How to Master Financial Modeling Techniques

Financial Modeling Certification Course: A Practical Overview of Financial Modeling in Practice, Resources, and Professional Development

Introduction: How to Master Financial Modeling Techniques

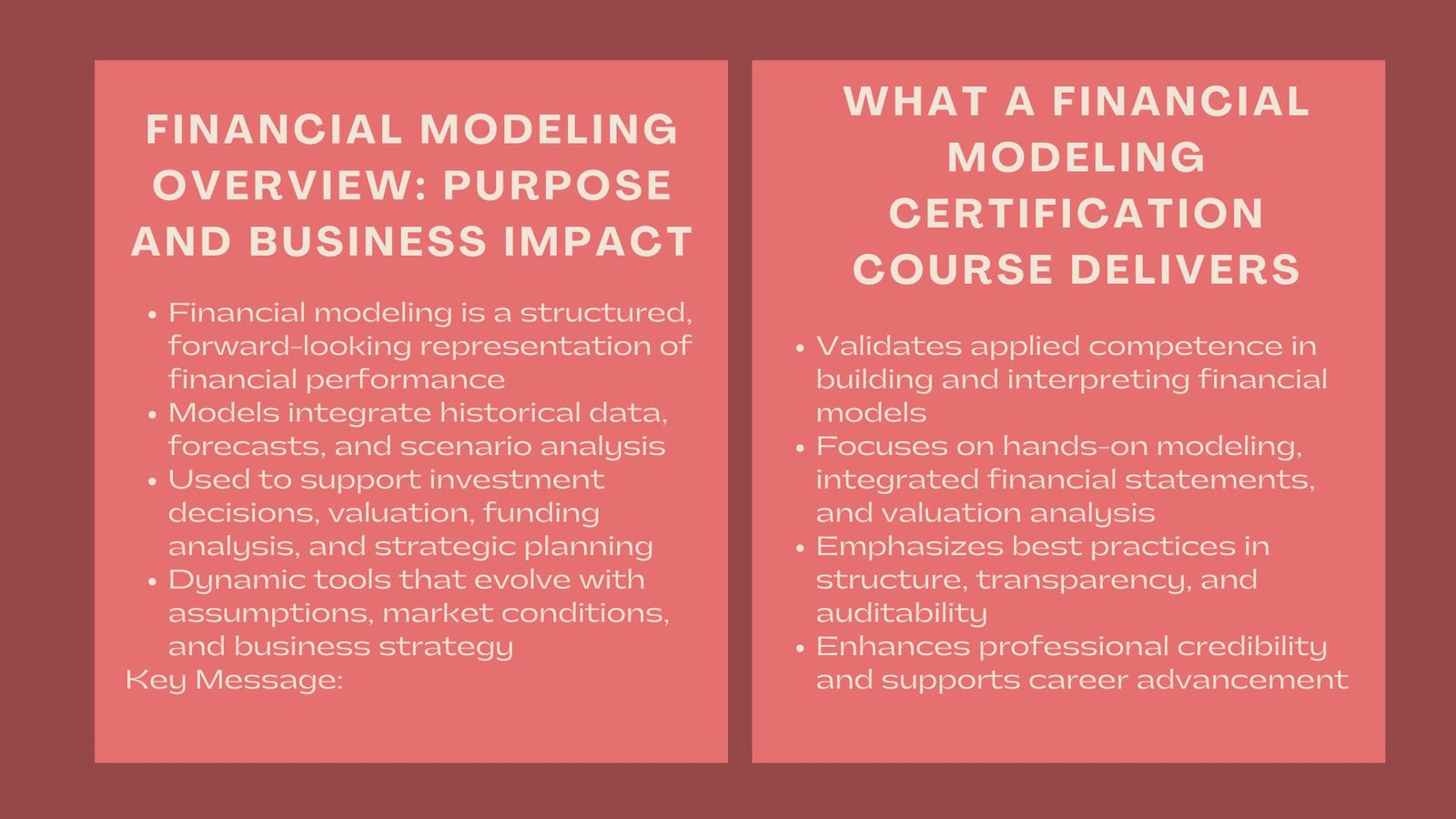

Financial modeling has become a core professional skill across corporate finance, investment banking, valuation, strategy, and consulting roles. Organizations increasingly rely on robust financial models to support decision-making related to investments, funding structures, mergers and acquisitions, and long-term planning. As a result, many professionals actively seek a financial modeling certification course to formalize their skills and demonstrate applied competence. This article provides a comprehensive financial modeling overview, explains how financial modeling in practice is applied across industries, and highlights the role of structured learning and high-quality financial modeling resources in building sustainable expertise.

