How Financial Modeling Supports Decision-Making and Career Growth

How Financial Modeling Supports Decision-Making and Career Growth

Introduction to How Financial Modeling Supports Decision-Making and Career Growth

In modern finance, financial modeling has become more than just a technical skill — it is a strategic capability that underpins critical business decisions and defines professional excellence. Whether in investment banking, private equity, corporate finance, or project management, models serve as the analytical backbone that converts complex data into actionable insights. They allow organizations to anticipate outcomes, measure risks, and allocate resources efficiently. For individuals, mastering financial modeling enhances credibility, how financial modeling supports business decision-making sharpens analytical thinking, and opens pathways to career advancement in the highly competitive financial sector.

This article explores how financial modeling supports both organizational decision-making and individual career growth. It examines the conceptual role of models as decision tools, explains their integration into strategic and operational choices, and discusses how proficiency in modeling strengthens analytical judgment, leadership potential, and long-term career trajectories.

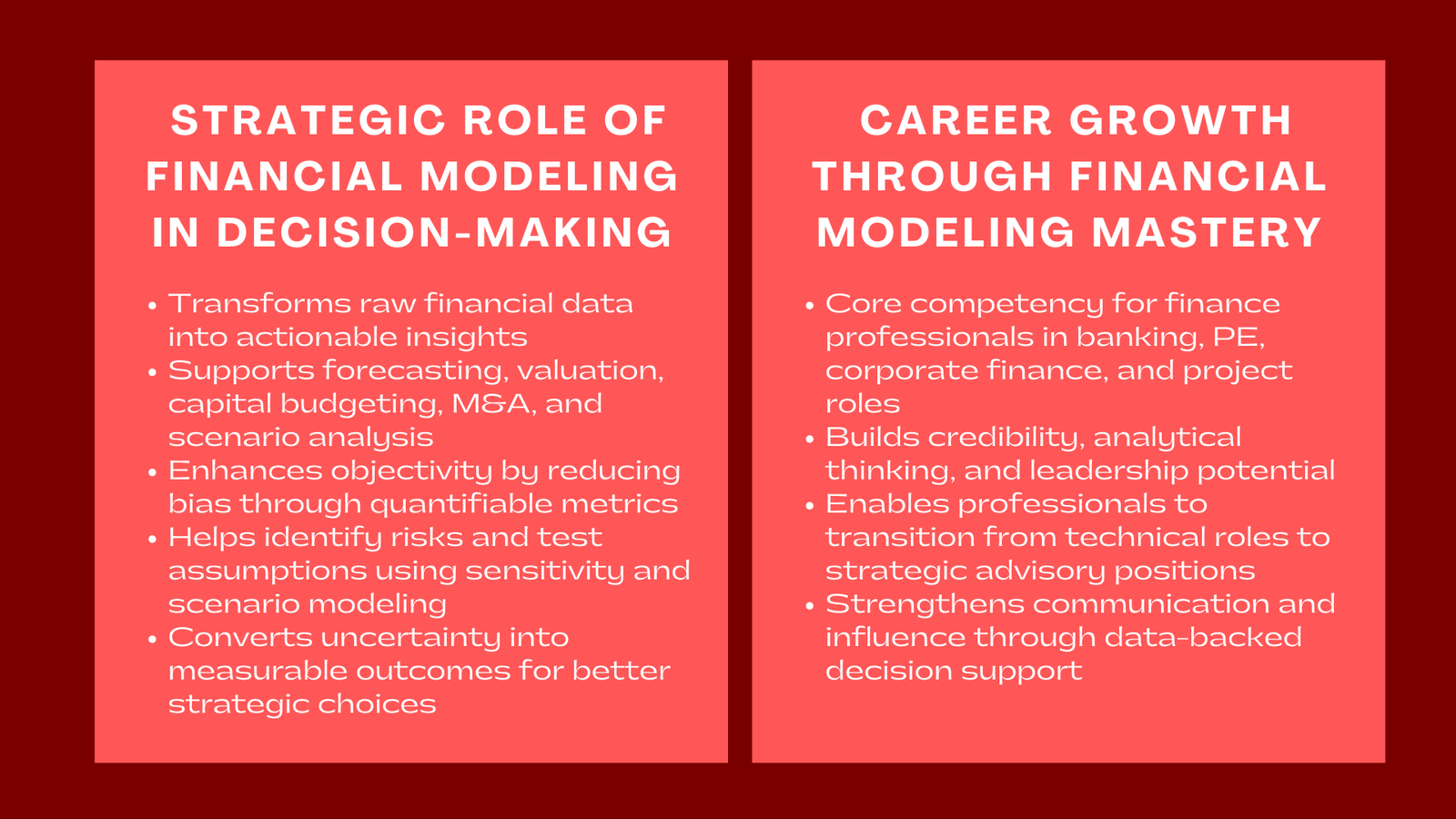

The Strategic Role of Financial Modeling in Decision-Making

From Data to Decision

At its core, financial modeling transforms raw financial data into a structured framework for evaluating business performance and potential. Decision-makers rely on these frameworks to forecast future outcomes, assess alternative strategies, and identify optimal solutions. By organizing assumptions, drivers, and interdependencies, models enable managers to test the implications of their choices before committing real resources, which is a core skill taught in a financial modeling course Singapore professionals often pursue to enhance decision-making accuracy.

