Financial Modeling Essentials for Modern Business

Financial Modeling Essentials for Modern Business

Introduction to Financial Modeling Essentials for Modern Business

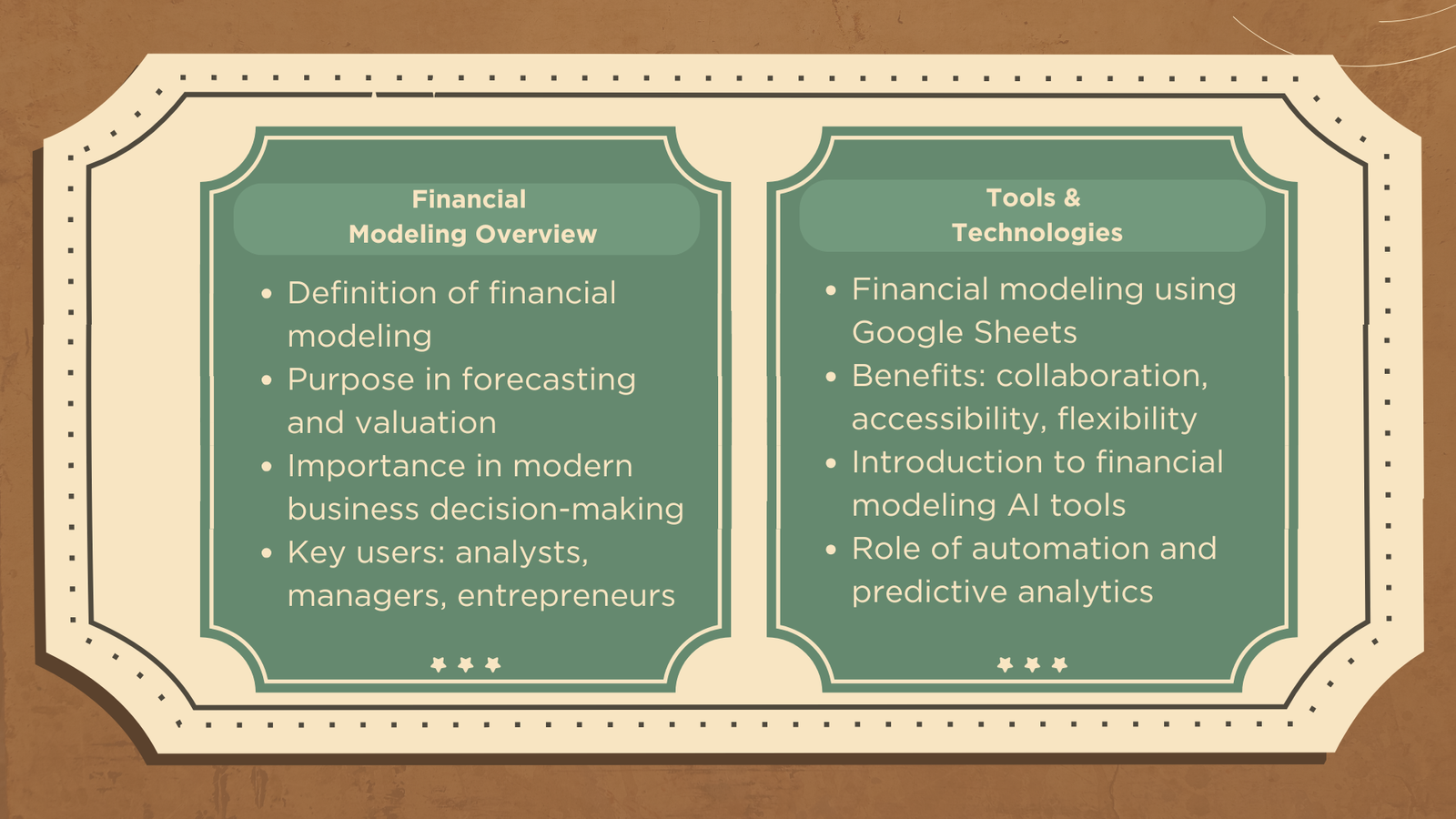

In today’s data-driven and highly competitive business environment, understanding what is financial modeling has become essential for professionals across finance, strategy, and management. Financial modeling is no longer limited to investment banks or large corporations—it is now widely used by startups, consultants, analysts, and business leaders to support forecasting, valuation, and decision-making.

With the advancement of digital tools, accessibility has increased through financial modeling Google Sheets and advanced financial modeling AI tools. These tools transform raw financial data into structured insights, enabling organizations to assess risk, plan strategically, and evaluate performance effectively.

