Amazing Financial Modeling in Building a Sustainable Startup

Amazing Financial Modeling in Sustainable Startup

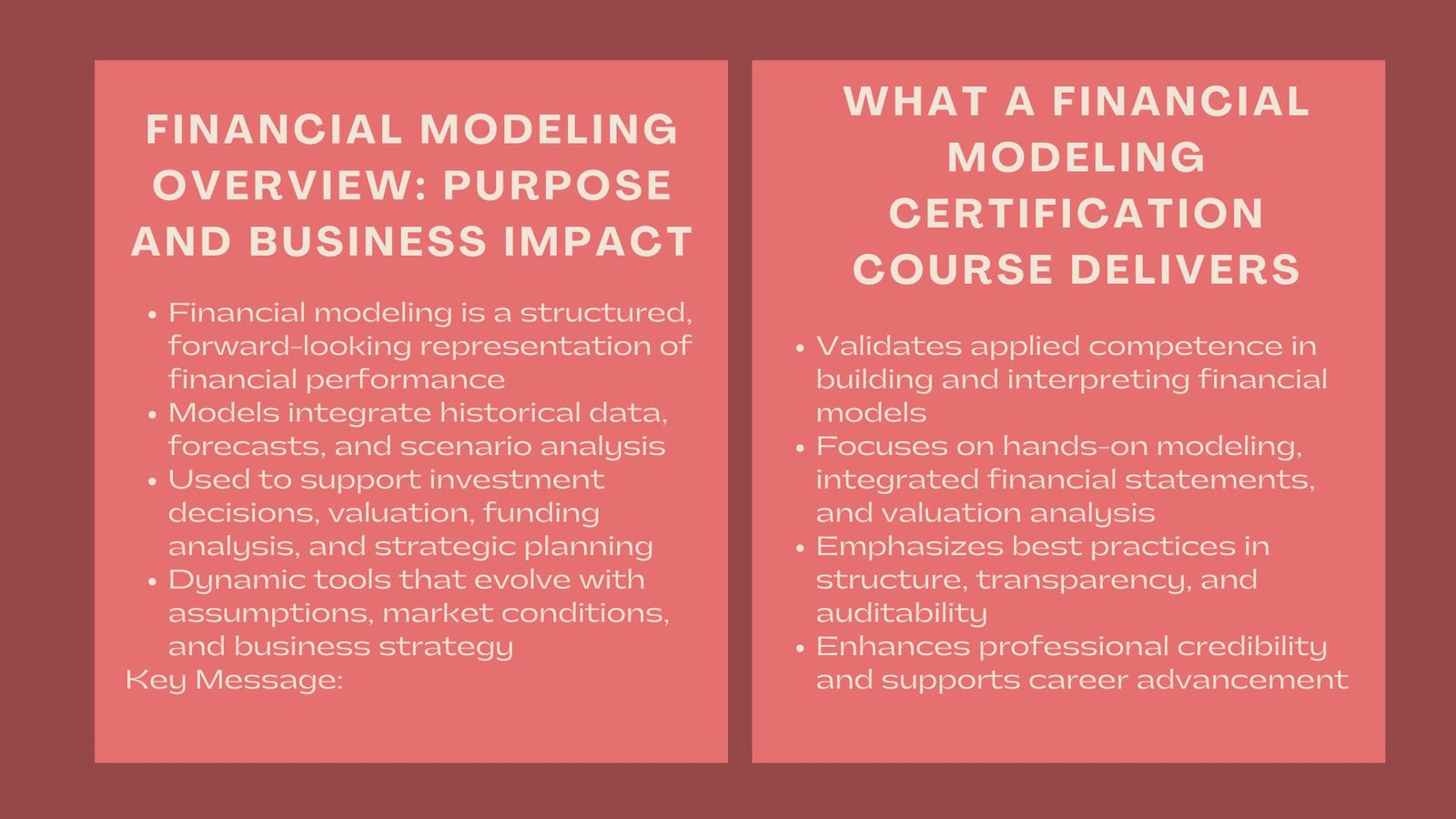

Introduction: Financial Modeling as a Startup Compass

When it comes to startups, there are hazardous situations, scarcity of resources, and constant uncertainty. All decisions, hires, launching a product, marketing budget, etc. disproportionately mean life and death. Financial modelling offers a free way out of navigating through this turbulent environment. Projection of revenues, expenses, cash flow and funding requirements allow an even better understanding of their business path so they can make an informed decision supported by data and not a reflexive decision.

