Scenario and Sensitivity Analysis in Financial Models Skills Employers Value

Scenario and Sensitivity Analysis in Financial Models: Skills Employers Value

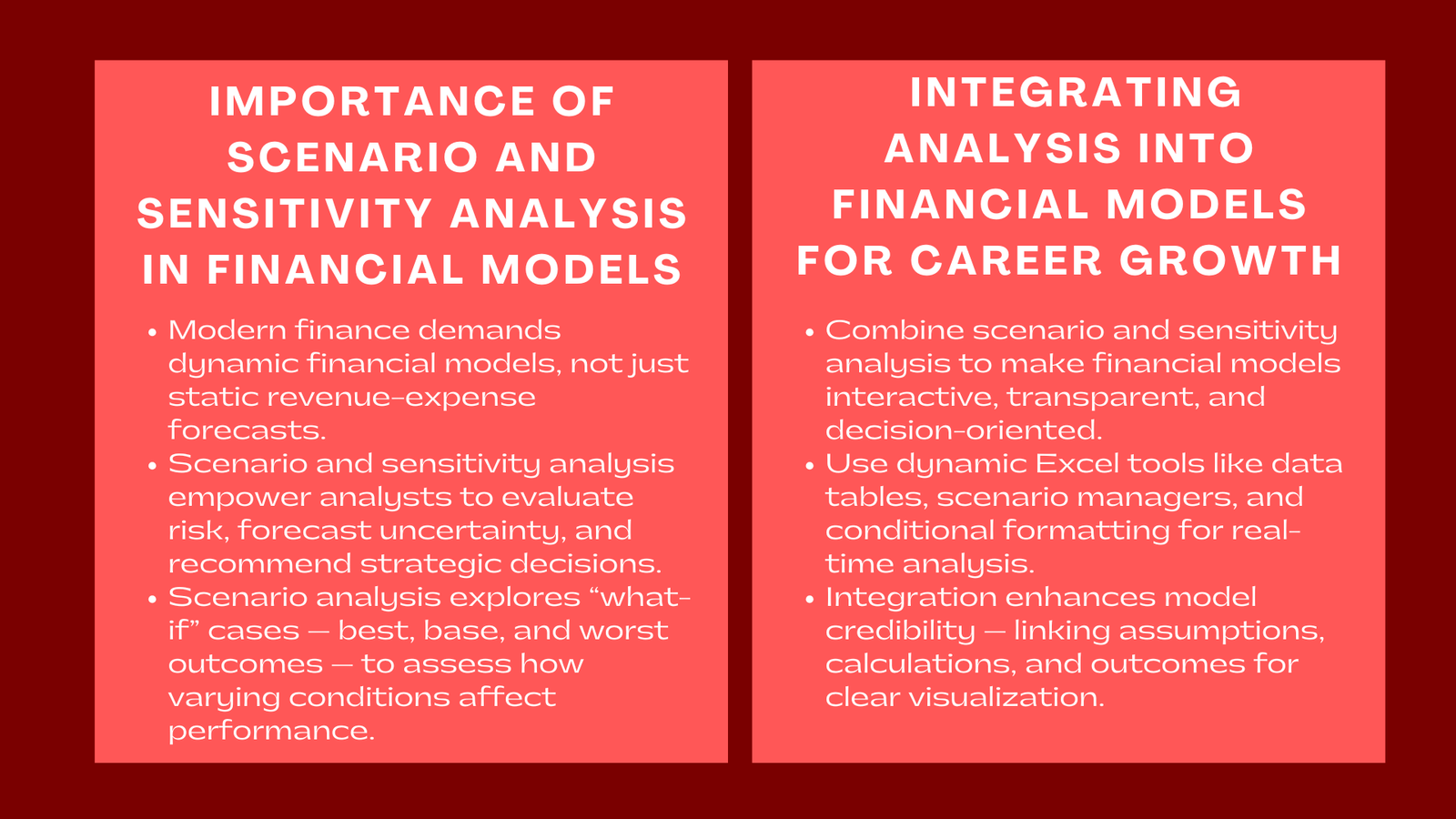

In the today competitive world of finance it is no longer enough to build a financial model for calculating revenues and expenses. Always evolving – Performance analysts responsible for developing, validating, and loading models will be sought after by employers that require their employees to be comfortable interpreting and stress testing their models in an array of business conditions. Scenario and sensitivity analysis are two of the most important skills in this respect. They help finance professionals to evaluate risks, quantify the potential consequences and deliver actionable recommendations based on key assumption variation. Also, from the staff employer’s viewing time frame, these competencies suggest that an analyst can strategically think, identify issues, and make decisions under uncertainty.

Scenario and sensitivity analysis is used to turn financial models from static models into dynamic models for decision making. They help to go beyond predictive analysis of a single outcome and give professionals the opportunity to pursue alternate “what-if” scenarios and consider the implications of different strategic decisions. This capability is especially useful in investment banking, private equity, corporate finance, and consulting, for which decisions are frequently based upon projecting a range of outcomes as opposed to a sole reliance on a base case or single possible outcome.

Mastering these analyses is more than a technical exercise, and is indicative of professional scenario and sensitivity analysis in financial modeling for career growth . Individuals that can determine what variables are important, appreciate what variables will affect other variables, or clearly and efficiently explain the impact of a change are high value contributors. By incorporating scenario and sensitivity testing into financial models, professionals present decision-makers with better insights and limit the chance for shocking costs to occur.

