Common Mistakes in Financial Modeling and How They Affect Job Performance

Common Mistakes in Financial Modeling and How They Affect Job Performance

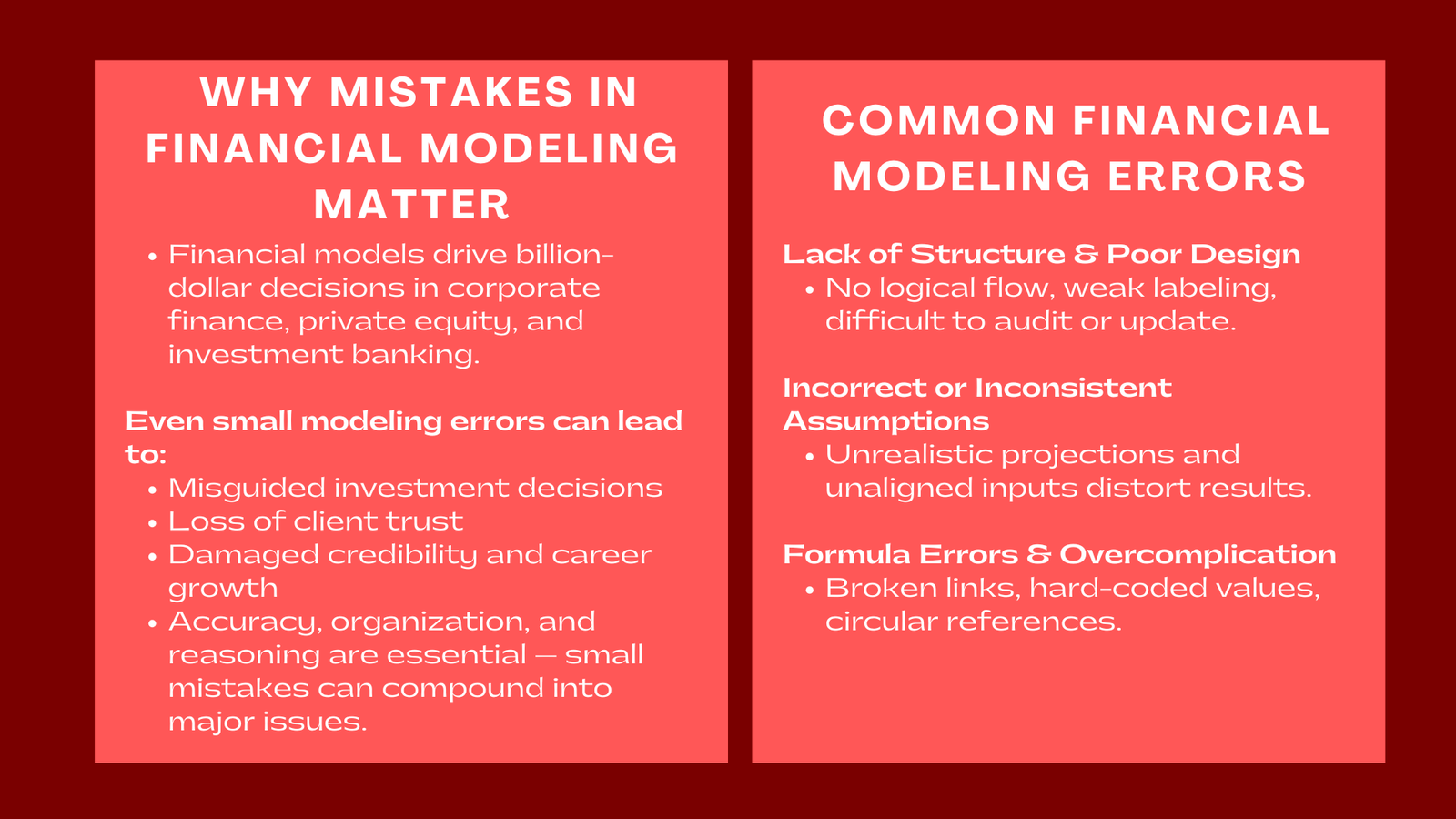

In the corporate finance, private equity and investment banking world, financial models have become the language of decision-making. These models are capable of establishing the business assumptions, numbers, projections, and valuations that fuel billion-dollar decisions. However, even the most seasoned professionals can make errors in constructing financial models or when they are interpreting the results. For analysts and associates, these errors are not merely scenic flaws – they may have a direct effect on credibility and accuracy as well as on performance on the job. A mistake in financial modeling can result in mis informed recommendations, poor investment decisions or a loss of client trust.

Financial modeling requires accuracy, organization and reasoning. Unlike theoretical understanding of finance, modeling is a practical skill in which little errors have a compounding effect. The misplaced cell reference, wrong formula or lack of consistency in assumptions, can mislead entire analyses. The societies that expect models from their work are correct but also clear, auditable and flexible. In the context of financial modeling and valuation Singapore, this standard of precision becomes even more essential in ensuring credibility and compliance. This means that analysts need to balance being highly analytical with being helpful – and this is a contradiction that separates experienced analyzers from novices.

