Private Equity Financial Modeling From Deal Sourcing to Career Advancement

Private Equity Financial Modeling: From Deal Sourcing to Career Advancement

Introduction

The role of the PE in global capital markets is the most important as it invests in potentially good companies, optimizes their work, and contributes to the creation of long-term value. The effectiveness of such investments is largely dependent on proper financial analysis and forecasting which can be developed in the course of the financial modeling of the private equity.

PE Financial modeling helps practitioners to assess investment opportunities, design leveraged buyouts (LBOs), and predict portfolio performance. With the expansion of the private equity firms in industries and regions, the need to have an analyst and associates who possess strong modeling skills has increased at a high rate, especially for those seeking a financial modelling course Singapore to build the expertise required in competitive PE roles.

The book Private Equity Financial Modeling: From Deal Sourcing to Career Advancement summarizes the nature of this technical field- and illustrates how learning it can help one jump-start their career in the private capital business.

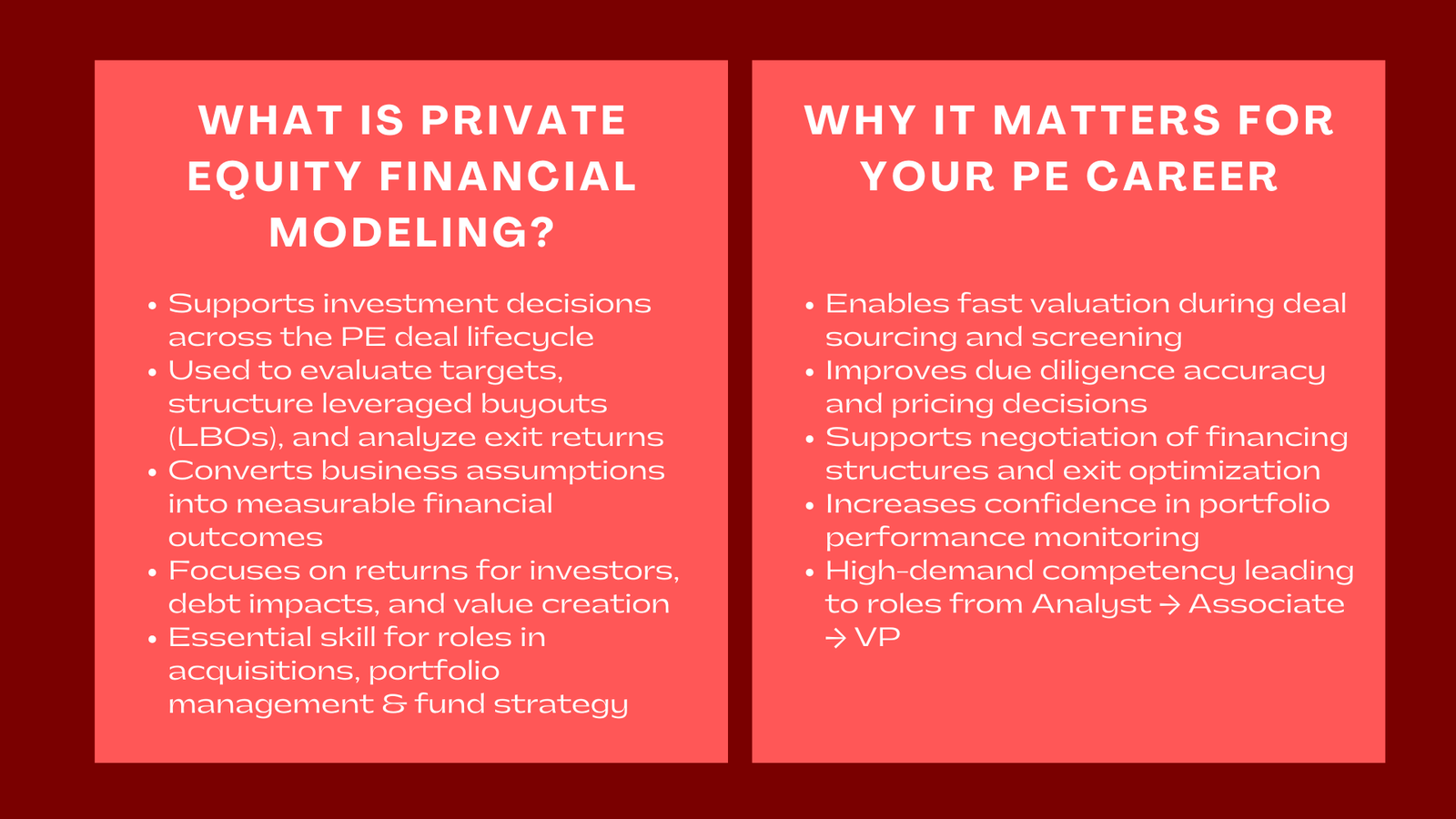

Introduction to Private Equity Financial Modeling.

The financial modeling of private equity is an elaborate process which makes use of built-in models simulating the financial performance of targeted companies during the process of investment. The models assist investors in establishing the price at which they should buy a firm, the sources of finance to use in the acquisition, and the returns that they would desire on exit.

In contrast to the classical corporate modeling, PE models include leverage, various scenarios of valuation and complex exit structures. They enable investors to determine the possible returns of limited partners (LPs) and general partners (GPs) in dealing with risk in a variety of operational and market situations.

PE modeling is fundamentally concerned with the conversion of business assumptions into measurable consequences: a necessary art in the case of the professional involved in acquisitions, portfolio management, and fund strategy.

The Function of Financial Modeling throughout the Deal Lifecycle.

Deal Sourcing and Screening

During the initial phases of deal sourcing, the analysts rely on the financial models to conduct fast valuations and assess the suitability of a target to the investment of the fund. This measure is concerned with high-level measures of revenue growth, EBITDA margins, and industry comparables.

