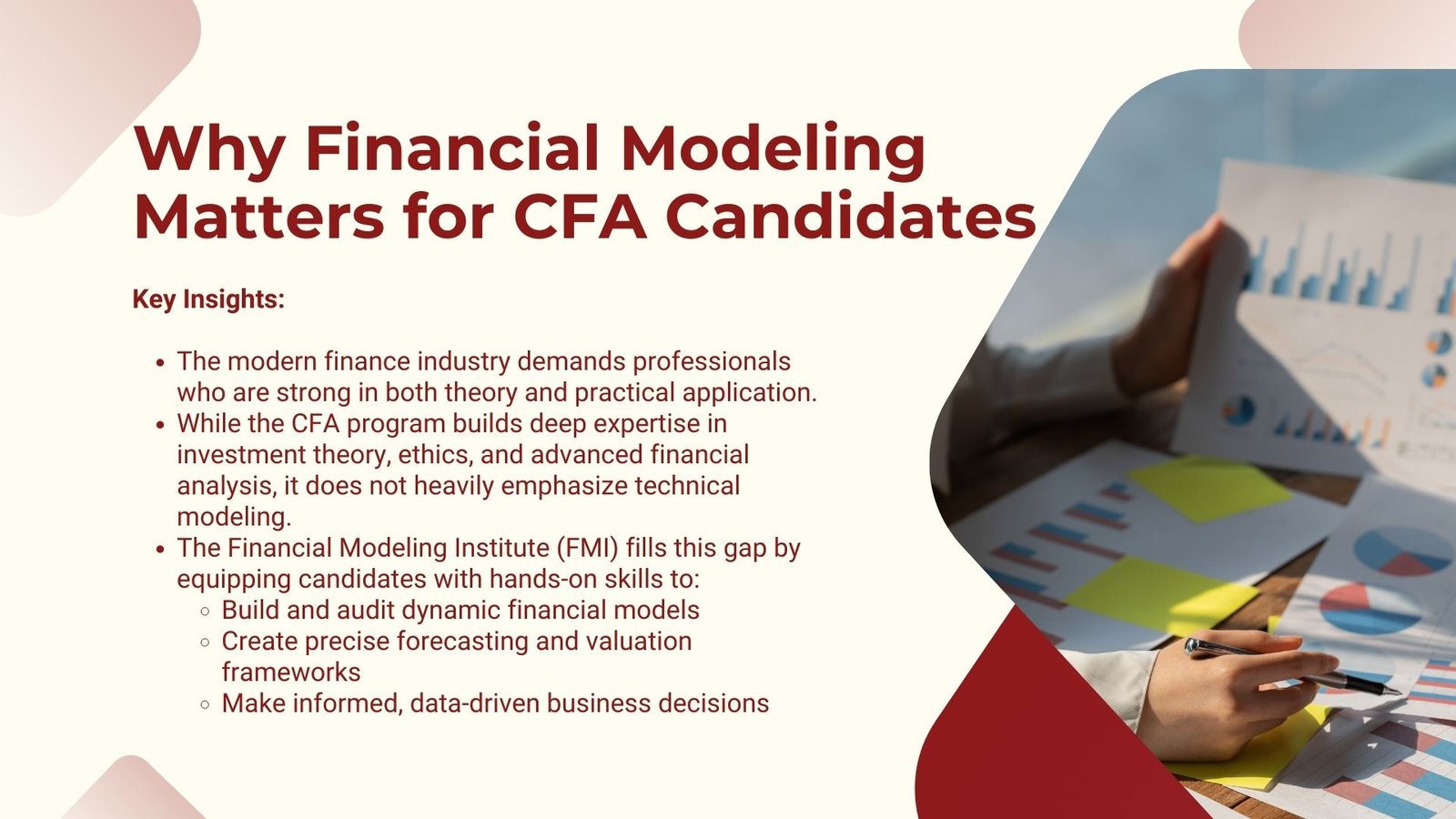

CFA ProgramStudents The CFA Program is considered to be the gold standard of investment professionals and has a powerful curriculum in corporate finance, equity, and fixed income analyses, derivatives and portfolio management. But the subject matter of CFA will lean more towards conceptual frameworks, analytical techniques, and financial theory as opposed to highly end-to-end hands-on modeling capability that is regularly required in top-tier jobs.

