Building accurate forecasts with the 3 Statement Model in finance

Building accurate forecasts with the 3 Statement Model in finance

Guide on Building Accurate Forecasts with the 3 Statement Model in Finance

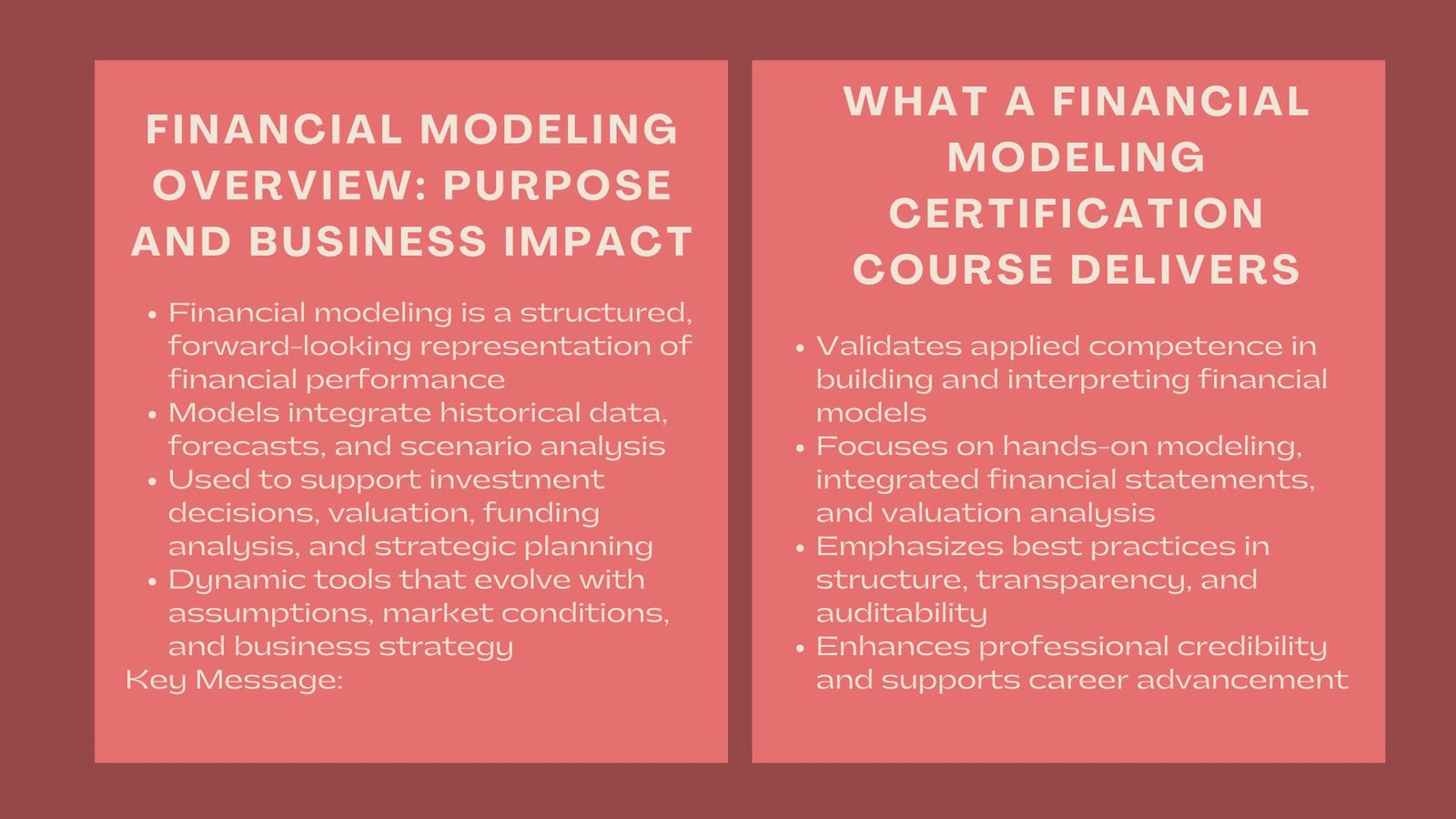

One of the key and most applicable tools in corporate finance, investment banking and financial analysis on the 3-statement financial model. It gives both the full and interrelated picture of financial performance and position of a company and its liquidity. This model enables the analyst to comprehend how various operational activities, financing decision making and investment plans interplay and affect one another as time goes by, by linking the income statement, balance sheet and the cash flow statement in a coherent structure.

What is significant about the 3-statement model is that it unites various elements of the financial reporting within the same structure, which is dynamic. All the statements serve different purposes, the income statement depicts profitability, balance sheet demonstrates the financial situation of the company at a specific moment, and a cash flow indicates the flow of cash. Taken in unison, these statements can be used to perform a higher grade of analysis, prediction, and decision-making.