Financial modeling has become a fundamental profession in the fields of corporate finance, investment banking, valuation, strategy and consulting. Organizations are increasingly using sound financial models as a tool in making decisions that are associated with investments, funding structures, mergers and acquisitions, and long-term planning. Due to this reason, there are a lot of professionals who are undertaking a financial modeling certification course to formalize their abilities and show applied proficiency. This article provides a comprehensive financial modeling overview, explains how financial modeling in practice is applied across industries, and highlights the role of structured learning and high-quality financial modeling resources in building sustainable expertise.

Understanding Financial Modeling and Its Strategic Role

Financial Modeling Overview in Modern Business

A clear financial modeling overview begins with understanding that financial modeling is the structured representation of a company’s financial performance using spreadsheets and analytical assumptions. These models are majorly built using past financial information, projections, and scenario analysis to determine the performance of the business in various scenarios. The financial models that are used in the modern organizations are not fixed models but dynamic structures that change over time as assumptions, market, and strategy shift.

Financial modeling aids a diverse variety of strategic choices. They are the assessment of capital investments, value estimation of companies, testing the financial resilience to a stressful situation and the effect of strategic projects. An effective model will enhance transparency and enable decision-makers to know how value is generated and how risks are spread across financial statements.

Why Financial Modeling Skills Are in High Demand

Financial modeling competencies are on the demand list since the challenge of uncertainty and complexity in business is on the rise. The investors, boards and the management teams are looking forward to finance professionals with future insights as opposed to historical analysis. One of the answers to this need is a financial modeling certification course, which provides professionals with standard methodologies, best practices, and practical tools that would apply reliably to a variety of business settings.

Financial Modeling Certification Course: Purpose and Professional Value

What a Financial Modeling Certification Course Delivers

A financial modeling certification course is achieved to ensure that a professional has the capability of developing, analyzing, and presenting financial models precisely. Compared to theoretical finance programs, certification courses are focused on practical modeling, step-by-step logic and practical use. The participants are generally trained on how to create integrated financial statements, valuation analysis, and scenario and sensitivity testing.

Model integrity is also one of the areas of certification programs. This also involves the design best practices in spreadsheets, error checking, documentation and auditability. The skills are essential in work settings where the review of models is done by senior stakeholders, auditors, or investors.

Career Impact and Credibility

Earning a financial modeling certification course is a way to add credibility to the profession since it signals applied competence as opposed to just familiarity in a concept. Employers tend to relate certification to discipline, attention to detail, and being ready to undertake complicated financial assignments. Certification is a benchmark of capability that is structured to professionals who want to move to the higher level of corporate finance, investment analysis or strategy.

Besides that, certification assists in standardizing competence levels of teams. Financial modeling certification is often a component of professional development programs promoted or sponsored by organizations in order to achieve uniformity in the analysis products.

Financial Modeling in Practice: Real-World Applications

Applying Financial Modeling in Corporate Environments

Financial modeling in practice is not limited to exercises. Models are applied in the business environment to appraise capital spending, determine sources of funding, and facilitate strategic planning. As an instance a manufacturing company can utilize financial models to determine whether to invest in new plants of production considering the cost of capital, the operating efficiency and the estimated demand.

Practically, budgeting and forecasting is also supported by financial modelling. Football forecasts and scenario models can assist organizations to act in advance with respect to the alterations in the market conditions, cost structure, or even the regulatory requirements.

Financial Modeling in Investment and Valuation Contexts

Financial modeling in practice is the central point of valuation in investment analysis. The estimation of intrinsic value and evaluation of investment attractiveness are achieved by the discounted cash flow models, the analysis of similar companies, and the transaction modeling. These models are the foundation of investment recommendations and they are evaluated by various stakeholders.

Financial models are used in a merger or acquisition to assess the economics of deals, the realization of synergy, and the performance in the post-merger. It is also essential to be able to modify models to accommodate various transaction structures which is an important skill acquired in highly qualifying certification programs.

Core Components of a Financial Modeling Overview

Integrated Financial Statements

An overall financial model involves the incorporation of income statements, balance sheets and cash flow statements. Integrated models offer the benefit of showing changes in one financial area to be reflected in all statements. This realization increases the reliability of the models and helps in the proper forecasting.