FMI programs fill the gap with a focus on how to rigorously build, analyze and appeal to detailed financial models. The deep understanding of both the analysis of facts and what these facts imply in terms of other driving factors in valuation that is acquired by CFA candidates is refined through FMI training to allow the candidate to translate this knowledge into the various applications: dynamic modelling, forecasting, budgeting, valuation and decision-making at the highest strategic level. The combination will produce a forceful set of skills that are academic and market-ready simultaneously.

Financial professionals who are already in the sector find the certifications of FMI a formal system, since they can formalize and develop their skills in modeling. When it comes to both corporate finance, investment banking, equity research and private equity, the skill of building, auditing and presenting models efficiently and accurately cannot possibly be overstated. The combination of FMI skills and CFA-level knowledge gives the professionals the ability to provide the insights which are strategy-sound and technically solid as well.

The FMI Certification Pathway

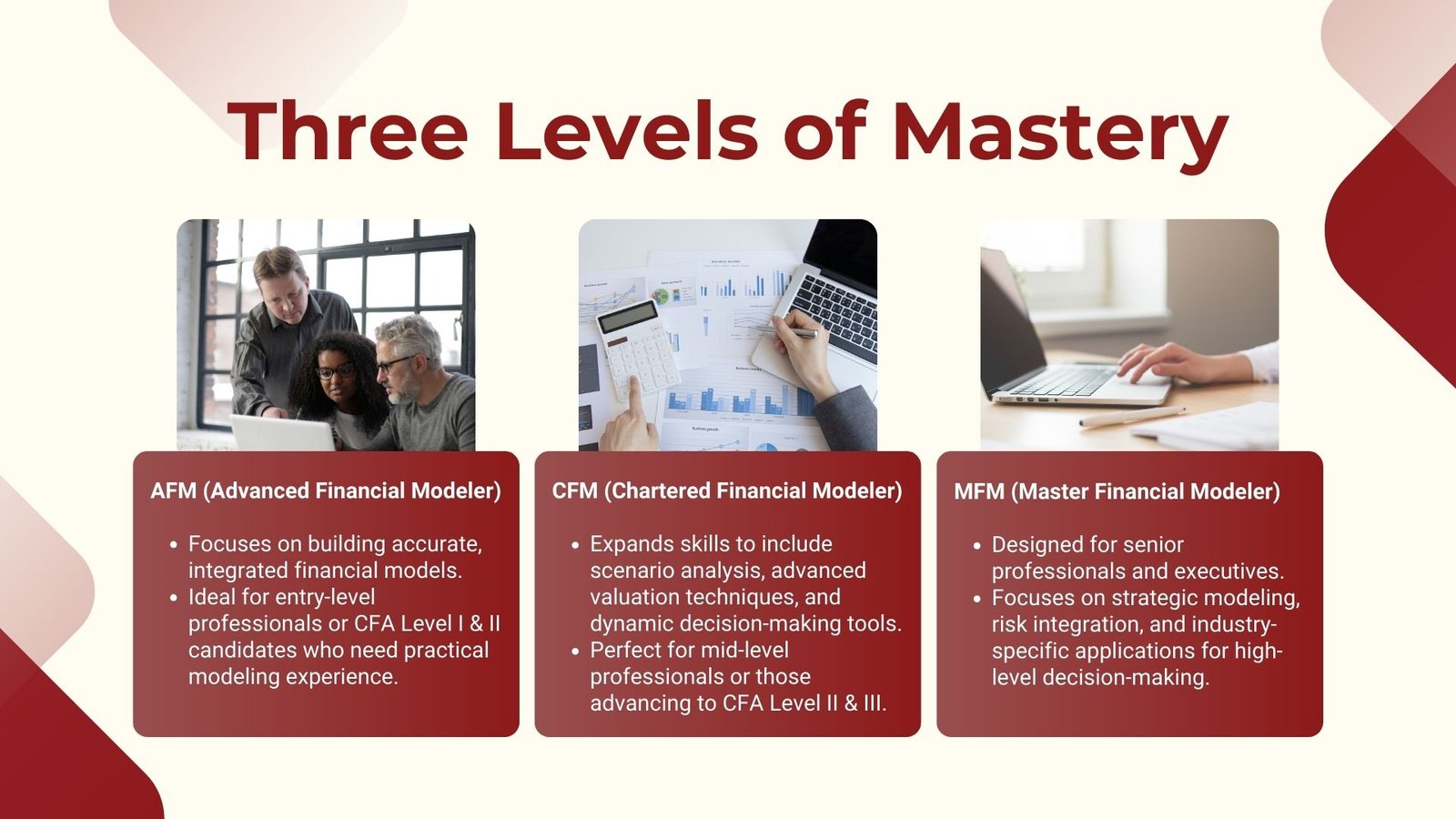

The Financial Modeling Institute has three main levels of certification including the Advanced Financial Modeler (AFM), the Chartered Financial Modeler (CFM) and the Master Financial Modeler (MFM). Higher levels take off where the last left and are more complex and deeper in application.

The entry point is the AFM where the primary goal is to ensure that candidates are able to prepare correct, flexible, and thoroughly integrated financial models. This certification includes best practice in Excel, standard build modeling structures and the creation of three core financial statements. AFM is a popular complement to studying the earlier levels of CFA as it allows studying how the financial information can be interrelated and how theoretical assumptions can be converted to a functioning model.

The CFM is built on the AFM and includes more complex methods of analysis, scenario and sensitivity analysis, and further valuation methods. The level is especially important to CFA candidates in Levels II and III, where theory of complex valuation techniques and real world case studies is the primary focus of exam preparation. By passing the CFM, the professionals attest to the skills in using valuation theories in dynamic, decision-support tools.