As an example, the 3-statement model is involved with the financial planning, raising funds, budgeting, mergers and acquisitions, and investment analysis. It can make professionals run a scenario test, evaluate risks, and estimate the effects of different strategies prior to any decisions. To anyone who desires to be good in the field of finance, one should understand how to develop a 3-statement model on financial modeling and how to interpret it.

The Role of the Income Statement in the Model

Most financial models begin with the income statement which is also known as profit and loss statement. It reflects revenues, expenses, and profits in a given time, normally on a quarter or yearly basis. This is mainly to demonstrate how strongly a business earns profit taking into consideration all operating costs, interests and taxes.

With regards to the 3-statement model, the net income used in calculating the equity of the balance sheet is based on the income statement and forms the starting point in calculating cash flow operations in the cash flow statement. The modeling process usually starts with revenue forecasting, which is based on a set of assumptions concerning the growth of sales, prices and market tendencies. These assumptions roll down to the cost of goods sold, operating expenses, depreciation, interest, and tax and eventually the net income.

It is important to understand what drives every line item. As an example, a decrease in gross margin may carry severe ripple implications on the operating profit and net income, whereas a variation in operating expenses may shift the company’s ability to spend in growth. Analysts need to make sure that the income is realistic in the modeling process, and it should represent the past performance as well as expectations. Precision is crucial in this case because any inaccuracy is likely to spread to the balance sheet and the statement of cash flow affecting the credibility of the whole model.

Integrating the Balance Sheet into the Model

The balance sheet depicts the financial status of a firm at a given moment. It shows assets, liabilities and shareholders equity in a manner that follows the equation, Assets = Liabilities + Equity. Under the 3-statement model, the balance sheet serves as an indicator to maintain balance of all the financial activities.

The connection between the balance sheet and the income statement entails making adjustments on retained earnings as it relates to net earnings and dividends or income distributions. A significant percentage of balance sheet accounts (accounts receivable, inventory, accounts payable) are related to the activities of the income statement by way of working capital assumptions. Such relationships are needed since they affect the computation of cash flow especially when undertaking the operating activities correlation.

In addition, the balance sheet shows the implication of investing and financing decisions. To use an example, creation of new debt will add cash and liabilities, new asset acquisition will alter the make up of both the asset base and financing mix. In the income statement, an amount of depreciation which is a book value decrease of the fixed assets is realized whereas the capital structure moves due to the alterations made in debt and equity.

Each line of the balance sheet must be well linked to the driver in order to obtain accurate modeling. These are the turnover ratios of working capital, schedule of capital expenditure on fixed assets and plans to repay debts. Stopped or haphazard balance sheets create inconsistencies, and this renders the model unreliable.

The Cash Flow Statement: The Bridge Between Profit and Liquidity

Though it is a measurement of the profitability, the income statement does not necessarily indicate the amounts of cash that are realized or expended within a time. This is where the cash flow statement will be significant in a three statement model. It creates a reconciliation between the net income and the actual flow of cash as it includes non-cash components and changes in working capital before adding or subtracting cash flows of the investing and financing activities.

The cash flow statement in the model is made following the linking of income statement and balance sheet. The operating activities line commences with net income then there is an addition of non-cash expenses such as depreciation and then there is a deduction of difference in current assets and liabilities. Investment activities monitor the capital expenditure, acquisition and sales of an asset. The financing activities measure the issuing and repaying of either debt or the sale of equity, and paying of dividends.

The net result for the period is the net change in cash and this figure is added to the beginning cash amount in the balance sheet to reach the closing cash amount. This final balance has to be equal to the cash line in the revised balance sheet in order to balance the model.

An analysis of the cash flow statement is especially significant in the assessment of liquidity and financial health. A business may report large amounts of profit and at the same time experience cash crunch when receivables increase rapidly or when the business makes some intensive investment without financing. Including the cash flow statement as part of the model, analysts can be confident about portraying the entire picture related to the capabilities of a firm in terms of paying off its debts and financing future activities.

