Financial Modeling Best Practices for Accuracy and Career Growth

Financial Modeling Best Practices for Accuracy and Career Growth

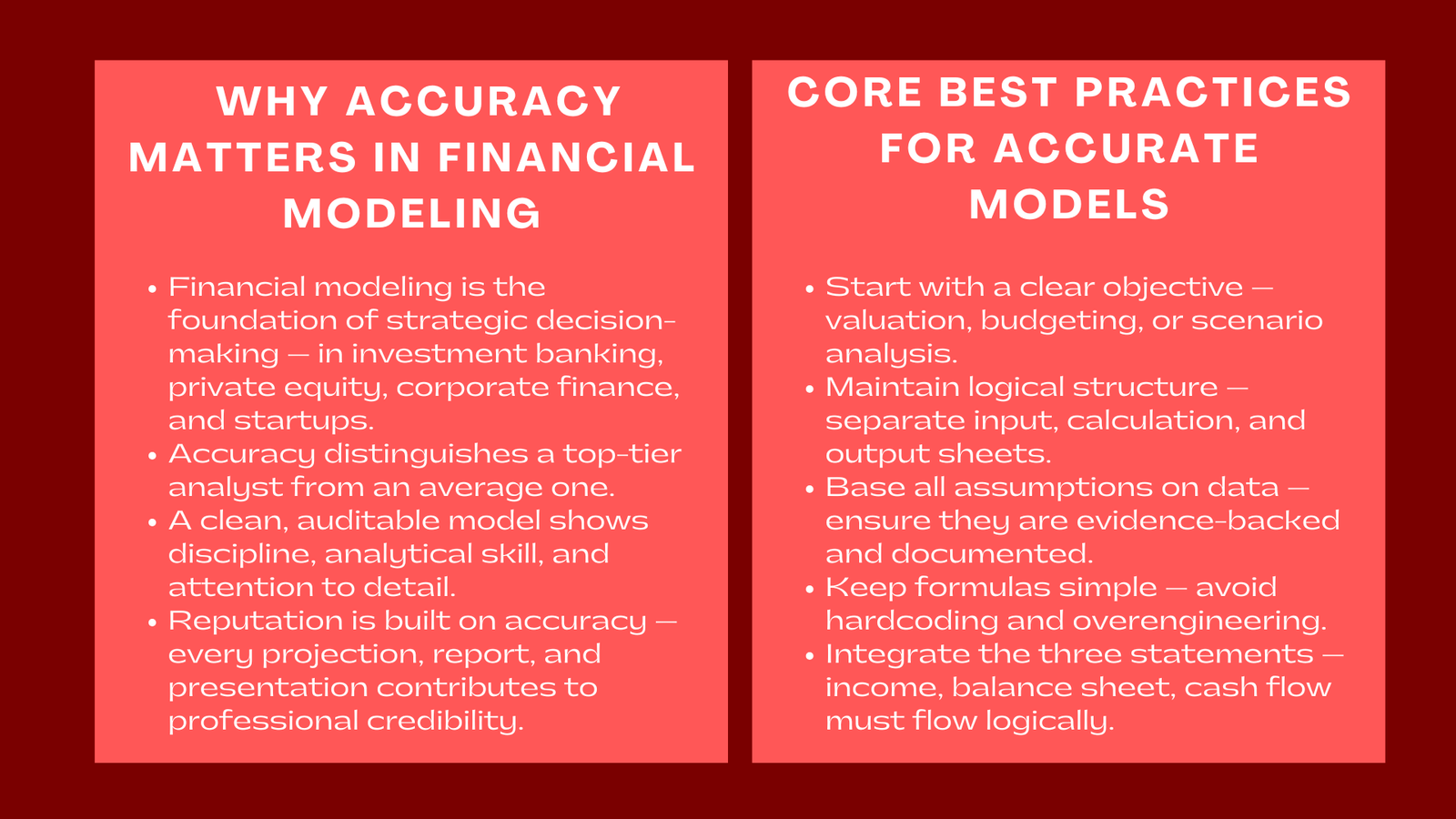

In finance, accuracy is power. Financial modeling is the basis of decision-making whether you are a part of investment banking, private equity, corporate finance, or startup valuation. It converts unstructured data and assumptions into systematic predictions that donate strategies, valuations and investments. However, it is not merely technical expertise that distinguishes an average analyst and a professional at the highest level, it is the skill to come up with accurate, consistent, and insightful models.