Due Diligence and Valuation

A potential target after passing initial screening will form the basis of due diligence on the financial model. Analysts develop detailed projections which take into account management assumptions, historic performance and sensitivity analysis. The techniques of valuation, which are discounted cash flow (DCF), similar companies analysis (CCA), and precedent transactions, are utilized in establishing a fair purchase price.

Arranging of Deals and Funding.

PE deals are frequently a combination of both debt and equity funding. Modeling assists in the process of establishing the best capital structure by the testing of various leverage ratios and interest coverage rates. Analysts model the impacts of financing costs on equity returns and measure risk on the several funds arrangements.

Post-Acquisition Performance

Models are employed in the tracking of performance after the acquisition. Portfolio teams revise forecasts and track important metrics as well as assess the rate of value creation achievement. This allows the proactive control of financial and operational results.

Exit Strategy and Return Analysis.

Exit modeling enables companies to estimate returns when using varying exit processes- IPOs, trade sale or secondary buyouts. Analysts consider internal rate of return (IRR) and multiple on invested capital (MOIC) as a measure on when to exit and how.

Critical Elements of a Finance Model of a Private Equity.

An effective model of private equity will normally consist of the following elements:

- Revenue, cost structure and Margin Evaluation: Historical financial analysis.

- Operating projections: Projects income statements, balance sheets and cash flows.

- Debt and equity plans: Info leverage plans, payment, and ownership divisions.

- LBO structure: Model the effect of debt financing on returns.

- Exit valuation: Approaches terminal values on the basis of EBITDA multiples or discounted cash flows.

- Sensitivity and scenario: Determines the impact of changes in key assumptions on IRR and equity returns.

The art of these elements demands accuracy, good knowledge of accounting principles and a tactical feel of the investment dynamics.

The Importance of Modeling Skills in the Private Equity.

The private equity professionals are in a data-driven business that requires them to make decisions that are not only financially justified, but also make strategic decisions. The modeling skills allow them to:

- Measurability of risks and returns.