Understanding Scenario Analysis

Scenario Analysis: This is the review of a financial model with different business assumptions for the scenario analysis. It is aimed at the development of a range of plausible outcomes consisting of best case, base case, and worst case. The planning scenarios include simultaneous fluctuations in a number of variables relative to best estimates about potential changes in revenues, costs, capital expenditures and market conditions.

For example, a revenue growth forecast could be that revenue will grow by 10% per year under the base case scenario, 15% under the optimist scenario and 5% under the pessimist scenario. In addition, expense forecasts, financing costs and tax assumptions are modified to ensure internal consistency. By comparing outputs between scenarios (such as net income, cash flow, valuation etc.), analysts can evaluate the spread of potential outcomes and draw attention to vulnerable or favorable areas.

Scenario analysis is an important tool for strategic decision making. In mergers and acquisitions, this can help determine the impact of different synergies, pricing model or integration time on deal returns. In capital budgeting, it can be used to give information about the investment choices and their performance with economic fluctuations. By examining various scenarios, the analyst sees that the recommendations are validated on the basis of realistic assumptions rather than optimistic estimate scenarios. Professionals who attend a scenario analysis training course in Singapore can further strengthen these skills, gaining practical experience in applying scenario techniques to real-world financial models and strategic decisions.

Employers place a premium on scenario analysis as it will show forward thinking and awareness around risk. In roles that demand executive-level thinking, the ability to create and consider detailed scenarios and their implications is a sign that the systems thinker can help predict the bumpy road ahead and point management toward a path of decision-making during periods of uncertainty – an important differentiator in high-stakes finance.

Understanding Sensitivity Analysis

While scenario analysis looks at several variables combined, sensitivity analysis looks at the important impact of just one input on particular outputs. A typical example is the question of how sensitive our net present value (NPV) is to changes in the discount rate or what happens to the profitability if the sales volumes drop by 10%.

In experiments, the analyst usually makes one input different and all other inputs equal to get a measure of the effects caused by varying the input. The results are usually shown in a sensitivity table or a chart, and are therefore more visual and easier for stakeholders to understand which variables are contributing the most to results. For instance, during a sensitivity analysis if the company finds small changes in the raw materials costs materially change the margins, this would indicate a potential risk area for the top management.

Sensitivity analysis is also an important part of stress testing a financial model as well. By understanding which assumptions are key triggers of variability, analysts can recommend ways of mitigating the risks such as hedging, cost management, or contingency planning. In the context of investments, it gives you some insight into the robustness of valuations, and allows you to set reasonable expectations of returns when things salaries and market variables fluctuate.

Sensitivity analysis shows analytical rigor and problem solving ability from a career perspective. A trusted advisor does more than just give them advice; an economist who can quantify risk, assess tradeoffs and help make sense of the outcomes they provide is one to follow. Employers view these skills as an indication that the analyst possesses the ability to work in complex environments for decision making and deliver quality financial advice.

Integrating Scenario and Sensitivity Analysis into Models

To have the maximum impact, scenario and sensitivity analysis should be incorporated into financial models and not an afterthought. This is usually done by making assumptions and calculations dynamically linked to each other, which means that changes that are made to input variables automatically permeate through the entire model. Analysts also use data tables, scenario manager and conditional formatting tools in Excel to create interactive dashboards that reveal the impacts of different scenarios and sensitivities in real time.

Combining these analyses improves decision making because it offers a framework for uncertainty exploration. It also leads to increased transparency, where managers, clients or investors can track the effect of assumptions on the final outcome. Analysts who deliver well-structured, dynamic models are not only helping to mitigate risk, but are putting themselves forward as strategic thinkers who have the ability to inform important business decisions.

In addition, scenario and sensitivity analysis, when combined, increase the professional status. It is a testament to the capacity for focusing on details, the skill to envision problems, and the ability to translate information from complicated data into practical information. These skills are extremely useful for career advancement because they raise the level of an analyst from being one who brings the numbers to one who drives strategy.

Conclusion to Scenario and Sensitivity Analysis in Financial Models Skills Employers Value

advanced modeling techniques are more than scenario and sensitivity analysis are skills that a career oriented finance professional needs. Through various results, risk analysis, and measuring the effect of the main variables, analysts can develop more implications, minimize ambiguity, and contribute to better strategic decisions. These skills are advanced financial modeling techniques for risk assessment and decision making appreciated by the employers as it demonstrates foresight, rigor, and clarity in communication of the complex financial implications.

Scenario and sensitivity analysis remain at the core of these advanced modeling capabilities. They are not merely technical exercises but strategic tools that transform a standard model into a dynamic decision-support system. By adjusting critical assumptions—such as revenue growth, cost of capital, or integration synergies—analysts can test how sensitive their models are to changing economic conditions. This process helps in identifying the most influential drivers of value, preparing management for both best- and worst-case situations, and ensuring that decisions are grounded in financial realism. Scenario and sensitivity analysis are, therefore, effective methods to gain mastery of high-quality models and build credibility in the finance career path. For professionals aspiring to become strategic advisors or corporate decision-makers, these skills make regular model-building work more insightful and purposeful. They position analysts as trusted sources of confidence and strategic clarity, showing they are fully prepared to work in high-impact financial positions. In the current financial market, where volatility and uncertainty are constants, the ability to predict, measure, and report risk is not only useful—it is an indispensable element of sustainable professional success.