Career development is not possible without learning about the most common errors committed in financial modeling. Specifically, it helps professionals anticipate and avoid errors, improve model reliability and provide accountability. Moreover, becoming aware of these transgressions strengthen disciplined practices that directly yield enhanced job performance, enhanced critical thinking, and enhanced professional image.

Lack of Structure and Poor Model Design

One of the most common and expensive mistakes people make when writing financial models is to create a model with no logical structure. Many beginners input numbers and formulas into the spreadsheets without first planning the way the model should flow. This results in poorly structured workbooks with assumptions, calculations and outputs all jumbled together which makes it extremely hard to audit or update the model. A well-designed model has a clear hierarchy with inputs feeding into calculations, the outcomes of which are outputs. When this logical flow is broken about, errors are more difficult to detect or to detect and results are less reliable.

Poor model design also includes inconsistent formatting, no labeling. When inputs, formulas and hard-coded values are impossible to distinguish, the potential for confusion is skyrocketing. For example, analysts might accidentally overwrite the formulas, or users might change some assumptions in the wrong section. Such errors usually go unnoticed until late in the decision-making process, when revisions cost a lot of time and money. This lack of organization is a reflection badly on an analyst’s professionalism, as the senior managers and clients have expectations about models which can be easily understood and tested.

When dealing with a professional setting, a model is usually not made to be used only once. It becomes a living document which circulates between teams and is updated regularly. Without explicit structure and labeling, it is impossible for other users to reliably count on it. This breaks the trust in the analyst’s work and this can impact performance evaluations and opportunities for advancement. A poorly structured model does not only waste time, but gives the impression that you lack your attention to detail – a crucial trait in finance jobs.

Incorrect or Inconsistent Assumptions

Financial models are only as good as the assumptions which drive them. One of the common mistakes by analysts is selecting unrealistic, inconsistent or unsupported assumptions. For instance, assuming unreasonably fast (double digit) growth in revenue in a mature industry, or projecting an expansion in margins without the analysis in place to back down this assumption, can result in a model that looks optimistic, but unreal. Such assumptions can generate pleasing results in the short term, but fail the test of credibility on close scrutiny.

Another common problem exists from inconsistency between allied assumptions. Analysts sometimes change one model component – such as revenue growth – without changing such inputs as cost ratios, capital expenditures, or working capital requirements. This inconsistency leads to internal inconsistencies that distort the cash flow techniques and valuations. Similarly, failing to do the same assumption across scenarios (base, upside, and downside scenarios) can result in confusion and misinterpretation of results.

In investment banking and private equity, unrealistic assumptions can be the downfall of transactions. For example, over prediction of synergies in a merger model, or under prediction of interest costs in an LBO may result in overvaluation and financial exposure. For corporate finance professionals, having wrong assumptions in corporate finance modeling Singapore can take their new budgeting plans to a wrong path, or influence the allocation of capital or feasibility analysis of a project. The repercussions are not just in terms of financial losses – it goes to the damage of the reputation itself. Senior colleagues are quick to appreciate the dis analytical quality of certain assumptions, and they can cause lack of confidence in the judgment of an analyst.

To avoid these sorts of pitfalls, assumptions must always be based on data, market trends and reasonable business logic. Experienced professionals rationalize each major input – be it a growth rate, discount rate or cost forecast – with external benchmarks or even internal performance measures. This analytical discipline only makes the model stronger and it shows professional maturity. Over time consistency and realism in modeling becomes the indicator of reliability and strategic insight both of which are highly valued in finance careers.

Formula Errors and Overcomplicated Calculations

Perhaps the most obvious form of error in financial modeling is formulae based. Incorrect data is everywhere, even now in the most mature workplaces. Something as simple as an incorrect cell reference, a circular reference or a broken link can skew an entire analysis. Because models are sometimes thousands of interconnected formulas in number, an incorrect input in one line would propagate through a number of sheets, giving incorrect results that are hard to track down.

One of the greatest issues is the fact that Excel does not necessarily notify a user about subtle logic errors. For example, an analyst can reference the wrong cell or use data from last year rather than the forecast for this year and not get any obvious error message. These errors are dangerous because they are their silent corrupters that give the impression of being accurate while being incorrect. Similarly, hard-coding values into formulae rather than referencing assumptions, creates low flexibility and transparency which makes the model less maintainable when generating an audit or updating.

Another issue is when the analysts try to jazz up their models with technical sophistication. The most complex figures and macros may look spic and span, but really cause more confusion than value. Overengineering results in slower model performance, increased maintenance cost, and increased possibility of making mistakes. Senior professionals are more likely to favor models that are simple, logical and easy to follow rather than ones that need to be decoded.

Formula modeling is a strong indicator of the professional modeling field. Best-in-class analysts do not just record important calculations but also try formulas using some sample data, plus, conduct regular error checks. The Excel tools like trace precedents, check formula and conditional formatting are used to identify inconsistencies. This carefulness in approach reflects not one of technical ability, however of accountability. In the financial sector mistakes are simply not acceptable, and no matter how small, formula errors can come with hugely expensive results; from mispricing an acquisition to misreporting performance data.