- Explain investment rationale to the partners and investors.

- Agreement on superior terms of deals using estimates.

- Provide support after acquisition value creation in the form of performance tracking.

- Consider various exit alternatives in order to maximize returns.

To work in the field of private equity or even to pursue a career in this area, it is not a wish, but a strategic mandate to have an excellent modeling skills.

Building Practical Skills Through Specialized Training

Structured programs like private equity financial modeling training courses for investment professionals have become essential for those entering or advancing in the PE field. These practical courses equip students on how to design and analyse the full transaction models themselves, and these models involve the full cycle of investment, i.e. acquisition to exit.

Participants usually get to know how to:

- Build up elaborated leveraged buyouts (LBO).

- Assess the target companies through sophisticated valuation techniques.

- Debt structure and refinancing analysis.

- Carry out sensitivity analysis of market and operation risks.

- Report current model findings to investors and senior partners.

This type of training improves technical and strategic capacity enabling professionals strike a balance between their analysis and fund goals and investor demands.

Fund and Portfolio Management by use of Modeling.

In addition to deal-level modeling, financial models are also used by the private equity professionals to analyze funds-level. This is in terms of monitoring fund performance, making projections concerning distributions, and the evaluation of liquidity needs.

Modeling is also very essential in the sphere of portfolio management where analysts assess the actions of various investments in different conditions of the market. They determine the contribution made by each individual company to the entire fund returns and determine areas where value can be added including operational or bolt-on acquisitions.

The insights are essential in ensuring that the fund achieves its returns and in making the capital allocation and divestment decisions.

The use of technology in modeling in the private equity.

The rise of increasingly advanced data analytics and automation has altered the way in which the models of private equity are created and maintained. Financial information Software packages currently include real-time financial data, which enhance accuracy and efficiency in deal-analysis.

Technology is also useful in increasing collaboration within a deal team, and multiple analysts can work on the same models at the same time. This simplifies the working process, minimizes mistakes and quickens the decision-making process.

Those professionals who are able to integrate the old models of Excel-based modeling with new models of analysis are in a better position to adjust to the changing needs of the industry, i.e. Python, Power BI or financial modelling software.

The way Expertise in Modeling drives Career Development.

Technical excellence in the competitive environment of the world of private equity can greatly enhance career growth. Those who are good at modeling can rise to the ranks of an associate and even a vice president where strategic decision-making and portfolio management can become the order of the day.

Enrolling in advanced private equity financial modeling and valuation programs for corporate finance teams provides a fast track to career development by combining theoretical insights with real transaction experience. Students that graduate such programs can often:

- Provide in-depth investment reports.

- Negotiate and support due diligence.

- Investment opportunities should be communicated to senior stakeholders.

- Give back to finance performance and deal success.

With precision, speed and judgment of success being key factors of success in an industry, the professionals who possess high modeling skills are regarded as invaluable players.

The Strategy Relationship between Modelling and Strategy.

Financial modeling in private equity does not by itself consist of number-crunching, but rather strategic story telling. Both models narrate the creation of value and mitigation of risks in the course of the investment.

It is the professionals that know both the technical and the strategic aspects of modeling that are more likely to determine the growth lever, foresee challenges, and use them as a guide to investment decisions that lead to better returns. It is this combination of financial rigor and strategic insight that makes a top performing private equity professional unique.

Conclusion to Private Equity Financial Modeling From Deal Sourcing to Career Advancement

The financial modelling of the private equity is the basis of informed decision making. It fills the distinction between theory and practical implementation in finance- any professional can analyze, work with portfolios and maximize returns using it.

Learning Private Equity Financial Modeling: From Deal Sourcing to Career Advice, the financial professionals do not only enhance their analytical skills but also provide access to high impact positions in one of the most dynamic and rewarding fields in the global finance. With the change in the industry, the future of private equity investing will still be characterized by individuals who possess profound knowledge on modeling and strategic foresight.