better benefit Real Estate Financial Models

Better Benefit Real Estate Financial Models Singapore

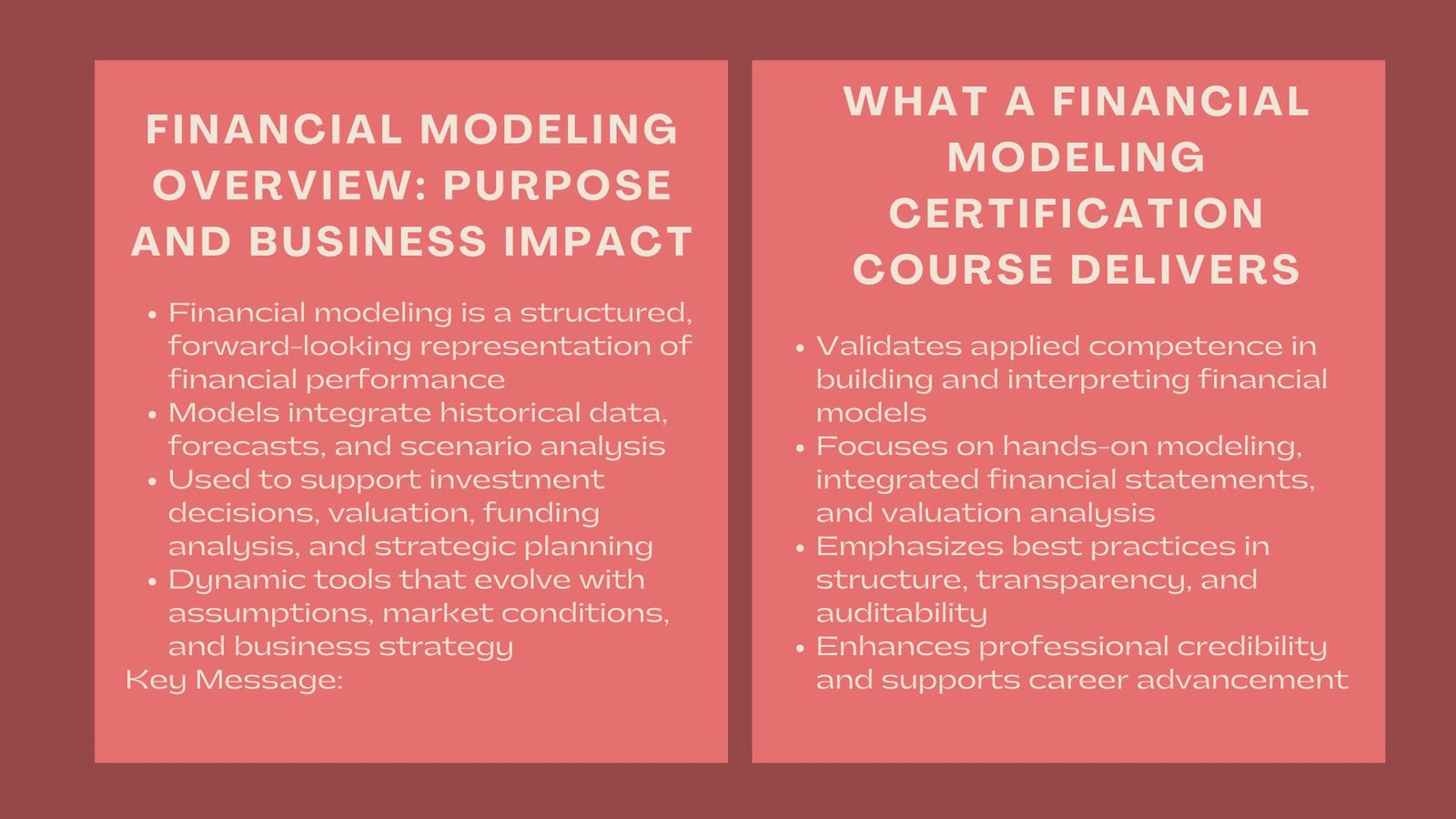

Introduction: Why Models Matter

It is all about location, time-location and location numbers as far as real estate Financial Models Singapore investing is concerned. The optimal investment decisions are those that have their foundation on an assessment of the appreciation, performance, and hazard of a property. These factors are assessed in organized structures through the Financial valuation company Singapore, which can give the investors an organized approach to taking informed decisions basing on facts and data, as opposed to mere intuition.