Lastly, MFM is the most advanced certification provided by FMI and is directed toward the top management level of the finance professionals, as they will have to cope with a multi-layer high-level financial issue. The level incorporates strategy, risk analysis, capital structuring and industry specific modelling needs. To make CFA charterholders, the MFM is more about a complete understanding not only of the valuation and analysis but also about the operational, strategic, and technical aspects of business that make it very successful.

Why FMI Is a Natural Fit for CFA Candidates

FMI programmes are not a peripheral option or a little bit of additional knowledge to anyone working toward a CFA designation; FMI programmes can be a strategic lift. CFA exams put candidates to practice by interpreting data, valuation techniques and giving recommendations on available investment strategies yet the exams are not designed to show that the candidates can build a complete working financial model using excel. A large number of employers however, require newly recruited employees, especially those in corporate finance, investment research and investment banking sectors to be in a position to do just that.

Candidates who take FMI training and also prepare to pass CFA attain two levels of training, namely, the acquiring of knowledge and the ability to apply it. To give an example, it is possible that a CFA candidate knows the discounted cash flow (DCF) methodology inside out, but another accredited by the FMI should be able to create a fully functional DCF model set up his or her own, connect it with integrated financial statements, model an array of scenarios, and report the results to the interested stakeholders in a graphical, not written, format.

Useful in a data-driven finance economy, where the speed and precision of decision-making may make significant differences between achieving success and failure, this dual capability is becoming even more important.

Benefits for Experienced Finance Professionals

In the case of highly experienced finance professionals, especially those that may have the CFA designation, FMI programs provide a method of furthering their technical designation and staying abreast of the changing requirements of the industry. The advancement in technology and financial analysis tools requires more use of technology that would allow the construction of advanced complex models using real-time data, predictive analytics, and advanced scenario planning.

Quants in corporate development, portfolio management or mergers and acquisitions can use FMI training to perfect their own modeling process, scale back on time-consuming debt and costly mistakes. The best practice element of the model design at the FMI also serves to address the desirable output of not merely accuracy but simplicity to audit and comprehend by others a factor that is becoming a far greater consideration in team-based workplaces and in review by the regulators.