A financial modeling as startup company is more than a spreadsheet; it represents a strategic direction book. Not only it predicts financial performances but also outlines dependencies, bottlenecks and opportunities. Models allow founders to explore the possibilities of various what-if scenarios, prepare in a variety of market conditions and present the story of their business in a manner that will make sense to investors, employees, and partners. In such an ecosystem with agility and foresight being key elements, financial modeling converts uncertainty into action.

Forecasting Revenue and Expenses

Start up company valuation Singapore can experience far-from-stable revenue sources particularly in their initial phases whilst product-market fit remains a determining factor. The financial model enables the founders to develop several income hypotheses (optimistic, realistic and conservative) when estimating the operation costs (salaries, rent, cost of technology etc.).

Its importance: Precise forecasting will make sure that the business can face all the necessary costs, define break even points as well as capitalize resources. It similarly earns an attachment with investors, who demand a defined financial way to money-making. As an illustration, forecasting various rates of sale growth will assist a SaaS start-up company to determine whether any marketing expense will result in the required revenue to keep the business afloat.

Managing Cash Flow in Financial Modeling in Sustainable Startup

Any startup is fueled by cash. Even businesses that are profitable would fail when money is not well handled. Financial models help to monitor inflows of sales, investments or loans, and outflows of paying payroll, rent, inventory and marketing. They also enable founders to approximate delays between collection of revenues and actual cash availability.

The importance of it is that early identifying the cash shortfall will allow them to plan ahead, either with bridge funding or with cost-cutting measures or by postponing unnecessary spending. When the start is looking forward to lean months, they are able to negotiate purchasing conditions, prevent monthly overdrafts, and ensure operational continuity which can be very important in the preservation of investor confidence.