Nevertheless, no model alone could be used to cover the whole picture. There are strengths and weaknesses of each model and, therefore, to get a more balanced opinion, smart investors mix a number of them. In so doing, they would be able to make more measured investment decisions that are objective and more capable of sailing through market uncertainties.

Discounted Cash Flow (DCF) for Real Estate Financial Models Singapore

Operation: DCF model estimates all future cash flows likely to occur on a property that are directly related to the property such as rental income after subtracting operating cost, maintenance expenses as well as capital expenditure. Discounting these future cash flows all the way back in our present value of these cash flows is therefore accomplished through the application of a suitable discount rate more representative of the time value of money as well as the operational risk management Singapore profile of the investment.

Best application: DCF is especially efficient to use with long-term positions in daycare investments in real-estates where the only aspect matters are the growth production, the stability of the income and sustainability. It is suitable when the property that generates cash is anticipated to be many years old (e.g., a commercial structure, multi complex, or long term rental) problem.

Importance: The DCF model is important because it allows one to comprehend subtly the use of the discount rate to state whether assumed future returns are warranted by the ongoing buying cost. It assists in the overvaluation of property based on its inherent value to the investor and helps one make rational decisions regarding property based on anticipated performance basis rather than past performance.

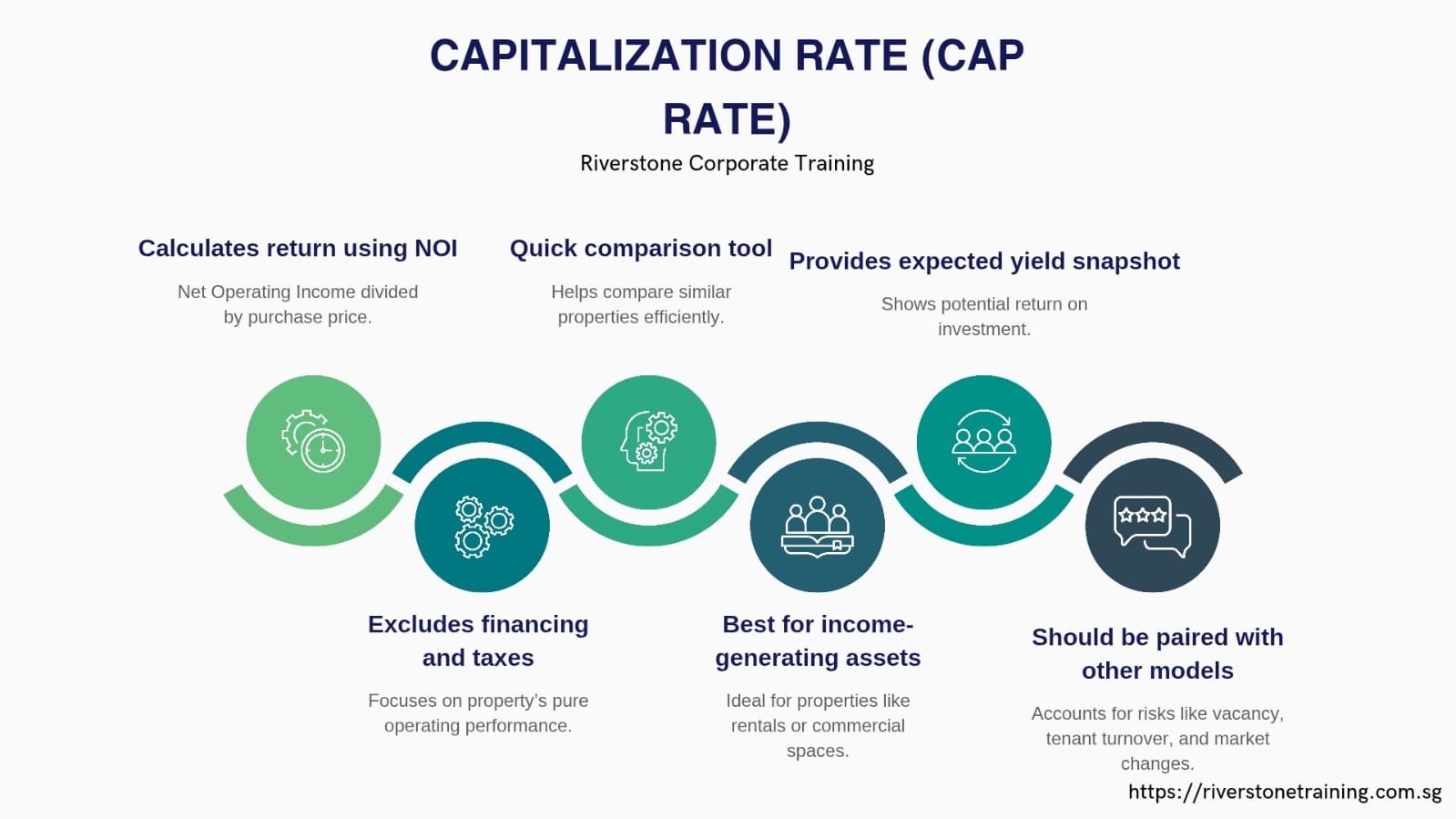

Capitalization Rate (Cap Rate) for Real Estate Financial Models Singapore

The mechanism Cap Rate: The Cap Rate is computed by dividing the net operating income (NOI) of the property by purchase price. NOI is the total income earned on the property in terms of all revenue that the property receives from its operation as compared to operating expenses without taking into consideration financing expenses and taxes.

Its best use: Cap Rate is a fast and effective tool to use in the comparison of returns that may be received with respect to various properties especially where similar assets are presented in either similar locations. It is mostly applied by the investors who have a quick evaluation of rent bringing home assets.

Why it is important: The Cap Rate is a reference that shows the yield that is expected out of a particular investment. Whilst it comes in handy to make first comparisons, one should always team it with other models in a bid to zero on risks related to tenant turnover, vacancy rates, capacity to boost the rent growth, and local market forces.