Best practices in financial modeling are not only an avoidance of error; they also involve a set of habits that enhance the quality of models and go toward making an individual professionally credible. An auditable copy that is clean indicates being disciplined, analytical and paying attention to details – all are important qualities of becoming an advanced profession in the field of finance. In the context of financial modeling for corporate finance in Singapore, these practices are especially critical as they align with industry standards and investor expectations. It is not a single occurrence, accuracy is a reputation that would be earned by each and every report, projection, and presentation that you make.

The paper will discuss the main best practices that will guarantee modeling precision and long-term career development. It addresses both the technical, structural and professional factors of modeling that make spreadsheets become strategic instruments assisting analysts gain trust, responsibility, and acknowledgement in their monetary profession.

Start with a Clear Objective and Model Blueprint

There is the right model that starts with a purpose. Numerous inaccuracies in models also take place not due to the complexities of the formula but because the analyst did not specify what is supposed to be accomplished by the model. Is it for valuation? Scenario analysis? Budgeting? Capital raising? All goals need to have varying structures, levels of detail and assumptions.

Prior to the entry of any data, highly seasoned professionals describe a blueprint – a road map of the way the model is to move. This entails the determination of key inputs, output measures and financial relationship between financial statements. A plan has to be carefully designed, confusion in the future will be lowered and the model can be used to make the intended decisions.

A good model has a good logic behind it in that there is a hierarchy: assumptions, calculations, results, analysis. This flow will make sure the changes to assumptions will automatically have a flow in the model and result in new output without having to make any changes on the aspect. This structure can be established at an early stage enabling analysts to develop dynamic and transparent models.

Individuals who always start with a distinct model design maintain the quality of strategic thinking, a trait that both the managers and customers are so proud of. As opposed to simply number-crunching, they demonstrate the awareness of the business context, which, in its turn, increases credibility and employment potential ratings. By applying principles taught in a practical financial modeling core concepts course Singapore, analysts can build structured models that reflect strong strategic and technical capabilities.

Maintain Logical Structure and Consistent Formatting

Formatting and structure may look cosmetic, but in financial modeling, they constitute the basis of everyone being correct and useful. Scattered spreadsheet is a nest of errors. With all the assumptions, calculations and outputs combined data can be easily misinterpreted or formulas can be easily broken by accident.

Best practice has it that the model should be divided into distinct parts or worksheets:

Assumption input sheet (marked with blue color or any other color).

Reasoning, assisting work schedules, and instructions.

Summary, financial, and dashboards output sheets.

This design is easy to audit, review and even modify the model which is a modular design. Color-coding and formatting structures make users immediately understand where they need to make amendments and where they are not to interfere with formulae.

Models are seen in a working finance setting as seldom being individual, and instead being within a team and department. A well structured model also portrays professionalism and one can easily be followed in logic. This does not only save time on revision, it also helps create an impression of a quality and accurate analyst.

Career-wise, consistency when it comes to modeling is a good indication of a detail-oriented attitude, which is also among the most appreciated qualities in a financial position. Neatly packaged models that are produced by analysts end up making them go-to team members when there are high stakes or even when they are required to deliver to a client.

Base All Assumptions on Data and Justifiable Logic

Any financial model is based on assumptions- and where inaccuracy can creep in very readily. Having unsubstantiated assumptions, excessively rosy assumptions or unstable assumptions may misrepresent the results and lead the decision makers astray.

