Financial Modeling for Budgeting Forecasting and Career Readiness

Financial Modeling for Budgeting, Forecasting, and Career Readiness

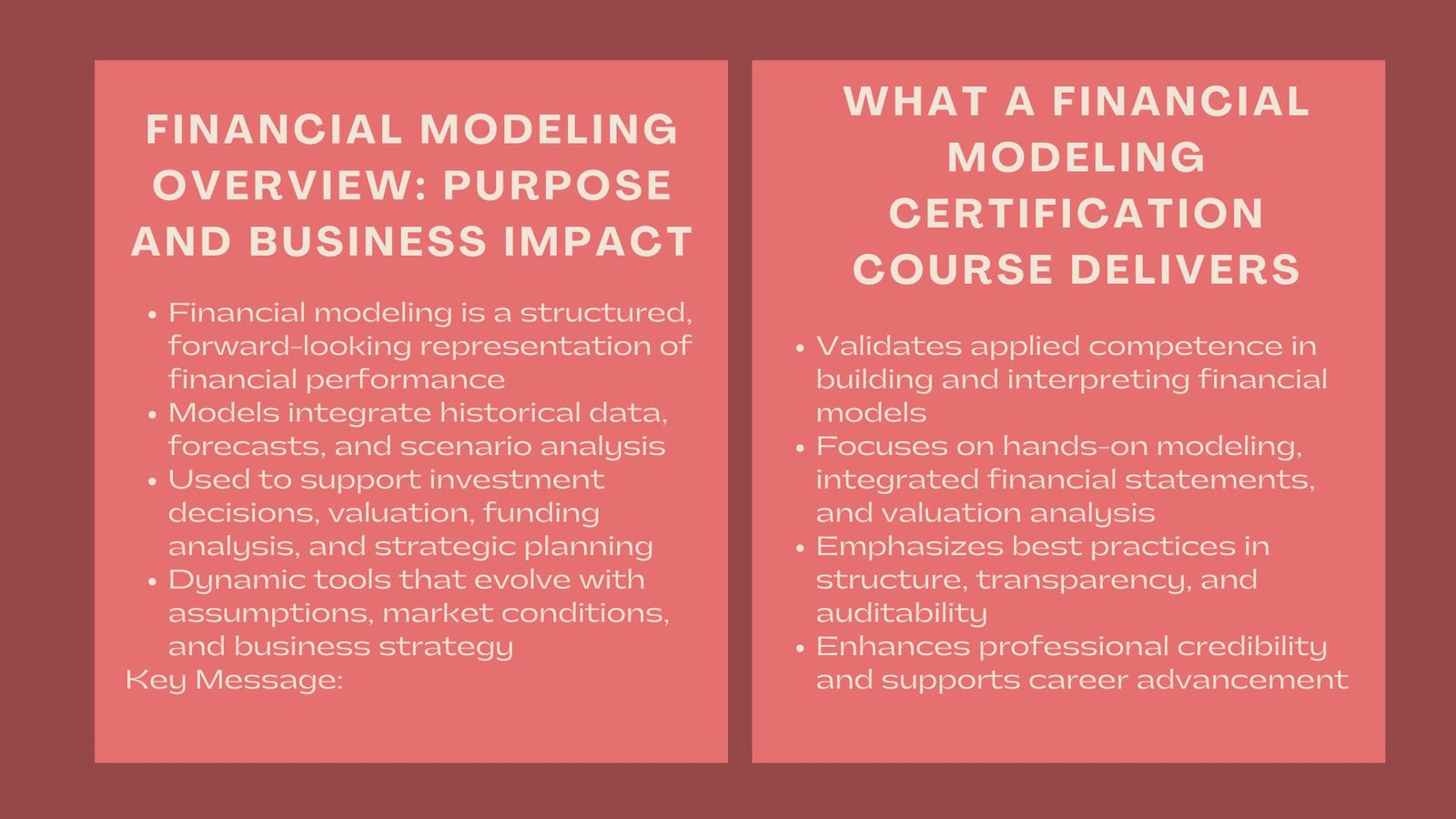

Introduction to Financial Modeling for Budgeting Forecasting and Career Readiness