In strategic planning, financial models are used to simulate mergers and acquisitions, project financing, capital budgeting, and valuation scenarios. They bridge the gap between financial theory and business reality, quantifying the impact of decisions such as pricing, investment scale, or funding structure. The ability to visualize potential outcomes through modeling converts uncertainty into measurable risk, thereby enhancing the quality of decision-making.

Enhancing Analytical Objectivity

One of the most valuable contributions of financial modeling is objectivity. In an environment where intuition or personal bias can cloud judgment, models provide a disciplined, evidence-based foundation for analysis. A well-structured model imposes consistency and transparency, ensuring that decisions are grounded in quantifiable metrics rather than subjective interpretation.

For example, when assessing whether to expand into a new market or invest in a new technology, executives can use models to test assumptions about costs, revenues, and risk factors. Sensitivity analysis helps identify which variables most influence profitability, enabling management to focus attention where it matters most. Thus, career growth through financial modeling skills transforms decision-making from a qualitative exercise into a quantitative evaluation.

Supporting Risk Management and Scenario Planning

Financial modeling is also integral to risk management. By simulating best-case, base-case, and worst-case scenarios, models help organizations anticipate the financial consequences of uncertainty. In project finance, for instance, sensitivity analysis on interest rates, tariffs, or operating costs reveals how resilient a project is under varying conditions. In corporate finance, scenario modeling supports stress testing for liquidity or solvency under macroeconomic shocks.

This capacity for predictive analysis allows decision-makers to plan mitigation strategies in advance. Rather than reacting to crises, they can proactively design risk-adjusted strategies based on quantified scenarios. Modeling, therefore, not only aids in choosing the right path but also in preparing for its potential deviations.

Applications of Financial Modeling Across Business Functions

Investment and Valuation Decisions

In investment banking, equity research, and private equity, valuation modeling forms the core of financial decision-making. Models such as discounted cash flow (DCF), leveraged buyout (LBO), and comparable company analysis (CCA) help determine the fair value of businesses and investment opportunities. These models allow analysts to project future cash flows, discount them using appropriate rates, and arrive at intrinsic valuations that guide buy, hold, or sell recommendations.

Accurate modeling ensures that investors avoid overpaying for assets and that financing decisions are aligned with expected returns. It also provides a common analytical language through which investors, managers, and lenders can communicate effectively about value and risk.

Corporate and Operational Decision Support

Within corporations, financial models serve as decision-support systems for budgeting, forecasting, and performance monitoring. Managers use models to allocate resources efficiently, determine optimal capital expenditure levels, and forecast profitability under different strategic assumptions. Operational models link financial outcomes to key performance drivers such as production volume, pricing strategy, and cost structure.

By integrating operational and financial data, these models allow management to see how day-to-day decisions — such as adjusting procurement strategies or revising pricing — affect the company’s financial trajectory. This integration strengthens coordination between departments, aligning operational execution with financial strategy.

Financing and Capital Structure Optimization

Another critical application lies in optimizing financing decisions. Companies use financial models to evaluate alternative capital structures, test debt covenants, and forecast repayment capacity. In project finance, for example, models calculate debt service coverage ratios (DSCR), internal rate of return (IRR), and other metrics that determine bankability.

Through dynamic modeling, organizations can assess the trade-offs between leverage and equity returns, ensuring that financing choices align with risk tolerance and market conditions. This analytical rigor helps maintain financial stability while maximizing shareholder value.

Financial Modeling as a Decision-Making Framework

Structuring Complex Problems

Financial models are more than spreadsheets — they are frameworks for structured thinking. By breaking down complex financial challenges into logical components, models force decision-makers to identify assumptions, relationships, and feedback loops explicitly. This structured reasoning promotes clarity, reduces ambiguity, and improves communication across teams.

In mergers and acquisitions (M&A), for instance, models dissect transactions into revenue synergies, cost savings, financing costs, and integration risks. This breakdown allows executives to understand how each component contributes to overall deal value and where potential vulnerabilities lie. The discipline of modeling thus enhances the intellectual quality of strategic decision-making.

Improving Transparency and Accountability

Transparency is another hallmark of effective modeling. Well-documented assumptions and clear calculation logic make it easier for stakeholders — including investors, lenders, auditors, and regulators — to understand and verify results. Transparency not only improves confidence in the analysis but also reinforces accountability.

When assumptions are explicit, management decisions can be traced back to quantitative evidence. This accountability culture reduces the risk of misrepresentation and promotes ethical governance. In capital markets, such transparency can strengthen investor trust and improve access to financing.