Mastery of creating combined models is one of the pillars of any viable financial modeling certification programs since it is a mirror of the professional standards in the field.

Assumptions, Scenarios, and Sensitivity Analysis

Financial models are the backbone of assumptions. Good financial modeling involves good documentation and proper organization of the assumptions in terms of growth rates, margins, capital expenditure and terms of financing. Scenario analysis and sensitivity analysis enable the professionals to experiment the impact of variations on assumptions.

In practice, these are used in financial modeling in order to aid in the assessment of risk and strategic decision-making. Before executives commit resources, they use scenario analysis to realize the risk of the downside and the risk of the upside.

Learning Pathways in Financial Modeling Education

Structured Certification Versus Self-Learning

Although it is possible to teach the basics of financial modeling by self-studying using online tutorials, a course on financial modeling certification provides a systematic advancement and examination. The certification programs provide the groundbreaking users to a high level of application to enable thoroughness and uniformity.

Fragmented financial modeling resources, which can be coherent or not, may be critical to self learning. During certification, resources are managed systematically in terms of alignment with learning outcomes and industry standards.

Progressive Skill Development

Proper financial modeling education puts an emphasis on progressive development of skills. Novices will learn simple spreadsheet logic and financial principles, whereas more advanced users will learn specifics of complex valuation, transaction modeling, and strategy analysis. A good financial modeling overview will make sure that the learner can see how the techniques used at the individual level can be applied within the bigger financial contexts.

Financial Modeling Resources and Tools

Types of Financial Modeling Resources

Financial modelling resources of high quality are templates, case studies, practice datasets, and the industry-standard modeling examples. These materials facilitate practical learning and put concepts back to practical through practice. Professional settings have opportunities to use sound modeling material which enhances effectiveness and minimizes mistakes.

Numerous certifications have proprietary financial modeling materials that incorporate the current industry practices. Such resources are usually revised periodically in order to meet the changing financial requirements and market performance.

Best Practices for Using Financial Modeling Resources

In order to optimize learning it is the duty of the professionals to be pro-active and not passive in utilizing financial modeling resources. This includes creating models, attempting assumptions as well as adjusting structures to suit various business situations. The hands-on practice consolidates the theoretical knowledge and instills trust in the real performance.

Financial modeling Practitioners in financial modeling usually make modifications to the existing templates instead of modeling completely at zero. Knowing how to customize and stress-test templates is thus a useful skill that is acquired in the framework of a systematic study.

Integrating Financial Modeling with Strategic Decision-Making

Linking Models to Business Strategy

Financial models are most effective when aligned with strategic objectives. A strong financial modeling overview emphasizes that models are decision-support tools rather than purely technical exercises. For example, growth strategies, cost optimization initiatives, and market expansion plans should all be reflected explicitly in financial assumptions.

A financial modeling certification course trains professionals to frame models around strategic questions, ensuring that outputs are relevant and actionable for decision-makers.

Communication and Interpretation of Model Outputs

Technical accuracy is not as important as the ability to communicate model results in the professional setting. In practice, financial modeling needs to have clear description of assumptions, limitations and implications. The presentation skills are frequently taught on the course of the certifications, allowing professionals to transform complex outputs into strategic insights.

Professional Development and Long-Term Value

Continuous Improvement in Financial Modeling Skills

Financial modeling techniques need to be constantly perfected. The variations in the accounting standards, valuation models, and technology have implications on the manner in which the models are constructed and read. Those professionals ready to invest in continuous learning, such as advanced financial modeling certification courses programs, have flexibility and are up to date.

The use of updated financial modeling resources on a regular basis enables constant improvement and ensures that professionals keep up best practices.

Organizational Benefits of Certified Financial Modelers

It allows organizations to hire individuals having formal training on financial modeling. Certified people also provide better quality of analysis, and lower the modelling risk and improve the quality of decisions. In the long term, this will enable the allocation of capital and enhanced financial performance.

Conclusion

The skill of financial modeling is needed in the current business world that is data-driven and strategy-oriented. A systematic financial modeling perspective presents the significance of combined analysis, scenario testing and strategic alignment. Practitioners use these skills to make real-world decisions in practice through financial modeling in situations in corporate finance, investments, and valuation. By taking a course in financial modeling certification, one obtains formal recognition of the applied experience, and access to the high-quality financial modeling materials enables lifelong learning and professional development. Financial decisions continue to grow more complicated, making the investment in sound financial modeling education an important milestone towards both short-term and long-term professional and organizational success.