Industry Demand for Combined CFA and FMI Expertise

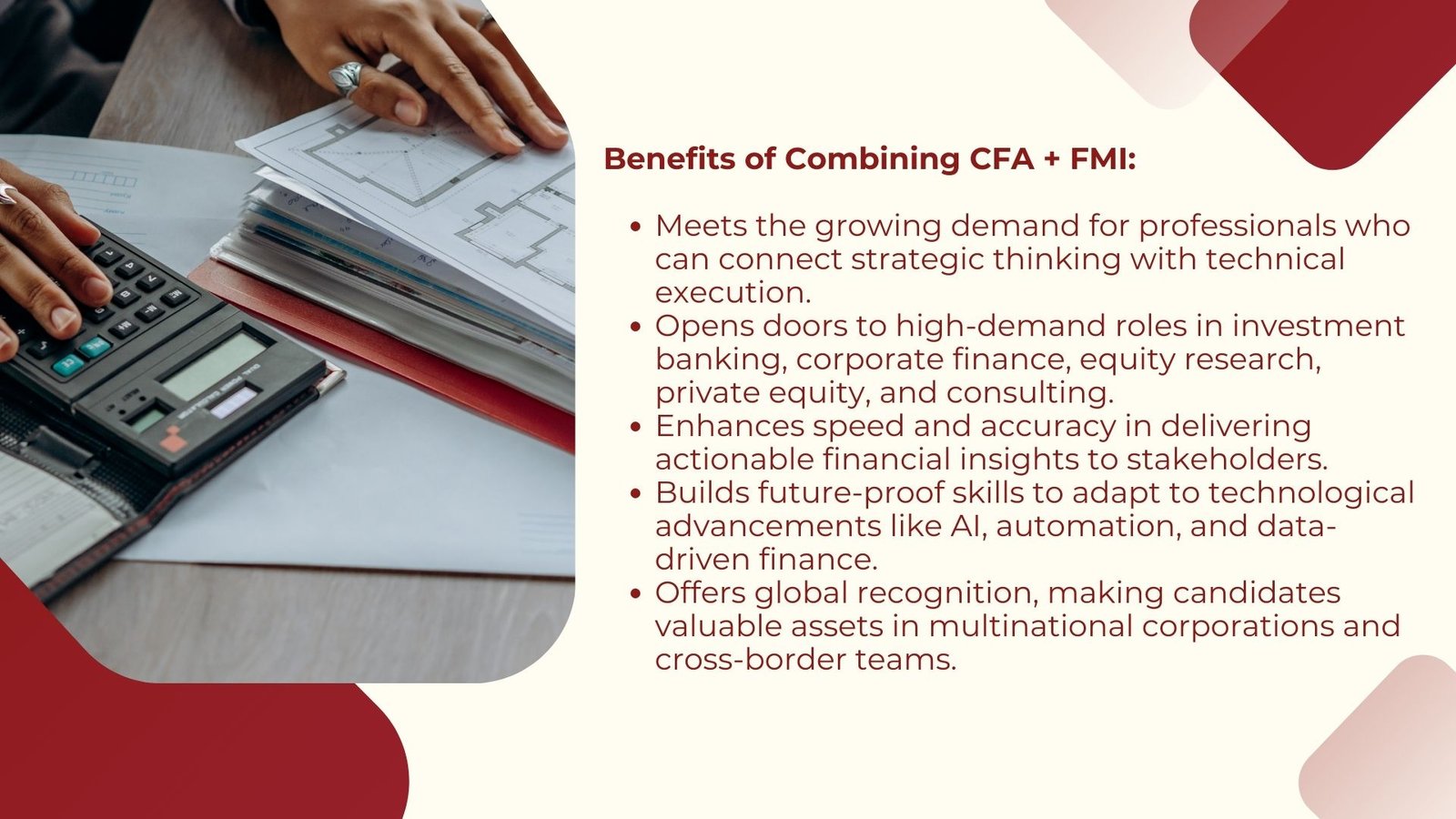

The increasing number of employers within the investment banking, asset management, corporate finance, and consulting communities are in need of professionals that can close that gap between analysis and action. A CFA designation reflects a strong analytical and ethical set of standards and the FMI certification proves that one can employ his or her insights in working real world models that are precise and well organized.

