Step by Step Guide to Building a Basic Financial Model in Excel for Job Readiness

Step-by-Step Guide to Building a Basic Financial Model in Excel for Job Readiness

Introduction to Step by Step Guide to Building a Basic Financial Model in Excel for Job Readiness

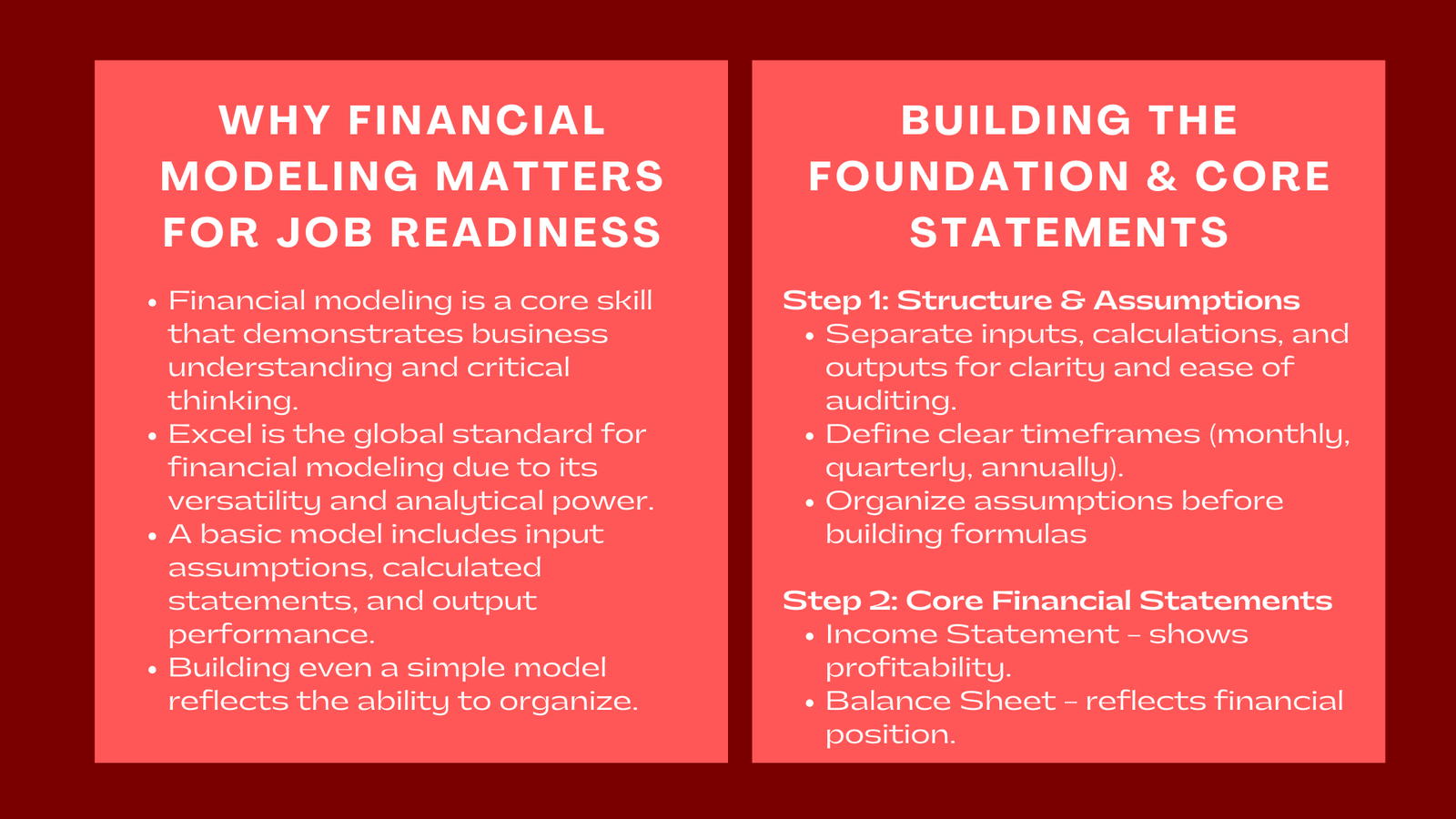

In terms of securing employment of a finance-related nature, there can be no skills that are more essential in terms of demonstrating the ability to create a clean and rational financial model in Excel than the one which exhibits competence and understanding of business processes. Financial modeling presents critical thinking, accuracy and capability to relate figures with hypothetical decisions. Although the most complicated models are applied in investment banking or project finance, every professional must begin with a simple model that is well typed and structurally organized to indicate the working of a business.

