Merger and Acquisition Financial Modeling Techniques for Professionals

Merger and Acquisition (M&A) Financial Modeling Techniques for Professionals

Introduction to Merger and Acquisition Financial Modeling Techniques for Professionals

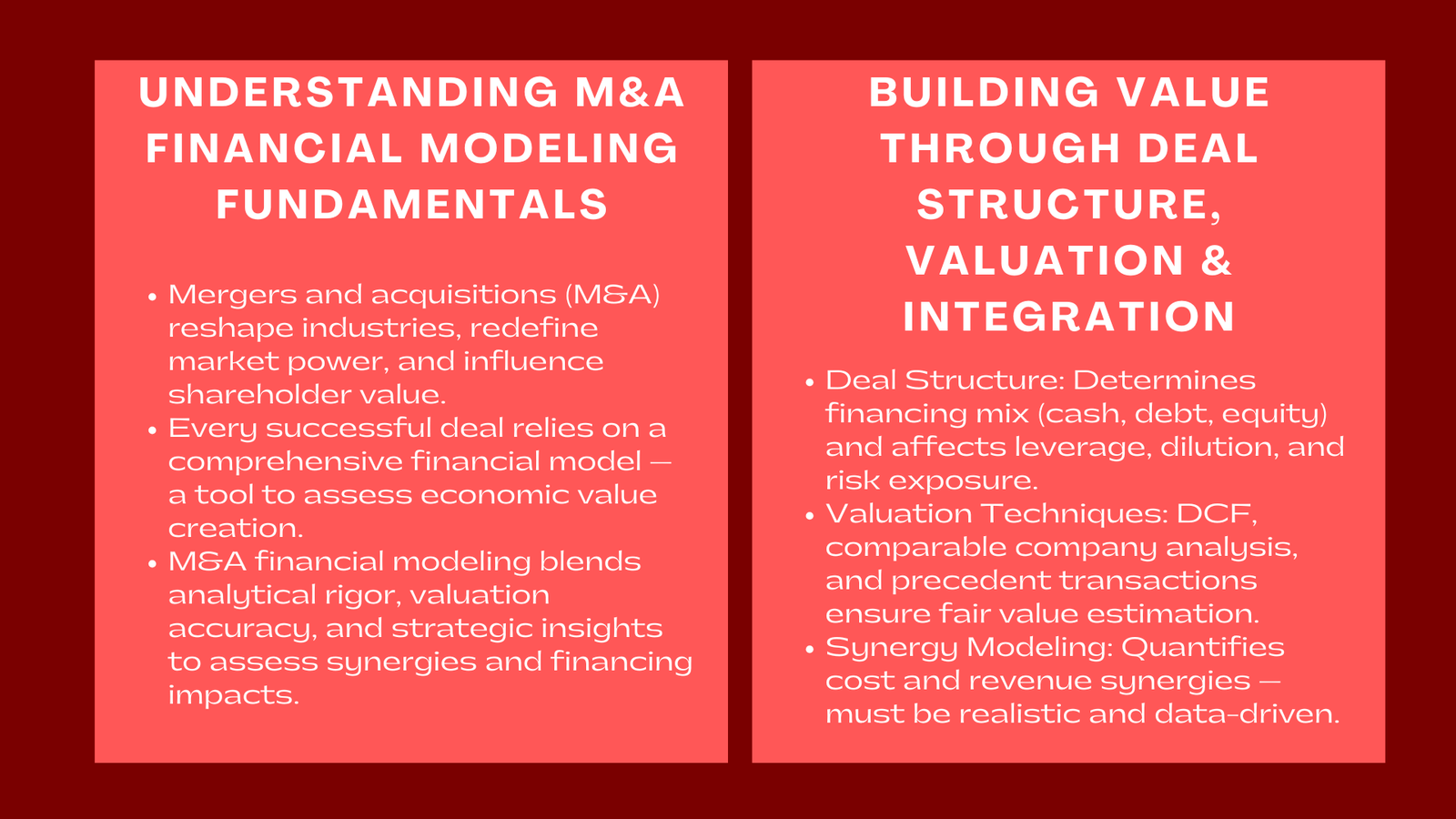

Mergers and acquisitions (M&A) are some of the most complicated and high-stakes activities in corporate finances. They are strategic transactions to reshape industries, redraw market power and make or break shareholder value. Behind every successful deal is a complex financial model – a quantitative framework for decision makers to comprehend whether or not a proposed merger or acquisition involves the creation of real economic value. M&A financial modeling requires a combination of analytical rigor with suitable valuations and strategic insights to analyse both synergies and financing structures with the performance following a merger or acquisition.