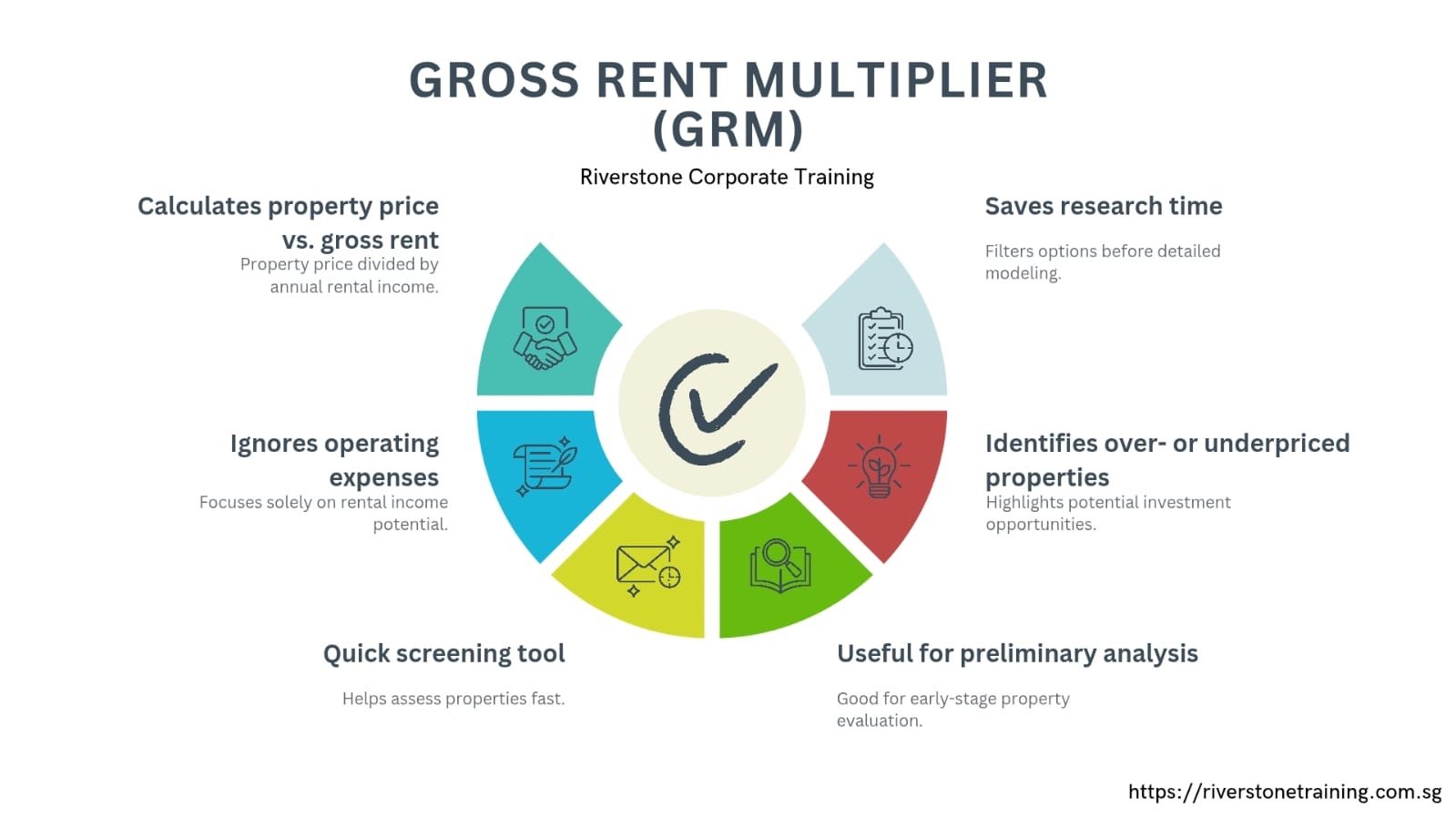

Gross Rent Multiplier (GRM) for Real Estate Financial Models Singapore

Calculation: GRM = price of the property/ rental income gained every year. GRM does not take operating expenses into consideration just like Cap Rate.

Best application: GRM can be considered as an efficient screening technique in rental houses that will enable the investors to have a quick idea that a particular house has an asking price value above what it will actually fetch in terms of net returns in terms of rental values. It is specifically handy when one is doing preliminary analysis before guarding time to more inclined budget assimilations.

The importance of this model: With the aid of the model, an investor can easily see when the properties are likely to overprice or underprice their properties. GRM can be utilized to use research and analysis resources more productively as it rapidly filters opportunities.

Comparable Sales (Comps) for Real Estate for Financial Models Singapore

Principle of operation: Comps analysis analyses the recent sales of comparable properties within a particular area in order to arrive at a market aligned company value. The aspects that include property size, condition, age, location and amenities are put into consideration.

Optimal use: Comps can be used in the best way to price homes or commercial facilities in active and open markets. They especially come in handy in learning the local pricing pattern and anticipations in the market.

Why it is important: Comps caters to the fact that investors do not overvalue as compared to comparable properties and also aids in confirming the appraisals made through alternative models. It is also helpful in determining the liquidity in markets and demand by buyers.

Sensitivity and Scenario Analysis for Real Estate Financial Models Singapore

Mechanism: Sensitivity and scenario analysis The analysis determines the effect of variations in crucial assumptions like critical variables (rent growth, interest rates, vacancy rates, or operating expenses) on the projected returns. The users or the investors are allowed to create various scenarios or: what-if scenarios in order to view best-case, worst-case, and most probable scenarios.