Failure to Integrate Financial Statements Properly

A good financial model should extend fluidly from the income statement, balance sheet and cash flow sheet. However, many analysts are not able to keep this balance causing the models not to balance, or not to balance correctly. When the three statements are said unbundle, the model is not analytically sound. For instance you may forget to match depreciation in the income statement to accumulated depreciation on the balance sheet, which may lead to inaccuracies in the asset value. In addition, mistakes in the working capital adjustments can result in the cash positions being out of balance.

This part of the integration error is usually rooted in the failure to understand how accounting relationships work. For example, increases in accounts receivable will decrease cash and increases in accounts payable, will increase cash. If these relationships are not modeled properly then cash flow projections will be unreliable. In corporate finance, where investment decisions are made in large part on the basis of accurate cash projections, such errors will produce incorrect decisions about capex, financing requirements or dividend policy, for example.

Another definition of this problem is an incomplete balance sheet balancing. When total assets do not equal total liabilities + equity, it means that the logic of the model is broken. This may sound like a technicality, but it has important ramifications for the professional credibility. An unbalanced model makes investors skeptical of the analyst’s knowledge of fundamental financial issues, including their competence in purchase price allocation valuation Singapore. In a job performance review, these mistakes are not only detrimental to attention to detail, but also technical skill- two of the most important characteristics for promotion in the finance field.

Professionals that are good at financial modeling focus closely on interlinking statements. They tie up depreciation, interest expense, taxes and financing flows dynamically. This level of precision separates the analysts that know how accounting mechanics work versus ones that merely push spreadsheets.

Lack of Documentation, Transparency, and Review

Another common error, a mistake that directly impacts the team performance, is that the assumptions are not explicitly mentioned or clarified in the model. In the business world models of financial information are shared between departments, audited and presented to executives or investors. A model that is not understandable makes it difficult for the user to ascertain how the outputs were generated, thereby slows down decision-making, and calls the model’s reliability into question.

Documentation is often overlooked either due to limited time constraints or by a false sense of security of the analysts in their work. They take for granted that other people will be able to perceive the logic without much trouble. However, when changes are necessary or when new team members begin working on the change, the lack of clear documentation causes confusion. Reviewers spend their valuable time attempting to reverse engineer formulas or find seminal assumptions. This inefficiency will be translated into poor collaboration skills or lack of professionalism.

Transparency Scientists also need to be able to see what they are doing, for quality control purposes. Modelling is an iterative process and peer reviews are important for financial models to be of better quality. Without good documentation even the most experienced reviewers might miss some hidden error. Modelers who create auditable models show maturity, anticipation and deference to the audit process – qualities which foster trust and also improve job performance.

In top financial institutions, the most productive professionals use their models as communication channels. They separate inputs in dedicated sheets, provide standardized colors and give comments to the key assumptions. This level of clarity means that models are more reliable, yet persuasive at meetings, presentations and investment discussions.

How Modeling Mistakes Impact Job Performance

The professional consequences of bad modeling transcend technical mistakes to a far greater extent. In a high stake finance position, modeling is an expression of analytical discipline, dependability, and attention to detail. Repeated errors indicate carelessness, which is one of the factors that can lead to the loss of trust from managers and clients. Analysts who produce erroneous work may be viewed as unsuitable for important tasks which may slow career progression. Those that are known for accuracy and clear communication, however, may be given more responsibilities, exposure to senior leadership, and receive quicker promotions.

Inaccurate models may also harm client relationships and firm rests. Any errors in valuation can result in a wrong pricing recommendation in the merger process or while securing funds which in turn can cost millions and damage credibility. In the corporate finance setting, an inaccurate forecast may lead to poor resource allocation or unsuccessful investment projects. In the end, modeling errors impact confidence – confidence in the abilities of the analyst and confidence in the institution that the analyst represents.

From a larger point of view, the consistent modeling discipline helps in career-growth as it helps attain mastery in detail-oriented, high-responsibility tasks. Analysts that gain a reputation for developing good models that are clean, accurate, and auditable frequently become go-to professionals within their teams. Their work becomes a standard of excellence that sets them apart in an industry that is competitive.

Conclusion

Financial modeling is the backbone of analytical work in finance but it’s also a minefield of possible mistakes. The most common mistakes improper structure, unrealistic assumptions, formula errors, weak integration and lack of transparency all have one chord beneath them-responsibility in lack of discipline and review. For those professionals looking for long term success, staying clear of these pitfalls is not only about correct technicalities, but it’s about building credibility and trust as professionals.

A financial model is not merely a spreadsheet, but a reflection of the mind of the analyst: his thinking, diligence, and dependability. Each formula contains a story of reason, and behind each assumption lies a thought of which we are accountable, each and every test is a display of responsibility. Not all analysts make models – only the best create confidence with accuracy. In the case of finance, a discipline governed by numbers, the ability to control the discipline of non-error models is one of the most effective tools to improve both performance and career path.