For those working in investment banking, private equity, or corporate development, being well-versed in M&A financial modeling is far more than a technical necessity, it is a strategic one. It enables analysts to model various deal situations, try out the effect of financing options and can preempt the post-merge integration outcomes. The idea is to give management and investors a good picture of the financial consequences of conducting a transaction before it occurs. In many cases, the credibility of an advanced M&A financial modeling technique for investment professionals depends entirely on the quality of its model – how logical it is structured, how transparent the assumptions are and how robust the outcomes turn out to be under different conditions.

M&A models require professionals to make confidence bridges between financial data as well as strategic objectives. They have to put assumptions about growth, cost efficiencies and integration success into numbers that can withstand investor scrutiny. In order to construct a durable M&A model, an analyst must comprehend the intricacies of the valuation, deal structure and synergy realization. The following sections investigate the most important techniques and considerations that are the hallmark of great M&A financial modeling.

Understanding Deal Structure and Key Modeling Assumptions

Every M&A financial model starts with the understanding of the structure and purpose of the transaction. The structure of the deal determines the way in which the acquisition will be financed – this could be from cash, debt or equity or a combination of these, and goes straight into the ownership dilution, the earnings impact and the risk exposure. A cash deal normally means higher financial leverage but provides full control whereas a stock deal can maintain liquidity but dilute the existing shareholders. The modeling process must provide a clear outline of these choices as they have different impacts on the financial profile and valuation metrics of the company.

Analysts must also establish a good solid basis of assumptions. This involves setting the purchase price, deciding how much of the enterprise value of the target will be used to pay the goodwill, tangible assets and identifiable intangibles after the acquisition. Purchase price allocation (PPA) is some of the most complex elements in the M&A modeling process, since it affects depreciation, amortization, and future earnings. A misclassification in the allocation of items can create misguided estimates of net income and cash flow and injection of wrong-sounding conclusions for the performance of deals.

The next consideration is that of synergy modeling. Synergies are the anticipated benefits that are derived when two companies join forces – they can be cost synergies, such as the reduction of overlapping expenses, or revenue synergies, such as increased market reach or cross selling opportunities. Accurately modelling synergies is an art and science. Over-estimating them can render a deal attractive on paper but impossible in reality. Underestimating them can make a sound strategic acquisition appear to be unviable. Analysts must base synergy estimates on base level detailed operational analysis and benchmarks from the industry to ensure that they are achievable within a reasonable time frame.

A professional M&A model must also reflect integration costs as well as transaction fees. These one off costs, which may be quite-high, can drain the short term financial benefits of a merger. They include advisory fees, restructuring expenses, integration of IT and potential severance payment. By having them factored into it, model makers provide a more accurate portrayal of the money journey from acquisition to the realization of synergy.

Building the Pro Forma Model and Assessing Synergies

Once the assumptions and the deal structure have been defined, the analyst proceeds to construct the pro forma financial statements — the heart of any M&M financial model. The process starts with consolidating the financial statements of the acquired and target companies as standalone financial statements. This means being consistent with accounting policies, making intercompany transactions and correcting non-recurring items to achieve comparability. The merged income statement, balance sheet and cash flow must represent the financial reality of one combined entity following the transaction.

The analyst makes some adjustments to the target’s revenues and costs, making the necessary adjustments for synergies, and recalculates the D&A charges based on the new asset base, after accounting for the purchase price of the target. Financing effects – such as new interest expenses, or alterations in the number of shares from equity then being issued – are also included. The result of this pro forma net income is an important measure for investors because it indicates whether the acquisition is an accretive (earnings per share is improving) or dilutive (earnings per share are deteriorating) transaction.