Best use These analyses play an important role in risk-testing investment strategies, which rely on the market conditions, which are volatile or uncertain. They tend to be mostly applied on more risky or longer investment horizon properties.

Why it is important: It is vulnerable to being sensitised and scenario analysis reveals almost invisible vulnerabilities but such as that which are not clear in static formulations. They enable investors to plan in advance, reduce financing frameworks and make decisions in their investment decisions that are more resilient.

Strategic Tip: Layer the Models

Investors ought to employ several models concurrently rather than employing one only so as to form a clear picture of the whole picture. For example:

Begin with GRM as a quick way of filtering any prospective property.

Use Cap Rate and Comps to check market validity and more moved income point of view.

Measuring long-term intrinsic value is best done with DCF.

Include Sensitivity Analysis to consider risk and be ready to risk volatility of the market.

Layering tutors help investors to reduce blind spots, reduce uncertainty that they are making a right decision, and make sure that not only the yield of the short-term value but also the long-term growth potential are also targeted in their investment strategy.

Conclusion: Smarter Decisions Through Models

Application of the various advanced financial models Singapore is not the intention of complicating the art of investing but getting clarity. All of the models offer a differing perspective, with brief histories of cash flow to intricate figures of long-term returns. With a combination of these views, investors will be better able to determine the threats, find opportunities, and make decisions, basing them on in-depth research.

When it comes to real estate, it is not appropriate to trust only one measure. Decisions regarding the best informed views can be made by remaining mindful of the entire picture that a variety of models assist in determining the performance of different entities needed in both the short-term and in the long-term objectives.