Advanced Excel Functions for Financial Modeling Boost Your Career Prospects

Advanced Excel Functions for Financial Modeling: Boost Your Career Prospects

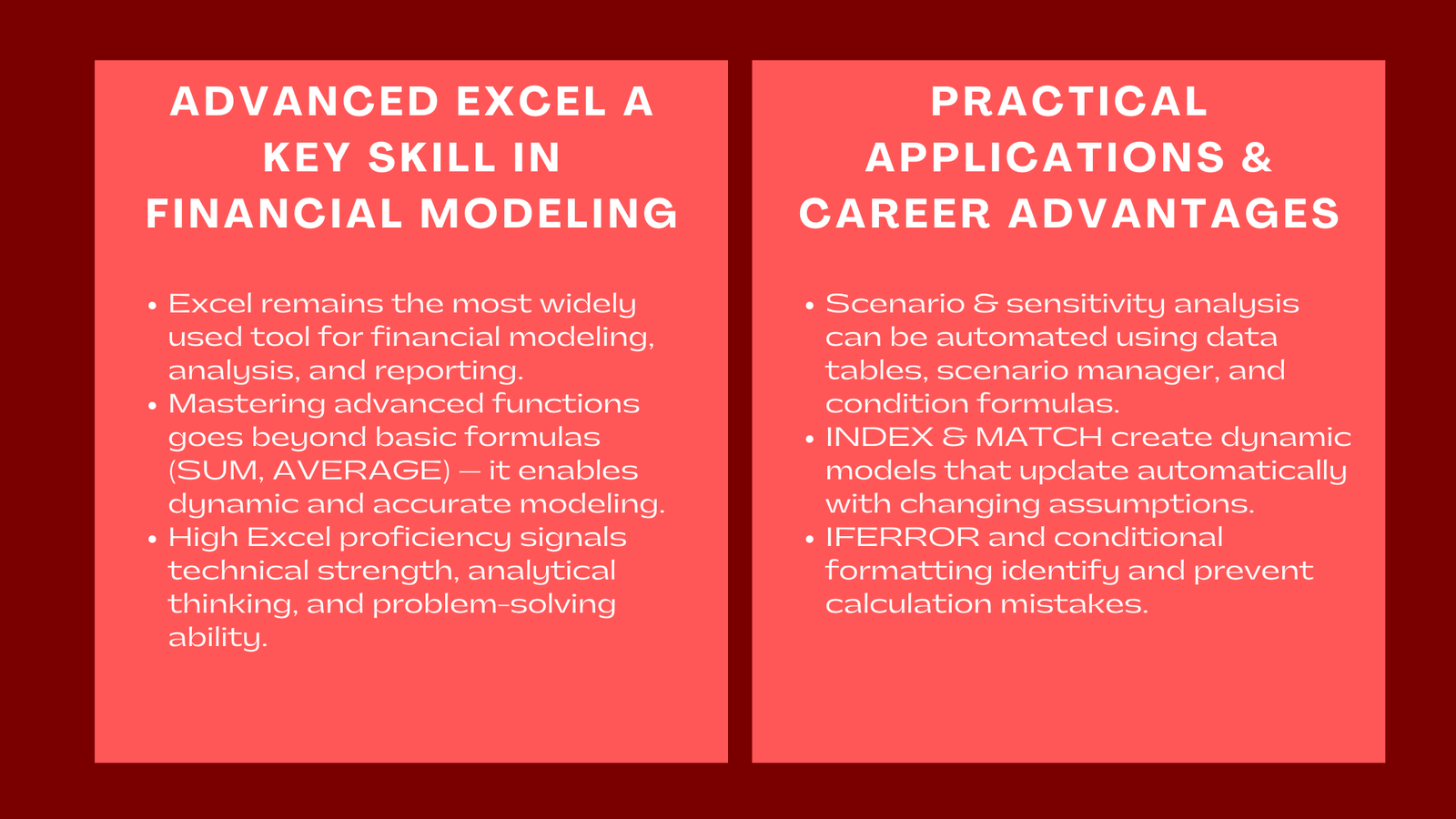

Excel has been the most popular finance tool and it was used as the basis of financial modeling, analysis and reporting. Nonetheless, it is no longer enough that an aspiring analyst, investment banker, or corporate finance professional has a basic understanding of such a formula as SUM or AVERAGE. The advanced spreadsheet applications are necessary in creating powerful, dynamic, and quality financial models that impress employers and cause business decisions.

Learning advanced excel not only makes a model efficient and particularly accurate but also gives one an opportunity to get a better job. Individuals with the ability to manipulate data that is large in size, automate calculations and develop meaningful analysis are unique in recruitment exercises and performance appraisal. High levels of Excel mastery are signals of technical skills, judgmental thinking, and the capacity to solve complicated issues, which can be characterized as very important qualities in a funding position. Enrolling in an excel training for financial modelling course Singapore can help professionals build these capabilities and stand out in a competitive finance job market.