Excel has been adopted as the standard platform of modeling due to its versatility and might. The simplest model has input assumptions, calculated statements, and performance outputs, which are in harmony with each other. Its very construction, mere construction, even at an amateur level, develops a sense of instinct concerning how business should run, as a matter of finances. This guide explains the process of the bought spreadsheet with the blank sheet into an operational financial forecast model that could show employment competence. Enrolling in Excel financial modeling training Singapore can further enhance these skills and make the learning process more structured.

Laying the Foundation: Structure, Assumptions, and Timeframe

The transparency of a model starts with the model structure. Analysts normally divide inputs (assumptions), calculating and results into different locations or worksheets. This makes the model easy to understand and auditable and updates it. The drivers are inputs, namely, the percentage of sales growth, price, cost, and tax rate, capitals, etc. As a novice, it would be valuable to come up with a rational layout on which assumptions would lead to formulas that would construct the financial reports.

It is also important to define the timeframe. The majority of models are on a monthly, quarterly or annual basis, depending on the analysis. To illustrate, a startup financial forecast can be based on projections on a monthly basis in the first two years of the business, whereas a mature business can be based on projections on an annual basis within a period of five years. Setting this timeline at the beginning would enable one to have a consistent reference of the formula throughout the model.

The biggest error that beginners commit is that they directly go into the formulas when they have not properly arranged their assumptions. This is usually done in a manner that causes mistakes and misunderstandings. In the most successful type, any person, doing either recruiting or managing or investing, can see the logic intuitively with all assumptions in plain view and all outputs readily decipherable. This is why enrolling in a practical financial modeling core concepts course in Singapore can help beginners build a solid foundation and avoid these common mistakes.

Building the Core Financial Statements

After the establishment of the assumptions, the second step is to build the three primary financial statements; that is, the income statement, balance sheet, and the cash flow statement. All of them are stories about a different aspect of the company in terms of its finances. The income statement indicates the revenue, expenses, and profitability. Financial position is shown in the balance sheet, the things that the company has and the things that the company owes. The cash flow statement is used to follow the flow of cash in terms of its operation, investment, and financing activities.

The real logic of modeling is seen in the way of linking these statements in Excel. An example is when net income provided by the income statement is entered into retained earnings in the balance sheet whereas depreciation provided and working capital adjustments have an influence onto the cash flow statement. Once all three statements are linked appropriately the model is dynamic where the analysts can do tests on how variation in assumptions can cascade down to the ultimate results.

The beginners must also be taught about the importance of balanced- a state where the assets of a company are equal to the liabilities of the company as well as the equity. This one check is enough to ensure that the internal logic of the model is good. When a completed model is achieved, it is a living profitability, liquidity and solvency analysis tool, which is what the employer wants to see out of an analyst. In addition, understanding various multiples used in company valuation Singapore can further strengthen the accuracy and relevance of the financial model.

Testing and Refining for Job Readiness

The truth and output of the model means that it will survive the process of professional scrutiny. Prior to distribution, analysts need to verify against formula errors and circular references and discrepancies. The audit functionality of Excel including tracing of precedents and dependents are useful in validating calculations. The outliers or errors can be indicated by conditional formatting. Competence: It is equally important to be concise as it is to be clear, so a well-formatted document with good labels and color patterns are indicators of a professional version of the company.

In order to practice the depth of analysis, simple sensitivity analysis should be incorporated by the beginners where the variations of revenue or costs are illustrated and how these variations affect the profitability. There is nothing that recruiters prefer more than to see this – it is evidence that there is no constant financial performance and that performance depends on the situations. The inclusion of charts or a summary dashboard will improve communication and the model is not just a calculator but a decision-making tool.

The other most effective interview preparation exercises is also the preparation of a model that can be developed by building it. It teaches candidates to make decisions under pressure, use organization, and present quantitative results, or the same skills that employers are most interested in when hiring in the field of finance.

Conclusion: Turning Excel Proficiency into Career Advantage

Decent financial model is an indicator of employment preparedness. It demonstrates the technical mastery as well as the discipline, structure and problem solving attitude required in finance. Although it is on the superficial formulas and spreadsheets, it is the idea of logic behind it that counts. Whenever creating your first model, it is important to remember that clarity, consistency, and comprehension are the attributes of professional modeling. Learning them at an early age makes one an Excel master.