Best Benefit Why use Multiple Financial Models Are Key in Real Estate Investing

Best Benefit Why use Multiple Financial Models in Real Estate Investing

Introduction: Beyond a Single Lens

Real estate investment is not an easy undertaking and it is characterized by several variables including the location of the property, finance, market cycle and risk. Using a single financial model may cause blind fold and bad investment decisions. Investors must combine models to identify growth equity of investment decision various aspects of risk, returns as well as value creation in order to make informed decisions.

The fact that many models are used to find a more benefits of financial courses Singapore view alone as well as enables investors to stress-test assumptions. This would help to make decisions that will not rely on optimistic calculations or a distorted set of narrow values, but a comprehensive side of the potential of the property.

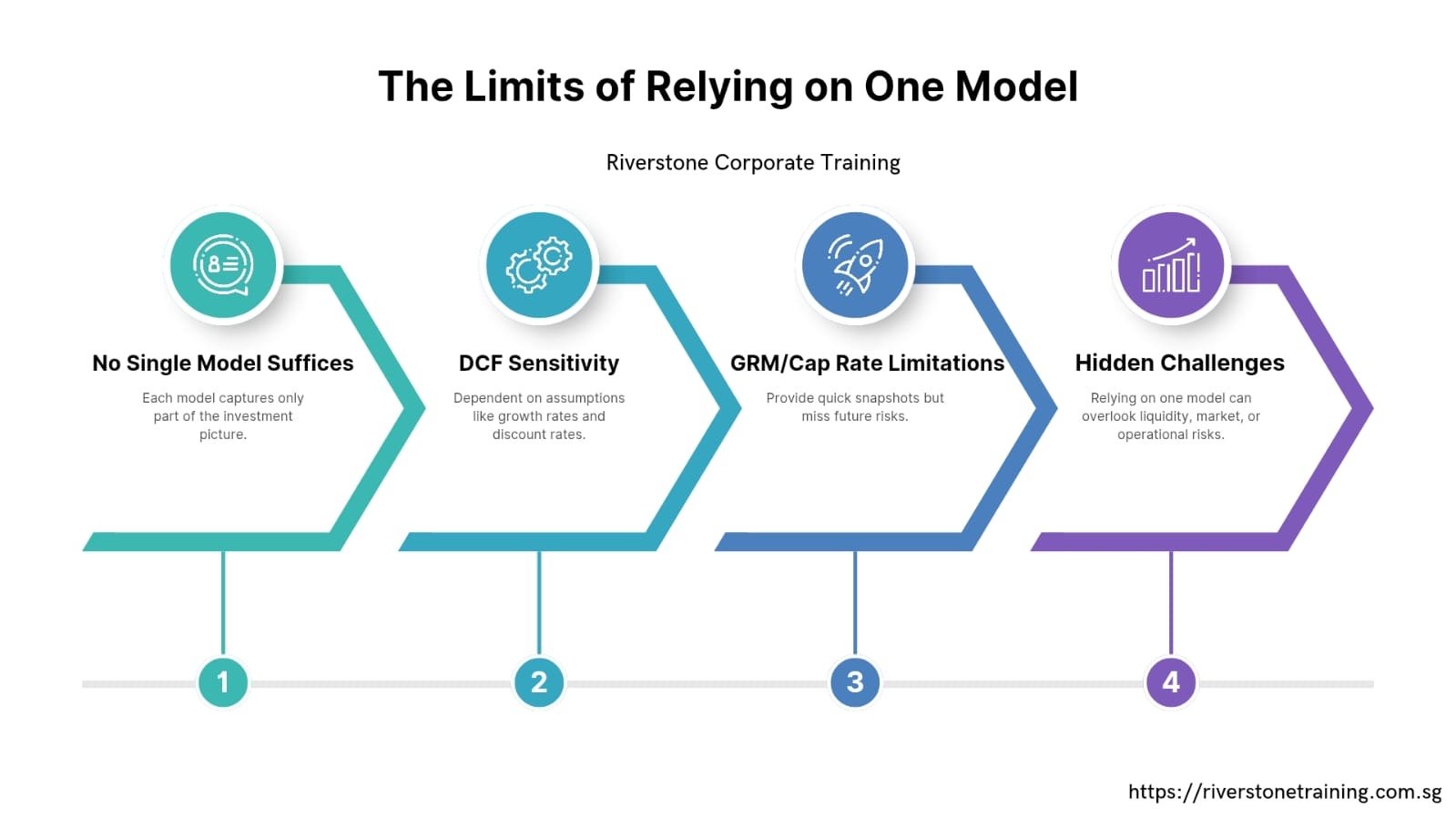

The Limits of Relying on One Multiple Financial Models in Real Estate Investing

There is no particular model of a real estate investment that describes the reality of the investment. To use an example, in a Discounted Cash Flow (DCF) analysis, the level of sensitivity can point up to long term value though it can prove to be sensitive to any growth rate and discount rate assumptions. On the same note, Gross Rent Multiplier (GRM) or Cap rate may be a momentary display of performance, but it may not reflect future performance in terms of tenant turnover or increasing interest rates.

Through a one-way process, investors stand the risk of excluding the underlying obstacles i.e. liquidity limitation, market fluctuations or unforeseen operation costs, that can drastically affect returns.