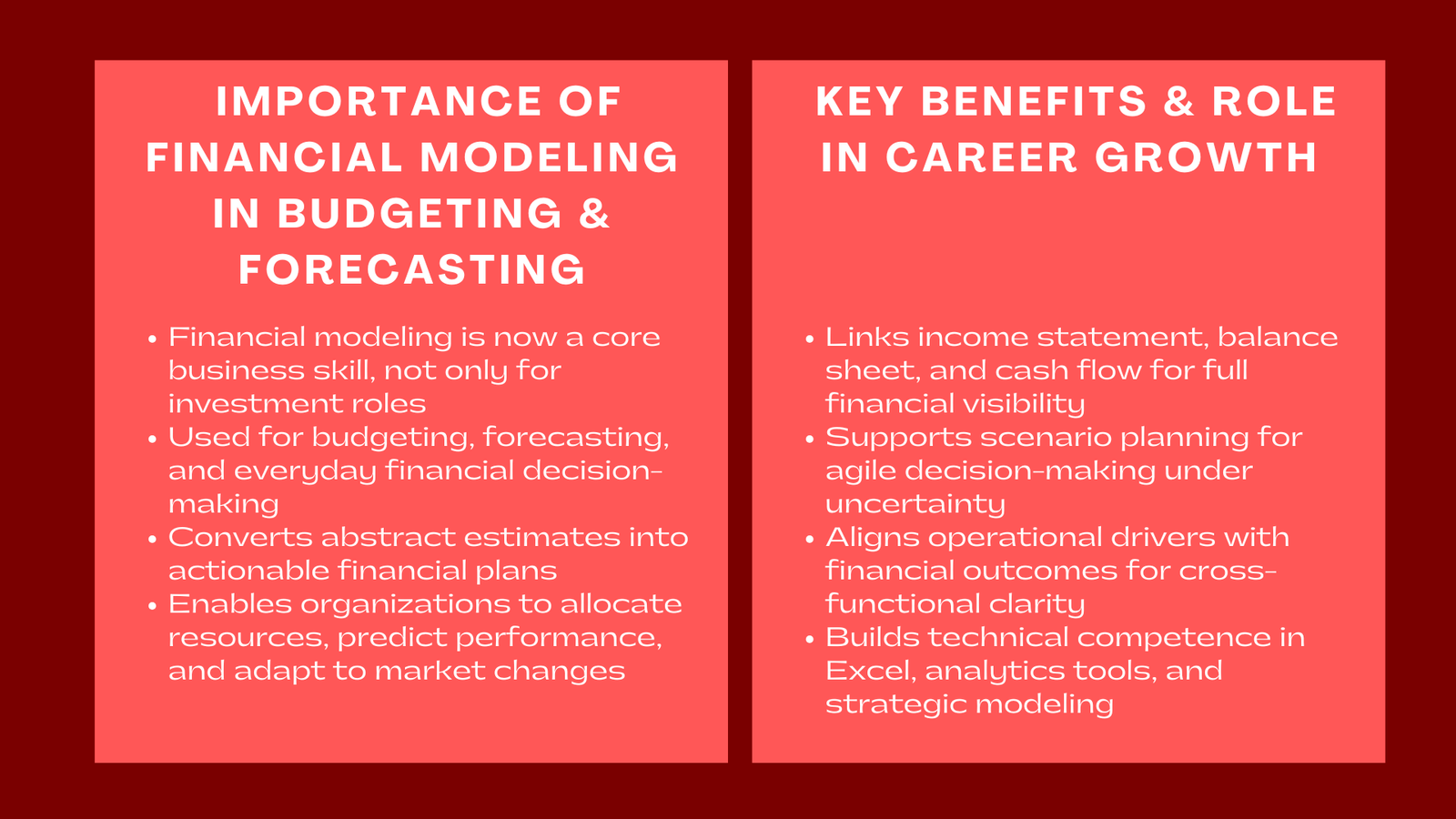

Financial modeling is no longer a specialized analysis application, but a baseline of the contemporary businessman. In the current data economy, organizations rely on the models to make their investments and financial decisions, as well as, their day to day decisions when budgeting, forecasting, and planning finances. The skills of creation and decoding of such models are not only under the responsibility of professionals working in investment banking or the private equity sector anymore but are now a competency that is crucial to corporate managers, entrepreneurs, and consultants alike.

Budgeting and forecasting through financial modeling converts the abstract financial modeling for budgeting and forecasting Singapore targets into real and practical plans. It helps the decision-makers to distribute their resources effectively, predict their financial performance, and introduce changes to their responses to market dynamics. Outside the corporate use, modeling aptitude is also noted to increase personal career preparedness, herald analytical cleverness, financial prowess, and analytical ability, all of which are characteristics that an employer in any sector greatly appreciates.

The paper will discuss the ways in which financial modeling will benefit the proactive budgets and forecasting, enhance the financial decision-making, and help achieve professional growth and career development.

The Role of Financial Modeling in Budgeting and Forecasting

From Static Plans to Dynamic Frameworks

The old budgeting and forecasting used to be a manual and stable process depending greatly on the past trends and the subjective. They have now since been turned into dynamic data driven frameworks by financial modeling. By using models, businesses can combine several business drivers, some of which include sales volumes, sales price, sales costs and capital expenditure, to project future performance with increased accuracy and flexibility.