In order to be credible all key assumptions must be:

Evidence based — historical, market research or industry standards.

In line with the other assumptions such as revenue growth ought to match with expansion of the capacity, pricing patterns and demand expectations.

In an easy to understand style- there is a text with the source or explanation referenced.

Scenario analysis is also another test that professionals do to assess the sensitivity of assumptions. Analysts can evaluate the probability of an outcome by manipulating growth rates, margins, or discount rates and also indicate the risks in an effective way.

Analytical maturity is seen in being able to justify the assumptions when making a presentation or conducting audits. Employers will observe that an analyst is able to give the reasoning behind an assumption- not how it was performed. This competency makes them more professionally credible and prepares them to leadership positions in which judgment rather than technical ability underlies the decision-making process.

Simplify Formulas and Avoid Overengineering

In financial modeling, complexity passes as sophistication. Many analysts would impress with taking away lots of time learning nested formulas or VBA macros, in order to end up with fragile, slow and hard-to-audit models.

The best models follow the rule of being clear rather than complex. Each formula should clearly have a purpose and should be easy for other people to understand. When calculations hit the complex level, there is a risk of hidden errors and the problem of finding the calculation can be time consuming.

Experienced professionals decompose complex logic in a number of simpler steps. Instead of putting five conditions in one formula, they use intermediate rows or helper cells that have a clear documentation of each of the assumptions. This not only helps for transparency but also assists other people in tracing the logic during reviewing.

Moreover, analysts should avoid hard coding, as much as possible. Embedding numbers in formulas instead of referencing input cells (e.g., “=A1 + 1.05”) makes it impossible to be flexible. Most importantly, when assumptions change, the analyst will need to manually change every instance – a recipe for inconsistency.

The ability to keep formulae simple, dynamic and well-referenced saves professionals time and eliminates costly mistakes. This habit represents technical discipline – one of the hallmarks of high-performing analysts whose accuracy won for them long-term trust and faster promotions.

Ensure Proper Integration of the Three Financial Statements

A major reassessment of modelling proficiency is whether the income statement, balance sheet and cash flow statement are completely integrated. An accurate model makes these statements logically flow into each other: Profits impact retained earnings, depreciation reduces the assets and profit and cash flow reflects the actual changes in working capital and financing.

If these statements are not correctly linked, the models give false results. For example, not the way that interest expense is reliant on debt levels or the failure to link depreciation in a clear way results in the balance sheet failing to balance – a sure way to flag a red flag for professional modeling.

Best practice is to have dynamic formulas linking these three statements together. The model will always automatically “balance” itself, checking that it is internally consistent. Failure to be perfectly balanced means that there is some error in a formula or logic that must be corrected immediately.

Integrating the three statements is a sign of technical ability and knowledge of how financial engines work. Congruently, a modeler who can build models that are in balance will be seen as professionals who can be trusted to handle important work – the types of analyst who can be relied on to handle work for valuation, forecasting or investor reporting. This skill has a direct correlation to increased visibility, performance reviews and career advancement opportunities, especially when applied in areas such as purchase price allocation valuation Singapore.

Build in Error Checks and Control Mechanisms

The best analysts make mistakes – but the great ones find them before anyone else has a chance. Therefore, strong models contain error checks and control cells that automatically identify any lack of consistency.

Common checks include:

Maintaining the balance between the assets, liability, and equity in the balance sheet.

Checking whether subtotals and percentages are correct

Monitoring if key ratios (e.g. margins or ratios) fall within reasonable ranges

Showing any missing or circular, or cycles of references.

The error checks are like an internal audit where you will be able to spot issues instantly. Investigative journalism – they impress reviewers and clients too – by showing they are going to be accurate and accountable.

In addition, using other tools such as Excel’s Trace Dependents, Evaluate Formula and Data Validation features can help in catching any subtle errors that might cascade. When you provide a model with built-in reliability, you will gain the trust of your people and superiors. Often that level of our trust will fuel the level of responsibility, may be in charge of due diligence work streams or are able to make presentations to the client or investors.