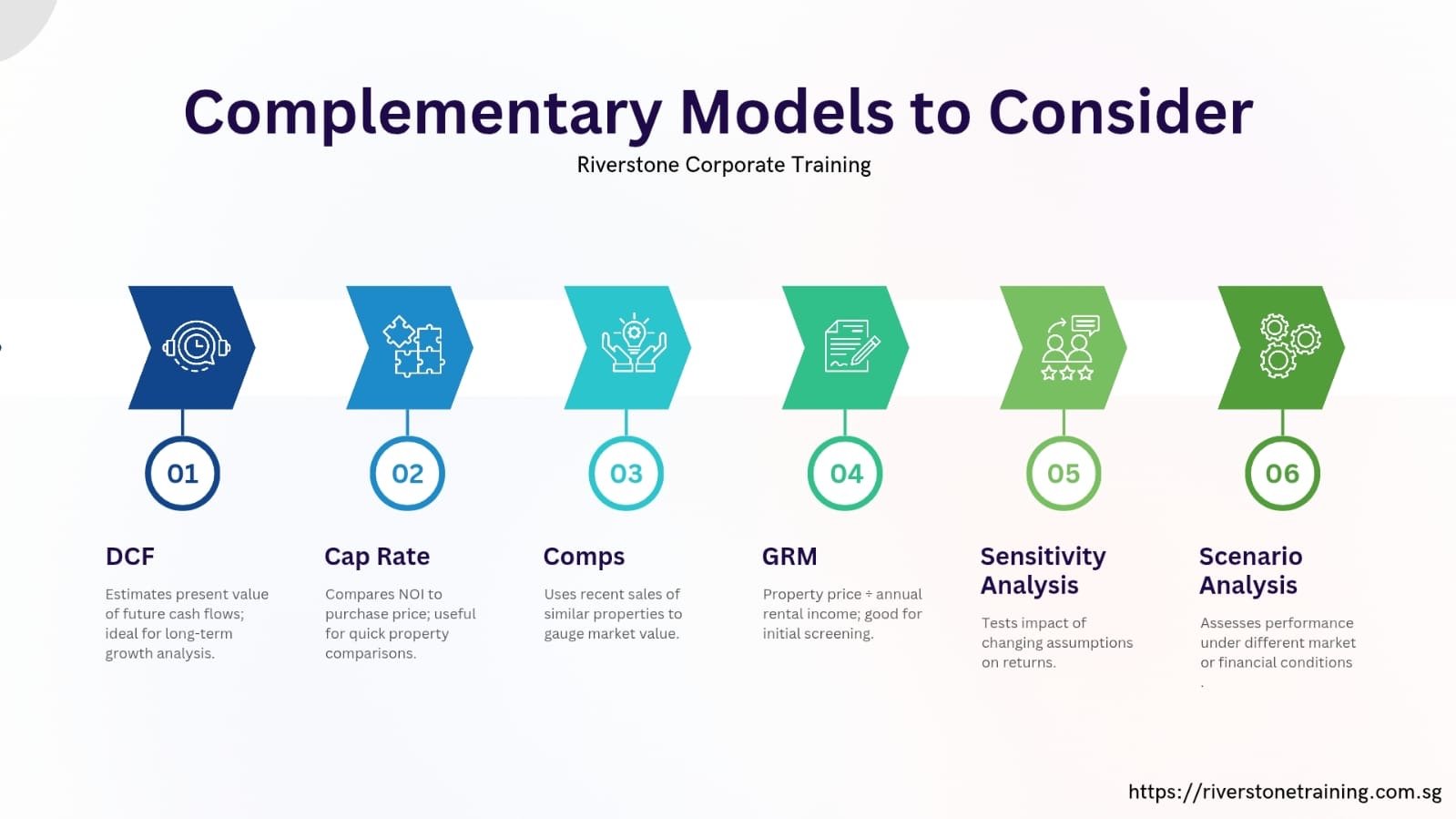

Complementary Models to Consider

1. Discounted Cash Flow (DCF)

Estimates the future value of the expected cash flows taking into consideration the time and the risk. It is best to use where sustainability and development in the long-run is to be investigated.

2. Capitalization Rate (Cap rate)

Indicates the correlation value of net operating income (NOI) and purchase price. Applicable in making rapid comparisons between the properties.

3. Comparable Sales (Comps)

Values the property according to the sales of similar properties in the recent past. Useful in determining the market mood and the pricing patterns.

4. Gross Rent Multiplier (GRM)

Simplified measure of the property price /year in terms of rental revenue. Recommended as an eligible first screening.

5. Sensitivity and Scenario analysis.

Examinations into the influence of varying assumptions such as vacancy rates, rent increase or financing cost on returns. Crucial for risk management.

Strategic Value of Using Multiple Models

These models act as a 360-degree view when they are combined to provide the investors a complete picture of what is happening. Indicatively, DCF can have appealing growth prospects in the long-run but sensitivity analysis could indicate that returns reduce drastically at increased interest rates. On the same note, Cap Rate and Comps will be able to justify whether or not the price of the acquisition is justified according to the existing market standards.

This multi-level strategy reduces bias and enables investors to make informed and data-driven decisions- buying, maintaining or selling property.

Conclusion: Building Confidence Through Multiple Perspectives

There is no single figure in real estate investing that can cut across the board. With the application of different financial modeling course Singapore , it is possible to be sure that there is a support of technology in measuring decisions and understanding of the process. It enables investors to unravel credit risk, credit type assumptions, and coordinates strategizing to the short and long-term plans.

Finally, using various models is not a matter of complexity per se, but one of confidence and clarity when it comes to the decisions demanding a lot. It is the combined effect of this in a dynamic market, that will lead to the distinction between the thoughtful and cautious speculation, and the actual strategic investing.