Understanding Financial Modeling: Purpose and Concept

To fully understand financial modeling, it is important to recognize its purpose. Financial modeling is the process of creating a structured representation of a company’s financial performance using historical data, assumptions, and mathematical formulas. These models simulate business outcomes under different scenarios, helping decision-makers test assumptions and anticipate results.

Financial modeling is grounded in accounting principles, finance theory, and business logic. A well-built model reflects the interconnection between the income statement, balance sheet, and cash flow statement, enabling professionals to evaluate profitability, liquidity, and long-term sustainability.

Core Components of Financial Models

Understanding what is financial modeling also involves knowing its core elements. Most financial models consist of:

- Assumptions: growth rates, costs, market conditions

- Historical data: revenue, expenses, and capital trends

- Calculations: formulas linking financial statements

- Outputs: forecasts, valuations, and financial ratios

Accuracy, transparency, and logical structure remain critical, regardless of whether models are built in spreadsheets or advanced software.

Financial Modeling Using Google Sheets

Financial modeling Google Sheets has gained popularity due to its accessibility and collaborative features. As a cloud-based tool, Google Sheets allows real-time collaboration, version control, and ease of sharing—making it ideal for distributed teams.

Google Sheets supports essential modeling techniques such as forecasting, scenario analysis, and sensitivity testing. While it may lack some advanced features of specialized software, it remains a cost-effective and practical solution for many organizations.

Best Practices for Financial Modeling in Google Sheets

To maximize effectiveness when using financial modeling Google Sheets, best practices include:

- Clear separation of inputs, calculations, and outputs

- Consistent formatting and labeling

- Proper documentation of assumptions

- Regular reviews and error checks

When implemented correctly, Google Sheets enables efficient and informed financial decision-making.

The Rise of AI in Financial Modeling

The emergence of financial modeling AI tools has added a new dimension to financial analysis. AI-powered platforms automate data processing, detect patterns, and generate predictive insights with greater speed and scalability.

These tools enhance accuracy by reducing manual errors and bias in assumptions. By leveraging large datasets, AI in financial modeling uncovers hidden correlations and supports real-time scenario analysis, particularly in complex business environments.

Applications of AI-Based Financial Modeling

Financial modeling AI tools are widely used in:

- Forecasting future financial performance

- Valuation based on market and peer data

- Risk management through stress testing and scenario simulation

While AI enhances analytical capability, it complements rather than replaces professional financial judgment.

Traditional vs Technology-Driven Financial Modeling

Traditional spreadsheet-based models offer flexibility and transparency, allowing analysts to clearly trace assumptions and logic. In contrast, AI-driven financial modeling emphasizes automation and predictive analytics but may reduce visibility if not properly configured.

Financial modeling Google Sheets serves as a balanced solution, combining accessibility with sufficient analytical power. Most organizations adopt a hybrid approach, integrating traditional models with AI tools for optimal results.

Financial Modeling as a Professional Skill

Mastering financial modeling significantly supports professional development. It is a highly valued skill for financial analysts, consultants, strategists, and entrepreneurs. Proficiency in Google Sheets modeling and familiarity with AI financial tools enhance employability and career advancement.

Beyond technical skills, financial modeling develops critical thinking, data interpretation, and strategic insight, which are essential leadership competencies.

Challenges and Limitations of Financial Modeling

Despite its benefits, financial modeling has limitations. Models are only as reliable as their assumptions, and incorrect inputs can lead to misleading conclusions.

Overreliance on financial modeling AI tools without sufficient expertise can also be risky. Results must always be evaluated using business logic and contextual understanding. Similarly, complex spreadsheet models require strong structure to remain manageable and accurate.

Future Trends in Financial Modeling

The future of financial modeling will continue to integrate advanced analytics and technology. AI tools will further enhance predictive accuracy, while collaborative platforms will strengthen the role of Google Sheets in remote and team-based environments.

Despite technological advancements, core principles—financial logic, transparency, and strategic alignment—will remain central to effective modeling.

Conclusion

Understanding what is financial modeling is essential for navigating modern business complexity and making informed financial decisions. Financial modeling provides a structured approach to forecasting, valuation, and strategic analysis.

The combination of accessible tools like financial modeling Google Sheets and advanced financial modeling AI tools has democratized financial analysis. By integrating traditional principles with modern technology, professionals can achieve greater accuracy, efficiency, and strategic clarity in a rapidly evolving financial landscape.