Document and Label Everything Clearly

Transparency is a financial modeling professional currency. Every assumption, source and key formulae should be suitably labelled or commented. Analysts tend to undervalue the importance of the documentary process until someone else needs to use their model – or perhaps they themselves need to revisit it months later.

A transparent model will normally contain:

Explanation of the source or logic for each input

Tracking of versions, to distinguish between drafts and/or versions

A summary tab on what the model is intended for, how it is meant to be used.

Clear labeling wastes no hours during the auditing, review or updating process. It also presents a professionalism in that the analyst demonstrates that they are organized and are mindful of the collaboration of the team. In client-facing positions, the less you have questions, the more confident you can be about your work.

Developing this habit as a professional is something that is often entrusted to people to present models to senior stakeholders. Their model becomes the train of thought for new hires – a silent but powerful statement of trajectory and knowledge for their advancement.

Regularly Perform Sensitivity and Scenario Analysis

Accuracy in modeling is not just one “right” answer – it consists of having the understanding of the entire range of potential outcomes. So, scenario analysis and sensitivity testing is part of what is considered best practice in finance.

Scenario analysis views how the model will behave under various business scenarios – such as optimistic, base and pessimistic cases. Sensitivity analysis isolates the various variables (interest rates or cost of capital) and determines the extent of their impact on key results like potential valuation or profitability.

We have professionals who are strategic in their thinking as they include these techniques. They are not just number makers, they help the decision maker comprehend risks, resilience and upside potential. In interviews and performance reviews, analysts who can explain the results of their scenarios with certainty are seen as visionary and business-minded in their thinking.

Conduct Peer Review and Continuous Refinement

No model is considered to be complete until it is looked over by a fresh pair of eyes. Peer review is one of the best practices to maintain accuracy and possible trust among team members.

By reading the work more than once, namely by more than one reader, paternity mistakes are detected, which might have escaped the recognition of the author: missing pipeline logic, unclear assumptions, or random imbalances of a prose monument may stand out. In addition to better models, soliciting feedback is a demonstration of professionalism and humility, both of which have a positive effect on career development.

Finally, based on the review, experienced analysts conduct stress testing, which means they change key assumptions to make sure that formulas are correct when used in all situations. Constant tweaks ensure the model remains robust, relevant and flexible enough to handle changing business conditions.

The credibility that is developed by being open to suggestions and providing better models helps build an analyst’s reputation as a reliable team member and problem solver, which is essential to fast-tracking a career in finance.

Align Modeling Habits with Career Goals

Ultimately, business habits such as financial modeling best practices are not merely technical rules – they are civic habits that define who you are as a professional. Accuracy, clarity and discipline are transferable skills that are the hallmark of successful careers in finance, consulting and investment management.

Professionals who internalize these habits acquire an advantage in all areas of his/her job. They deliver work that is trusted, present ideas confidently and earn respect for the precision of their analysis. Over time their models form the basis for critical business decisions – from M&A to capital budgeting to portfolio strategy.

Basically, learning the discipline of modeling is indicative of leadership readiness. When managers can rely on your models without checking you get even one, you’ve proved not just your technical skill but your judgment – for without judgment analysts are no better than decision-makers.

Conclusion

Financial modeling is not just a technical exercise – it’s a professional language with its own rules, language of trust, logic and precision. Whether that’s through the principles of structured design, starting with assumptions, and then validating them through code checks, or through documenting design decisions, the best practices described by the above adage tend to result in accurate work and professional development.

Accuracy builds confidence. Credibility is derived only from true confidence. And credibility means a career ladder to advance. By mastering the art of modeling best practices, finance professionals ensure they are not just contributors of numbers on a spreadsheet, but sources of information that are strategically used to drive the creation of the overall organizational decisions.

In the fast-paced world of finance, accuracy isn’t something you need to be a good finance professional, it’s a legacy of a good finance professional.