Introduction to Financial Modeling A Beginners Guide for Career Starters

Introduction to Financial Modeling A Beginners Guide for Career Starters

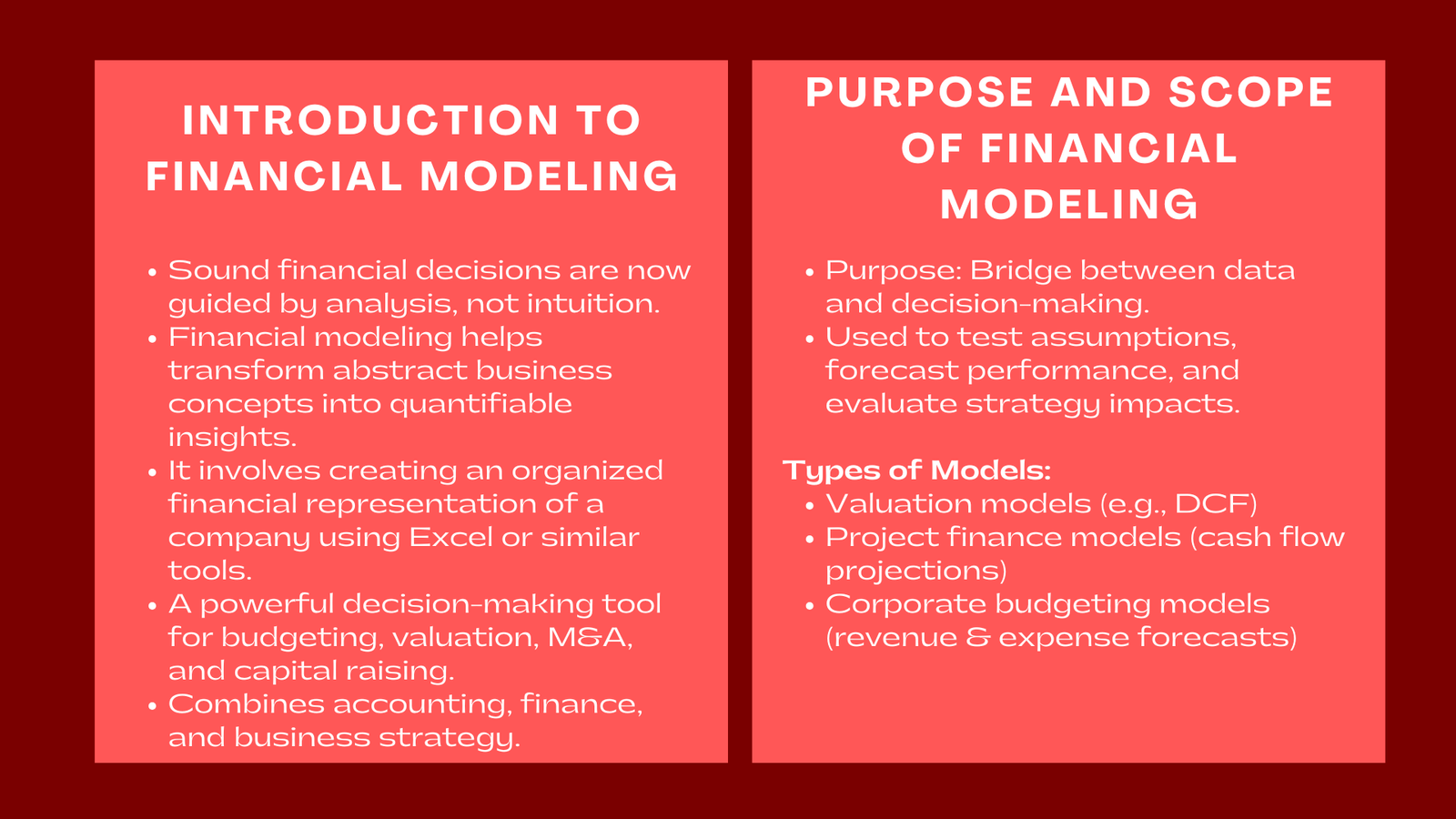

In the hectic financial industry, sound judgment has been made to be based on facts. Business organisations no longer base their decision on profitability, growth, or investment plans based on their intuition alone, but rather, they are now guided by sound financial analysis. To those who just get into the field of finance as a beginner, learning how to create and pass through these models is a basic talent that ushers into corporate finance, banking, a consulting career, and entrepreneurship. Good knowledge of financial modeling can assist one to be able to transform abstract concepts of the business into quantifiable, testable, and practical information.