Financial models can help organizations how financial modeling supports business decision-making and career growth to estimate the impact of shifts in market conditions, changes in input prices or operation efficiency on profitability and liquidity by mapping the assumptions and output relationships directly. This dynamic capability ensures that modeling is much better than the normal spreadsheets which might not even identify any interdependence between financial variables.

Therefore, the foundation of modern financial planning and analysis (FP&A) is modeling. It enables the decision-makers to go beyond the fixed projections and build town moving projections capable of changing with the current business realities.

Integrating Financial Statements for a Complete Picture

A strong budgeting and forecasting model is one that links the three financial statements which are the income statement, the balance sheet and the cash flow statement. Through this, the projected revenues and expenditures are determined to pass through to the assets, liabilities and cash balances in the right way, a key skill often emphasized in financial modeling training Singapore for finance.

As an example, as the assumptions of increased revenue growth are made, the model automatically changes the working capital, capital expenditures and financing requirements. This interrelationship assist the financial teams to know the complete consequences of their suppositions and also makes sure that the plans of strategy would hold together financially.

Such a combined strategy does not only make this more accurate but also, it helps various departments communicate. The teams on operations, financial and Strategy can agree on one perspective of financial truth and the model logic can be traced, unhindered by clouded model logic.

Building Effective Budgeting Models

Defining Drivers and Assumptions

The first step in building a budgeting model is defining the key drivers that influence financial outcomes. These may include sales volume, pricing, cost of goods sold, headcount, and capital expenditure. Establishing these drivers ensures that forecasts are grounded in operational realities rather than arbitrary targets.

A well-designed budgeting model separates input assumptions from calculation logic, creating transparency and flexibility. This structure allows managers to update drivers easily without disrupting formulas or interlinked statements. It also encourages ownership and accountability among teams who contribute their respective assumptions.

Scenario-Based Planning and Flexibility

Financial modeling enhances the adaptability of budgeting by allowing users to simulate multiple scenarios. Instead of committing to a single rigid plan, managers can test optimistic, conservative, and base-case assumptions to prepare for uncertainty.

For example, a model can demonstrate how a 5% decline in sales or a 10% increase in raw material costs affects net income and cash flow. This ability to visualize financial sensitivity helps organizations identify risk exposure and establish contingency plans. Scenario-based budgeting also supports strategic agility — enabling companies to adjust resources quickly when market conditions shift.

Resource Allocation and Performance Monitoring

Budgeting models provide a rational framework for resource allocation. By linking departmental budgets to overall financial objectives, they ensure that capital is deployed toward initiatives that generate the highest returns. Furthermore, actual performance can be compared against model projections to measure variance and identify areas for improvement.

This continuous feedback loop between modeling, execution, and monitoring fosters a culture of financial discipline. Instead of treating budgets as static documents, organizations use them as living models that guide performance management throughout the year.

Forecasting Through Financial Modeling

Translating Strategy into Forecasts

Forecasting through financial modeling translates strategic plans into quantitative outcomes. It projects future financial statements based on assumptions about market demand, pricing, cost behavior, and investment levels. Unlike budgeting, which sets targets, forecasting focuses on predicting what is most likely to occur.

Models enable analysts to align strategic initiatives — such as product launches, market expansions, or cost restructuring — with measurable financial projections. By quantifying the expected impact of these initiatives, management can evaluate strategic feasibility before implementation. This alignment between strategic vision and financial outcomes strengthens organizational accountability.

Rolling Forecasts and Continuous Planning

Modern organizations increasingly favor rolling forecasts over traditional annual forecasts. A rolling forecast extends the planning horizon continuously, typically adding a new month or quarter as each period concludes.

Financial models make this process efficient by automating updates based on the latest data. As new actuals are entered, models recalculate projections, keeping forecasts relevant and forward-looking. This approach enhances responsiveness, allowing management to identify emerging trends early and adjust course accordingly.

Rolling forecasting models are particularly valuable in volatile industries such as technology, energy, or retail, where market conditions evolve rapidly. They provide management with the foresight needed to adapt strategy proactively rather than reactively.

Linking Forecasts to Cash Flow and Funding

Accurate forecasting is crucial for liquidity and capital management. By linking forecasted revenues and expenses to cash inflows and outflows, financial models help predict funding needs and investment capacity.

For instance, models can show when a company might face cash shortfalls, prompting management to secure financing in advance or adjust expenditure. Similarly, surplus cash forecasts can inform dividend policies or reinvestment strategies.