Building and Linking the 3-Statement Model

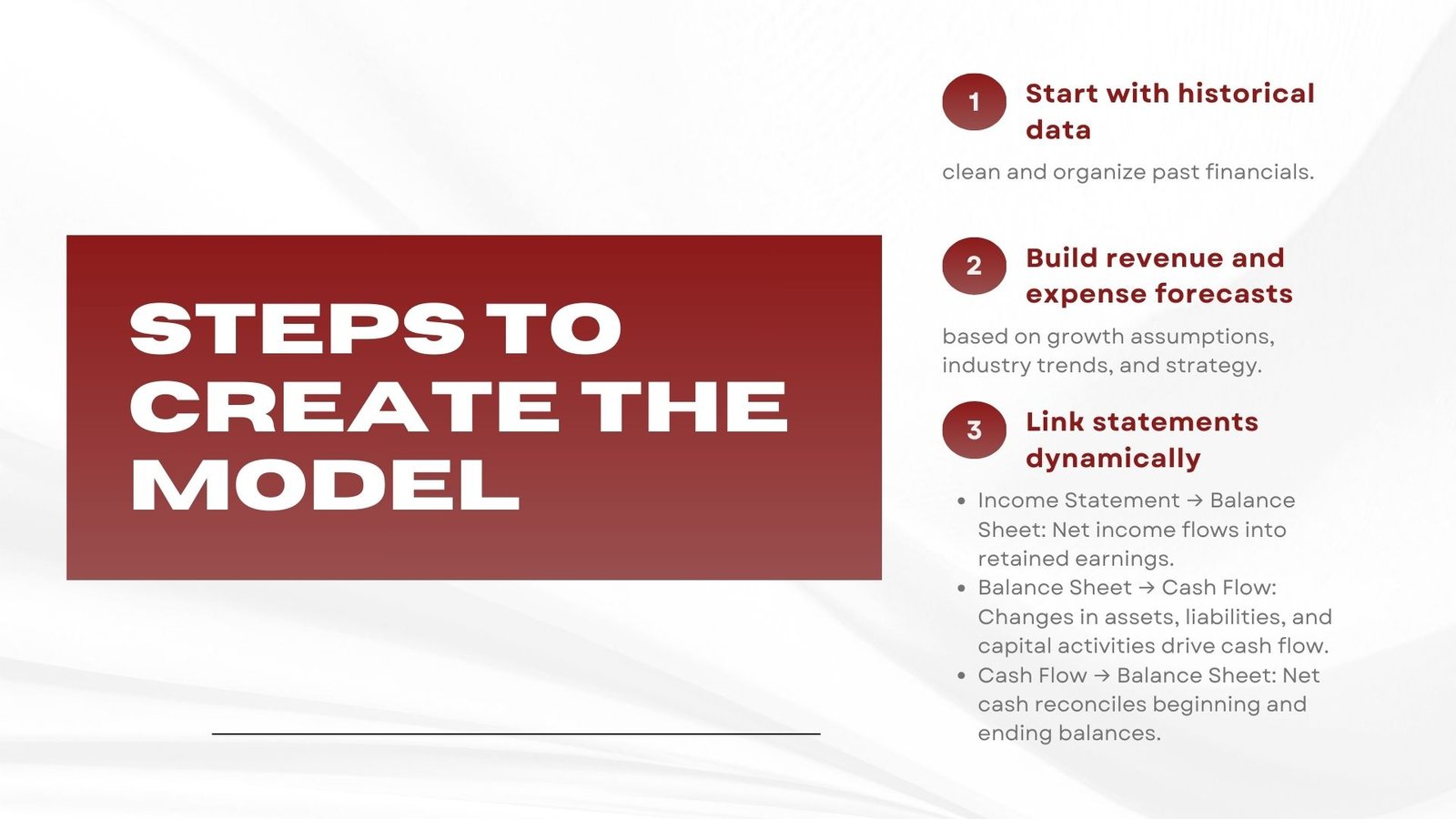

The process of building a 3-statement model will start by using past financial statements, cleaning, formatting, and inspecting past results in order to find relationships and trends among statements. Future period assumptions are then made on past performance and industry standards as well as strategic objectives. Based on these assumptions, it will be possible to extrapolate the revenue forecast, expense trends, capital expenditures, finance plans, and working capital variations.

The initial build process nonetheless involves a project of the income statement and that would be the projection of revenues to a net position in the income statement. The updated balance sheet then follows by connecting the net income to retained earnings along with planned capital investments stock, issues or repayment of debt and also change of equity. Lastly, the statement of cash flow is taking an indirect method to make the three statements interrelated using dynamic formulas.

The main point in this process is that once there is a change on any statement, the change must be appropriate in all the statements. Take as an example, when the company increases the capital expenditures in the fixed asset section of the balance sheet, outflow will be recorded on the cash flow statement and there must be adjustment of the depreciation expenses affecting the income statement. Likewise, when the debt is repaid, the liabilities will drop out of the balance sheet, interest cost will decline on the income statement and outflow of cash will be found under the financing part of the cash flow statement.