This paper examines the most significant advanced excel functions in financial models, their use in real life and the advantages of learning how to use them in a career. Combining these functions in modeling practice will allow you to produce a high quality output, minimise errors as well as emerge as a high performance analyst.

Key Advanced Excel Functions for Financial Modeling

Out of the vast number of Excel tools there are functions that are applicable specifically in financial modeling. Lookup and reference is similar to VLOOKUP, HLOOKUP, INDEX, and MATCH that enables analysts to access results of a given data point based on the large data set. These advanced Excel functions for financial modeling and career development functions are important in connecting the financial statements, updating the assumption and constructing dynamic models whereby the inputs keep on changing.

Scenario building, conditional calculations, and error handling are made possible through use of logical functions IF, AND, OR and nested formulas. An IF statement wants work to be able to modify revenue assumptions automatically based on a key threshold value whereas nested logical formulas enable more complicated enterprise guidelines to be embedded directly into the formula itself.

Valuation, cash, and investment appraisal are based on mathematical and statistical functions such as NPV, IRR, PMT and SUMPRODUCT. The aforementioned NPV and IRR in particular are required to assess profitability of a project and returns on investments to offer some important information on which strategic inferences will be drawn.

Managerial functions such as SORT, FILTER, and UNIQUE are used in order to organize and analyze huge data. Such functions decrease the amount of manual work, decrease the error rate, and allow acquiring insights much more quickly. Having conditional formatting, they can be used to bring out trends, anomalies, or risks visually by the analysts enhancing the interpretability of the models to the decision-makers.

Practical Applications in Financial Modeling

The reseller functions of the Excel are not limited to technical knowledge and skills, it enriches how to use Excel for professional financial analysis and the practical modelling. To illustrate, a model that includes an INDEX and a MATCH means that any reference of assumptions and outputs can be dynamic and thus as revenue growth or costs change, forecasts can automatically change. This minimizes hand and gestures corrections and maximizes precision, especially when using complicated many years of financial models.

Data can be automated to create scenario and sensitivity analysis through condition formulas, scenario manager, as well as data tables. Analysts are able to analyze many scenarios where there are changes in the variables without having to recreate the model fresh again thus saves time and the results become more reliable. On the same note, the interactive dashboards based on SUMIFS, COUNTIFS, and pivot tables enable the stakeholders to engage data and have insights in a short period.

In addition, developed competency in Excel is able to check on errors and actions that are audit-able. Iserror, Iferror and conditional formatting provide the means of detecting broken formula, inconsistency of formula or outlier assumptions. This not only enhances accuracy but also professional demeanor, and this is of course, good that the models are considered as reliable as well as transparent.

Career Benefits of Mastering Advanced Excel

Employers consider high levels of Excel skills as a decisive factor in the hiring process, performance consideration and promotions. The analysts are able to develop dynamic, efficient and accurate models and therefore they are better placed to aid in the decision making process. They are perceived as problem solvers who can work with complex data and create working information and automatize routine activities.

Further excel skills also harness faster learning in other fields in finance. The functions applied in modeling are similar to the valuation, budgeting, forecasting and reporting. When mastered by the professionals, these tools enable them to adjust to the new projects faster so that they can provide a shorter onboarding period and enhance their productivity. More so, working with Excel is the base of more advanced analytics, such as VBA automation, Power Query, and integration with business intelligence platforms, which can lead to strategic positions.

Career-wise, the skill of using advanced Excel does not only make things more efficient but also credible and visible. Those analysts who deliver quality models, free of errors on a regular basis, are trusted by the managers, exposed to the high-impact projects, and set themselves on the path of leadership. Technical proficiency in Excel spreadsheets is sometimes what separates an average player in the competitive world of finance and a desired employee.

Conclusion to Advanced Excel Functions for Financial Modeling Boost Your Career Prospects

Advanced Excel functions: more than a technical tool, it is a professional tool, a career enhancer to financial professionals. The INDEX, MATCH, NPV, IRR and dynamic data management capabilities are functions that enable an analyst to construct sound, error free and insightful financial models. These competencies enhance effectiveness, decrease mistakes, and help professionals provide decision-makers with some practical advice. Beyond just calculation accuracy, advanced Excel skills also enhance analytical depth and decision-making efficiency Singapore. They allow finance professionals to build dynamic models that automatically update with changing inputs, track key performance indicators (KPIs), and perform comprehensive sensitivity and scenario analyses. Such capabilities make financial reports more interactive, flexible, and responsive to managerial needs. The use of features like PivotTables, Power Query, and dynamic arrays can further enhance productivity by enabling faster data manipulation and cleaner model structures. Moreover, professionals with advanced Excel mastery can better communicate financial insights through visually compelling dashboards, charts, and visual analytics that make complex information accessible to decision-makers.

Advanced Excel skills are desirable to employers since they are indicators of analytical rigor, problem-solving skill, and attention to detail. Those analysts that have mastered such functions not only come up with better models but they are also more likely to improve their professional credibility, future career as well as future leadership positions. Technical mastery of Excel has become a useful requirement of the world of finance and an attractive career-bringer.