An example can be that in mergers and acquisitions, a professional may be charged with the role of assessing several acquisition targets. CFA skillset will give the professional the understanding of both the strategic rationale, industry context and the valuation implication like FMI skills will enable him to come up with a dynamic model where the stakeholders can test various assumptions, financing structure and market conditions. Such a mixture results in more informed choices and the increased confidence in the advice given.

On the same note, in corporate finance a combination of CFA and FMI knowledge will allow the professionals to not only evaluate investment opportunities, but also predict cash flows, design financing plans, model the influence of strategic plans on shareholder value.

The Global Recognition of FMI Certification

Relatedly, FMI programs also happen to be globally recognized, which is another underlying cause of relevance by FMI programs in terms of relevance to CFA candidates and the financial professionals. FMI-certifications are coming to the fore on the financial capitals just like the CFA certification is revered across the world. This credence is very imperative to those professionals who would like to work abroad, or with multinational clients.

The fact that FMI specializes in standardized modeling techniques implies that certified practitioners can easily do cross-team work, even if the physical location is not the same. The standardization can assist in international organizations where international cooperation demands a common technical language of model building and interpretation.

Integrating FMI Training into Career Development

Integrating FMI training into career development at the appropriate time in the name of strategy may be strategic in the case of CFA candidates. Those just preparing to take CFA Level I or II often pick the AFM to make sure that they also acquire the modeling skills alongside the analysis knowledge. Some will take CFA and then take the CFM or MFM later, when they have the CFA behind them, and are looking to switch tracks into management roles or work in specific areas of the business (such as project finance, or even in the field of private equity).

To qualified practitioners, FMI certification may be a career propellant, which would allow them to tackle projects of greater complexity, manage teams, or switch to the role of consultants or advisers. The combination of CFA and FMI certification may also enhance the candidacy of a professional to become an executive in several fields (especially in highly finance-oriented businesses).

The Future of Finance Skills: Theory and Application Combined

Since the finance sector is ever changing, the need to combine theoretical insights and technical practical skills is bound to be of high significance. Artificial intelligence, automation, and data analytics are changing the landscape of how financial analysis will be done but what cannot be changed is the human capability to interpret, adapt and use the insights.

FMI programs are designed to not only enable professionals to adjust to these changes, but become leaders of their change. CFA candidates and charterholders who include FMI as part of their designation stand out as well-rounded finance professionals- able to think and strategize, make ethical decisions and act with precision.

Over the next several years, the ability to integrate the breadth of study that can be gained through training with the CFA program and the applied modeling skills of the FMI program, including the Riverstone mastering financial modeling program, will put the professional in a unique position to seek opportunities with the most vision and precision. This combination of expertise is the best of both worlds whether you are in investment management, corporate finance or advisory services as it is the ability to traverse in a world that is increasingly becoming difficult to navigate.

Conclusion

The Career Development Programs of the FMI on the CFA candidates and the financial professionals offer a distinctive chance to combine extensive training in analyzing the world with a practical understanding through modeling. Even as the CFA designation is the gold standard in respect to knowledge and ethics pertaining to investment, FMI certifications would guarantee that this knowledge can be translated into practicable data-driven financial models that would be strictly relevant to the decision process.

To CFA test takers, incorporation of FMI training at an early stage of their career advancement can enable them to be more employable and faster in achieving high impact jobs. To experienced professionals it provides the avenue of career enhancement, a chance to better hone technical competencies, and stave off obsolescence by providing increased value to customers and employers.

In either scenario, the extension of the credentials of both CFA and FMI to the market assures the market that the practitioner has not only the potential to gain insight into complex financial concepts but also to be able to use such knowledge in practice. Considering the fact that the finance industry still requires not only analytical and strategic but also well-grounded technical skills, it is safe to assume that incorporating FMI programs in professional development plans will be a wise and strategic decision well into the future.