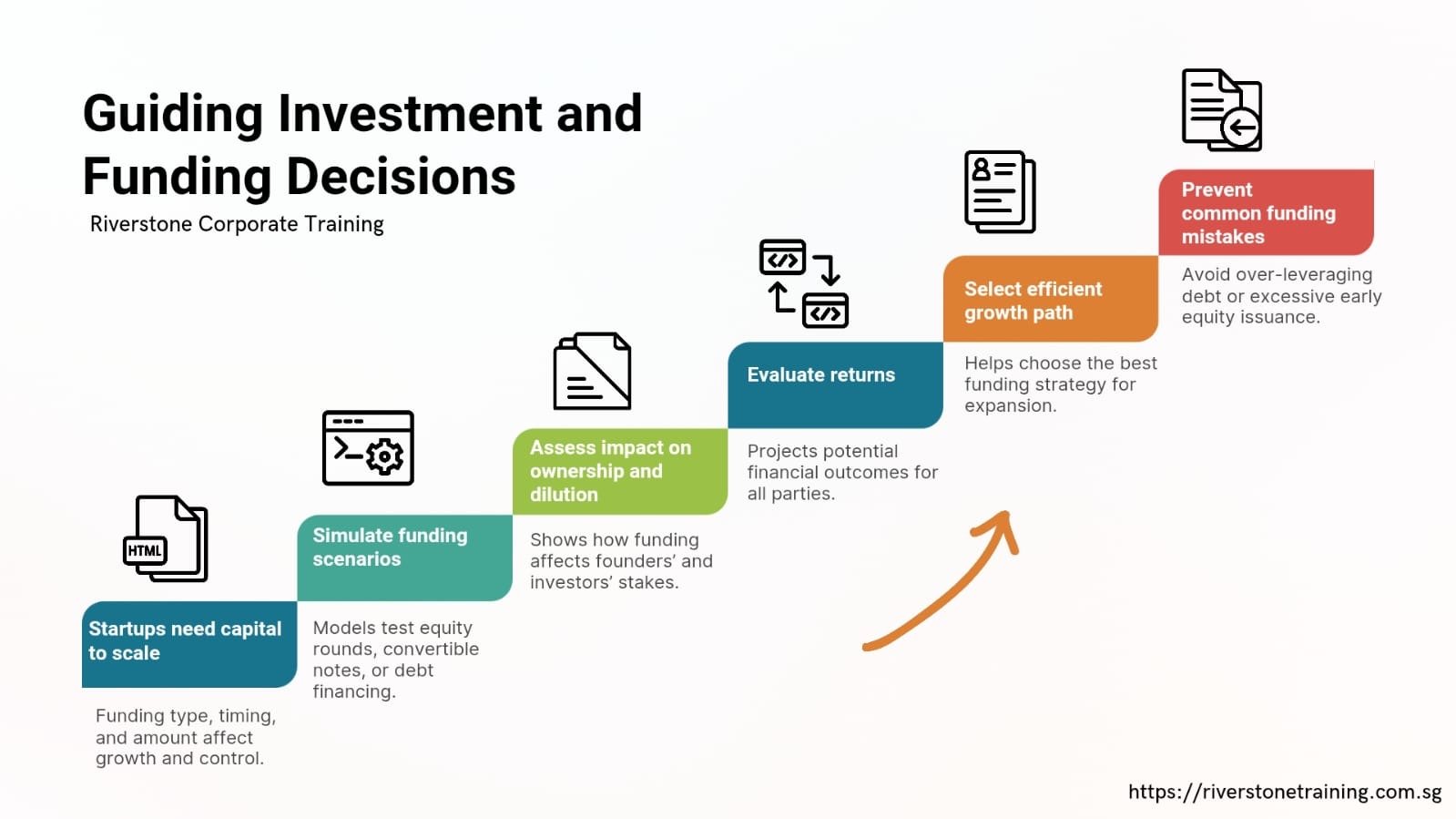

Guiding Investment and Funding Decisions

The type, timing, and quantity of funding a startup requires to scale affect the equity, control, and future flexibility greatly. Financial models have the ability to emulate different funding options such as equity rounds, convertible notes, or debt financing, and display their impact of the ownership participations as well as dilution and returns of both founders and investors.

Why it is important: Funding strategies modeling allows founders to choose the most effective direction to develop a company and write some convincing and fact-based stories to present to potential investors. It also eliminates typical errors such as usual over leveraging in debts or excessive equity issuance too early which leads to loss of control or major problem of hindering further financing choices.

Scenario and Sensitivity Analysis

Customers and markets are unpredictable. Sensitivity analysis will enable the founders to change certain key assumptions in the model i.e. the growth rate, the cost of acquiring customers, or the churn or operating cost to determine the effect of any changes. Scenario planning may mimic best and worst as well as moderate results.

Why it is important Did the startups plan ahead of volatility and how to manage risks Learning the possible variances. This makes the decision making process resilient to the market shock, regulatory changes or latest changes in the demand of the consumers. In some examples, an e-commerce startup will be able to estimate the extent to which a 20% discount in the conversion rates would impact runway and plan contingency initiatives.

Supporting Strategic Decision-Making

Financial modeling is not limited to numbers and is used to make such important strategic decisions: prices and staffing arrangements, selling at investment decisions, product and growth and malleus penetrations into our plan. Founders have an opportunity to predict what will work and what will not by making decisions in advance, since it lowers the likelihood of actions that consume resources unnecessarily, and focus on those that will deliver the most long-term benefits.

Why this is important: The financial course Singapore of strategy can decrease the reactive decision making process, enhance better allocation of resources and also promotes growth that is sustainable. More precisely, a startup can see which of investing in automated marketing equipment and additional sales staff gives better returns to recruit more sales workforce or to hide and be mobile.

Conclusion: From Numbers to Sustainability

Uncertainty is made certain through financial modeling. It provides startups with a systematic growth plan, a risk management instrument, and a system to convey prospects to the investor.

With the use of powerful models, founders retrieve difficulties, assess trade-offs and decide wiser and concerning the future. In addition to surviving, financial modeling will help startups to weigh-off short term operational requirements against long-term strategic requirements, to develop a sustainable business that can be made to survive the aggressive competitive, unpredictable markets.