Financial modeling is at the simplest level the art of creating an organized representation of the financial situation of a company on excel or any other such software. It is a combination of accounting, finance and business strategy to come up with a future performance prediction. A financial model is not merely a spreadsheet with numbers, it is a decision making tool where professionals can analyse the various scenarios and risks and make predictions about the financial results. The power to design, read, and interpret a model is one of the most potent tools that the analyst can possess whether it is with regard to budgeting, valuation, executive takeover and acquisition or with regard to raising capital with startups.

Financial modeling does not only involve technical expertise, but also knowledge of the way businesses work, in the career entrant. Every formula of the model is a real world process, revenue generation, managing costs, servicing debt or returns to the shareholders. The knowledge fills the missing links between theoretical and practical finance in the corporate world, and as such modeling, becomes an indispensable skill in the young professional who is getting into the business. Enrolling in a financial modeling course Singapore for beginners can help bridge this gap effectively and build strong foundational skills.

Understanding the Purpose and Scope of Financial Modeling

The initial step to perfecting the financial modeling process is to know the reason why the modeling process exists. Financial modeling is a medium between the data and decision making. Executives use models to test their assumptions before they make a commitment of capital, how shifts in strategy could impact profitability and how financial performance serves the interests of the business. They are applied by the analysts to gauge growth, predict performance, and signal any early warning in the financial operations.

Models might be extremely diverse in case of purpose. The valuation model is concerned with the determination of the value of the company through the use of such tools as the discounted cash flow (DCF) or other tools of similar analysis of the company. A project finance model is an estimate of the cash flows of the large infrastructure projects which analyzes the debt repayment capacity and returns to the investors. At the same time, the corporate budgeting models assist the inner teams to project expected annual revenue and expenditure. Although the variations can be found, the fundamental principles are also similar: clarity, logical structure, and correct assumptions.

The beginners can begin with creating simple models which project the revenue and expenses and then incorporate the more complicated integrated models which are the ones that connect the cash flow statement, the other statements balance sheet and income statement. What is necessary is to understand that modeling is an analyzing and narrating instrument – the figures convey the financial story of a company and the modeler is the narrator. Enrolling in a financial modeling and valuation training course in Singapore can help beginners build these skills more effectively.

How Financial Modeling Enhances Career Opportunities

In the case of professionals working in an early career, financial modeling is a skill and a credential. Investment banking, private equity, consulting and corporate finance recruiters always make modeling ability one of the highest hiring criteria. A strong model presents rational thinking, observation and comprehension of business and these are such attributes that the employers should cherish.

In addition, modeling capabilities enhance skills in career development since they enable professionals to amicably convey finance information. A junior analyst who is able to clearly present the assumption of increased revenue or cash flow forecasts is instantly noticeable. In addition to technical skills, financial modeling also builds a mentality of how to solve problems in an organized and structured way, think in digital form, predicting events and how each decision impacts the bottom line.

There is a concern that with the emergence of automation and artificial intelligence, Excel is showing some signs that its skills can soon be rendered not only useless, but also unneeded. Nevertheless, critical thinking through the financial issue, organization of assumptions, and construction of the logical model will never be useless. It is possible that tools will change and the tools will not change the analytics of modeling. This is also true when applying various multiples used in company valuation Singapore, where strong analytical skills remain essential despite evolving tools.

Conclusion

The majority of the finance careers are based on financial modeling. It translates the abstract notions into the real projections as well as enables professionals to assess, plan and communicate effectively. To a beginner, mastery of this skill does not only involve knowing how to use Excel but also developing an acute knowledge of the way business decisions are given in business performance concerning a financial aspect. All aspiring practitioners of the finance field of study must consider modeling as an analytical art, career-pressurizing shot as it is a skill that hones the mind, and it also clears an entry path in the international marketplace of financial opportunities.