Accretion and dilution analysis is one of the hallmarks of how to build and analyze merger and acquisition financial models . It is used to assess the effect of a transaction on the income per share (EPS) of the acquirer after the transaction, taking into account financing, synergies. An accretive deal often is considered to be a good thing, because it creates added value immediately for shareholders, whereas a dilutive deal can only be justified based on long-term strategic benefits. Analysts usually create sensitivity tables to see how assumptions, such as purchase price, financing cost, or synergy levels, related to the outcome of EPS. This gives decision-makers a clear picture of the balance between the risk and return of the transaction.

The pro forma balance sheet reflects the new capital structure of the company. It makes adjustments for the amount of debt raised, cash spent, good will created, and equity issued. A well-built model must ensure that at the post-acquisition time the balance sheet must balance and be an accurate reflection of the ownership distribution. Meanwhile, the pro forma cash flow statement is the connection between the income statement and balance sheet that illustrates the capability the company can produce cash for the debt repayment, dividends or reinvestment to be paid after the merger.

To make the model credible analysts need to have some stress-tests on the key assumptions. For instance, what effect would a delay in the realization of synergy have, or an increase in financing cost have, on valuation. How sensitive are the results to the changes in tax rates and or working capital assumptions? Sensitivity and scenario analyses make a static model into a dynamic decision tool that reflects the real world of uncertainty that surrounds major transactions.

Valuation, Integration Planning, and Strategic Implications

Beyond the financial mechanics, however, M&A modeling is also a strategic evaluation tool. A comprehensive model enables executives to trade off various acquisition targets, financing means and integration timelines. It helps them to answer some important strategic questions: What premium is reasonable for this acquisition? How much leverage will the company be able to support post deal? What is the combination of synergies and cost savings which justifies the investment? These questions extend beyond the accuracy of the spreadsheets – the financial rationale for the entire transaction is defined.

Valuation is the key in the M&A modeling world. Analysts generally use several valuation techniques – Discounted Cash Flow (DCF), comparing company analysis, and also precedent transactions – in order to determine the fair value of the target as well as the acquirer. The model needs to reconcile these methods in order to ensure consistency and transparency. For instance, if the purchase cost is significantly higher than the DCF making the purchase favorable for the target, the analyst must explain the premium based on prospective synergies or strategic position. This connection between valuation and strategy rationale is what distinguishes a good M&A model from a purely mechanical model, and mastering this process is often emphasized in a financial modelling training course Singapore professionals attend to build real-world M&A modeling expertise.

Post-merger integration (PMI) is another critical issue to be considered. Even the most financially sound of acquisitions will fail if the integration is not carried off well. Analysts should use the financial model to predict integration milestones, track the realization of synergies and measure the return on investment (ROI) on time. The model thus becomes a living document – not only a pre deal evaluation tool; it also becomes a performance tracker post deal.

M&A financial modeling is also related to jurisdiction of governance. Investors, lenders and regulatory authorities often have a look at these models in the course of due diligence. They have expectations of transparency, documentation and logical consistency. Any ambiguity in the assumptions and model flow may undermine any confidence in the analysis. Therefore, professionals need to make sure that their M&A models are fully auditable with clear input sections, blocks of calculations, and output summaries. Clarity in structure goes beyond showing technical competence, and also shows professional integrity.

Conclusion to Merger and Acquisition Financial Modeling Techniques for Professionals

M&A financial modeling is more than a technical exercise – it is a strategic decision-making process that combines a sense of financial acuity, business acumen and strategic thinking. However, for finance professionals, it is one of the most difficult and exciting modeling disciplines. Being able to build and read an M&A model helps analysts analyze complicated deals, find value in them, and communicate their results well to stakeholders.

In the modern competitive financial world with deal volumes and valuations being more scrutinized than ever before, knowledge of M&A financial modeling separates the high-performing professionals from the average ones. It demonstrates an individual’s ability to think holistically in terms of growth, risk and value creation. Ultimately, individuals who are able to translate data and assumptions into a clear and compelling strategic narrative that makes sense in a financial context will be out in front of the corporate decision-making and investment packs.