The Professional Value of Financial Modeling Skills

A Core Competency for Modern Finance Professionals

Proficiency in financial modeling has become a core competency across the financial industry. Employers increasingly view modeling skills as evidence of analytical rigor, problem-solving ability, and attention to detail. Analysts, associates, and managers who can construct accurate, dynamic, and auditable models are trusted to handle complex decisions and high-stakes transactions.

In many organizations, the ability to model effectively is a prerequisite for promotion. Professionals who demonstrate fluency in modeling are often tasked with leading investment appraisals, structuring deals, or advising senior management — roles that accelerate visibility and career growth.

Enhancing Analytical Thinking and Judgment

Beyond technical skill, financial modeling enhances analytical thinking. Building models requires understanding how financial statements connect, how operational drivers influence outcomes, and how risk and uncertainty affect value. This process cultivates disciplined thinking and sharpens financial judgment.

By repeatedly analyzing scenarios and interpreting results, professionals develop intuition for what drives performance in real-world situations. This analytical maturity enables them to move beyond mechanical computation and provide strategic insights — a distinguishing trait of senior financial leaders.

Communication and Influence

Financial modeling also strengthens communication and influence. Models distill complex financial dynamics into clear, quantitative visuals and narratives that support persuasive presentations. Whether pitching an investment, negotiating financing terms, or presenting forecasts to boards, professionals with modeling expertise can convey credibility through evidence-based arguments.

This ability to translate numbers into strategic stories enhances influence within organizations. It enables financial professionals to contribute meaningfully to discussions that shape corporate direction, fostering their reputation as trusted advisors rather than mere analysts.

Career Growth Through Modeling Mastery

From Analyst to Strategist

Mastery of financial modeling often marks the transition from analyst to strategist. Early-career professionals focus on technical accuracy — building models, validating data, and ensuring consistency. As they gain experience, their focus expands toward interpreting model results and advising on strategic implications. This evolution mirrors the shift from tactical execution to strategic leadership.

Senior professionals use models not only to calculate outcomes but also to shape business strategy — determining capital allocation, structuring deals, or designing growth plans. Thus, modeling proficiency becomes a foundation for broader leadership responsibilities.

Cross-Functional Mobility and Specialization

Strong modeling skills create cross-functional mobility. Because models are used in investment, operations, risk management, and corporate planning, professionals fluent in modeling can transition across functions or industries more easily. They are able to adapt their analytical framework to diverse contexts, from infrastructure and real estate to private equity and venture capital.

Some professionals use modeling expertise to specialize further — becoming valuation experts, project finance modelers, or strategic consultants. Others use it as a springboard to leadership, leveraging their technical foundation to drive strategic conversations at the executive level.

Long-Term Career Resilience

In a rapidly changing financial landscape shaped by automation, artificial intelligence, and data analytics, modeling skills remain resilient. While tools evolve, the underlying logic of financial modeling — structuring problems, analyzing scenarios, and making evidence-based decisions — continues to be indispensable.

Professionals who understand not just how to operate models but also how to design and interpret them retain a competitive edge. They are better positioned to adapt to technological advances and to integrate new analytical tools into traditional financial frameworks. Modeling, therefore, serves as both a technical and intellectual anchor for long-term career relevance.

Educational and Institutional Implications

Modeling as a Learning Framework

Financial modeling also serves as a powerful educational tool. For students and professionals alike, constructing a model reinforces understanding of accounting, finance, and valuation principles. The process of translating theory into numbers deepens comprehension and reveals the interconnections among financial concepts.

Institutions that integrate modeling into training programs equip their teams with practical decision-making tools. This applied learning approach bridges the gap between academic knowledge and real-world financial practice, producing professionals who can think both theoretically and pragmatically.

Institutional Decision-Making and Governance

At the organizational level, widespread modeling capability fosters stronger governance and analytical culture. When decision-makers across departments share a modeling mindset, discussions become more evidence-based, and resource allocation more rational. Institutionalizing modeling standards — including transparency, documentation, and version control — promotes consistency and accountability.

This collective modeling competence strengthens institutional credibility in front of investors, lenders, and regulators. It signals that the organization’s decisions are driven by analytical integrity and disciplined financial management.

Conclusion

Financial modeling stands at the intersection of analytical rigor and strategic foresight. It transforms numbers into narratives, uncertainty into structured risk, and data into decisions. For organizations, it is the mechanism through which complex financial realities are quantified, compared, and optimized. For individuals, it is a gateway to professional mastery, critical thinking, and career advancement.

By cultivating modeling expertise, professionals gain not only a technical skill but also a decision-making philosophy — one that emphasizes structure, clarity, and accountability. In an increasingly data-driven financial world, those who can model effectively are those who can lead effectively.

Ultimately, financial modeling is more than a spreadsheet exercise. It is the language of financial intelligence and strategic influence — a skill that empowers both organizations to make better decisions and individuals to shape their professional destinies with confidence, precision, and purpose.