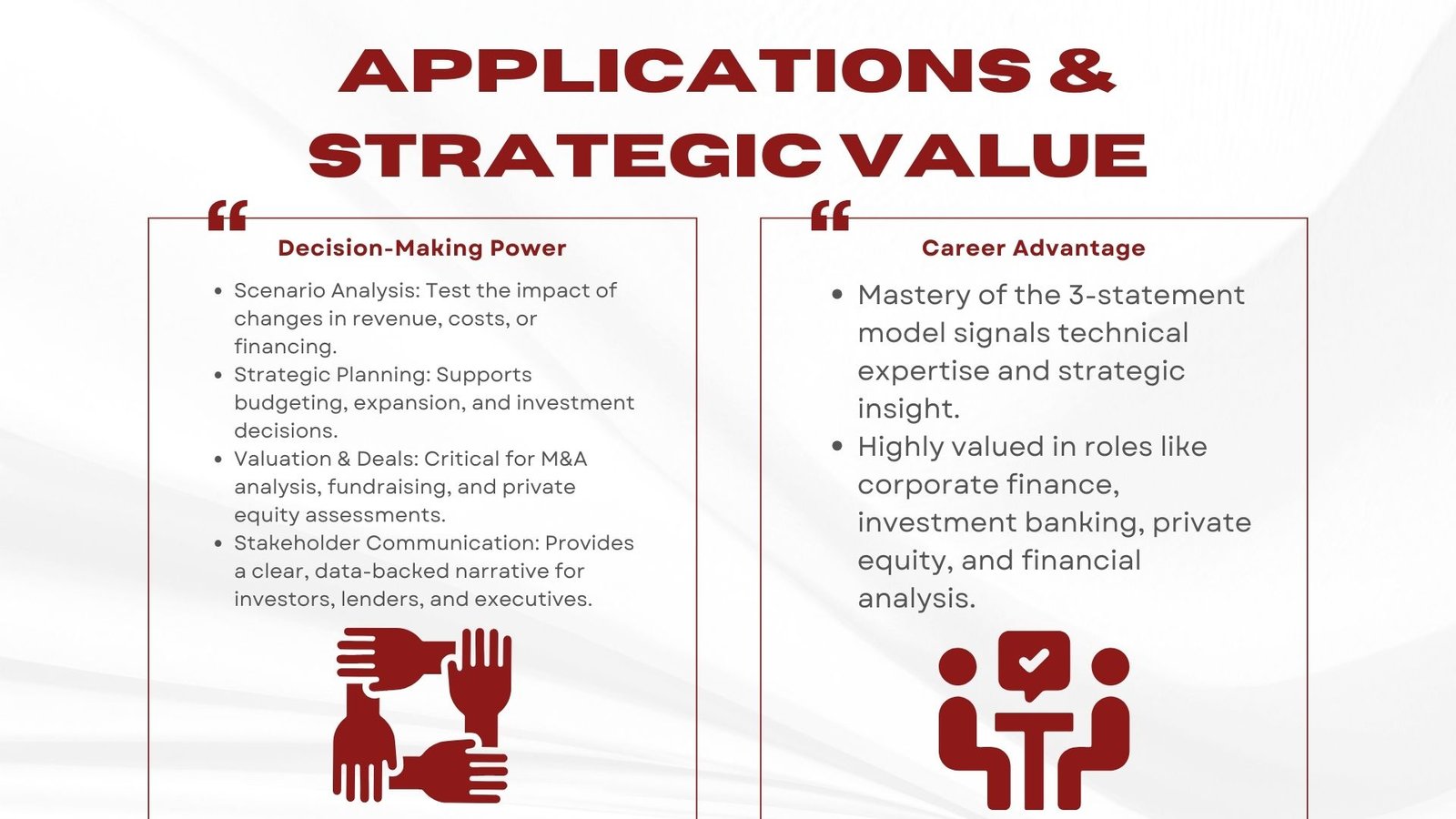

After the construction of the model, scenario analysis can be undertaken where assumptions are changed to determine the effects of various strategies used in business, the condition of the market or decisions related to finance. The 3-statement model is a strong decision making tool because of this flexibility.

Applications and Importance in Decision-Making

Applications and Importance in Decision-Making

Conceptualizing the 3-statement model is applicable in areas other than the reporting aspect of the model. It is a needed component of strategic decision making and allows businesses and investors to predict financial operations, compare potential investment projects, and plan against most of the situations. To the corporate management, the model facilitates budgetary and performance monitoring to determine where modifications should be done to meet the financial goals.

The 3-statement model in mergers and acquisitions uses the combined financials of both the acquiring and target companies to project the combined financials, evaluate synergies and answer how this will impact the profitability and the cash flow. It is regarded as useful to prepare pitch books, conduct valuations, and advise clients on how to finance their investments through investment banking. In the case of private equity and venture capital, the model is part and parcel in determining the possibility of the returns as well as how the deals could be structured.

In addition to corporate application the 3-statement model is more useful as it can be applicable to the lenders, analysts and investors in case they require an integrated and concise understanding of the financial standing of a company. Knowing how alterations in any region influence the overall financial situation, the stakeholders will be able to make more adequate decisions.

The skill to construct a 3-statement model, interpret the construction and modify the approach to the model is a sign of technical expertise and strategic insight by the finance professional. It links accounting information and practical knowledge to act and therefore, is the core competency in the financial sector.