This foresight ensures that financial decisions remain aligned with both operational performance and long-term capital strategy, reducing the risk of liquidity crises or inefficient cash utilization.

Analytical and Strategic Value of Modeling in Planning

Supporting Data-Driven Decision-Making

Financial modeling transforms budgeting and forecasting from administrative exercises into strategic decision tools. By simulating multiple pathways, organizations can identify the most resilient strategies under different market conditions.

For example, scenario modeling may reveal that a moderate growth strategy produces higher long-term value than an aggressive expansion that strains cash flow. The quantitative evidence provided by modeling enables decision-makers to justify strategic choices with confidence, reducing reliance on intuition or hierarchy.

This data-driven decision culture enhances organizational agility and accountability. It ensures that strategies are grounded in economic reality rather than optimism or bias.

Aligning Financial and Operational Performance

A key strength of financial modeling is its ability to bridge the gap between operational metrics and financial results. For example, sales forecasts, production efficiency, and inventory turnover directly influence profitability and liquidity.

By linking operational drivers to financial outcomes, models encourage cross-functional collaboration. Operations teams understand how performance affects corporate financial goals, while finance teams gain insight into the operational levers that drive results. This alignment fosters a shared sense of responsibility and strategic coherence across the organization.

Career Readiness and Professional Growth Through Modeling

Developing Analytical and Technical Competence

For professionals, financial modeling represents a powerful tool for career readiness. Mastery of budgeting and forecasting models demonstrates analytical intelligence, quantitative fluency, and business understanding. Employers across finance, consulting, and corporate sectors view modeling skills as evidence of structured thinking and financial discipline.

Technical competence includes proficiency in tools such as Microsoft Excel, Power BI, or Python for data analytics, combined with the ability to integrate accounting, finance, and strategy into coherent forecasts. Beyond the technical dimension, modeling builds a mindset of structured problem-solving — an essential capability for leadership in data-driven organizations.

Enhancing Decision-Making and Communication Skills

Modeling not only improves numerical proficiency but also enhances communication. Professionals who can translate complex financial models into clear insights become valuable advisors to senior management. They learn to present assumptions, defend projections, and articulate implications with confidence.

This communication ability is critical for career advancement. Analysts who can connect financial logic to business strategy often transition into managerial and leadership roles. Their ability to bridge analytical precision with strategic storytelling makes them indispensable in decision-making environments.

Building Career Agility and Long-Term Relevance

In an era of automation and digital transformation, modeling skills provide career resilience. While software may automate basic calculations, the human ability to design, interpret, and communicate models remains irreplaceable. Professionals who understand both the mechanics and the meaning of financial models can adapt to new technologies, industries, and roles.

Moreover, financial modeling expertise offers cross-functional mobility. It allows professionals to move seamlessly between FP&A, investment analysis, strategy, and operations. This versatility enhances employability and opens global career opportunities in finance and beyond.

Institutional and Educational Perspectives

Modeling as a Core Element of Financial Literacy

At an institutional level, financial modeling represents a form of financial literacy essential for organizational success. Companies that promote modeling literacy across departments improve their collective decision-making quality. When managers understand the logic of financial models, they make more disciplined budget requests, interpret performance metrics correctly, and align their actions with corporate objectives.

Educational institutions and professional training programs increasingly recognize this importance. Courses in financial modeling for budgeting and forecasting prepare graduates not just for technical roles, but for leadership positions where analytical thinking and strategic communication intersect.

Embedding Modeling into Organizational Culture

Embedding modeling into corporate culture creates a shared analytical language. When departments use consistent modeling frameworks, data flows seamlessly between planning, operations, and reporting functions. This consistency reduces errors, improves accountability, and enhances transparency.

An organization that values modeling fosters continuous learning and evidence-based decision-making. It becomes more agile, resilient, and performance-oriented — qualities that are indispensable in today’s volatile business environment.

Conclusion

Financial modeling for budgeting and forecasting represents both a technical discipline and a strategic capability. It enables organizations to plan more intelligently, allocate resources more effectively, and adapt to change more swiftly. By integrating financial statements, testing scenarios, and linking strategy to outcomes, modeling turns budgeting and forecasting into continuous learning systems rather than one-off exercises.

For individuals, mastering these models signals readiness for the analytical demands of modern business. It builds a bridge between technical skill and strategic insight — the combination that defines professional excellence in finance, consulting, and corporate management.

Ultimately, financial modeling equips professionals and organizations alike to navigate complexity with confidence. It transforms uncertainty into structure, data into foresight, and potential into performance — establishing itself as both the cornerstone of sound financial planning and a catalyst for enduring career growth.