3 better benefit Real Estate Financial Models

3 Best Benefit Real Estate Financial Models

Introduction: Why Models Matter

Real estate investing is not just about location or timing—it’s also about understanding the numbers. Investment decisions are most effective when grounded in a clear assessment of a property’s performance, value, and risk. Financial valuation provide a structured framework to evaluate these factors, helping investors make informed choices based on data rather than intuition alone.

However, no single model can capture the full picture. Each model has its strengths and limitations, so savvy investors combine multiple approaches to gain a more balanced view. By doing so, they can make investment decisions that are measured, objective, and better equipped to navigate market uncertainties.

Discounted Cash Flow (DCF) for Real Estate Financial Models

How it works: The DCF model projects all expected future cash flows from a property, including rental income minus operating expenses, maintenance costs, and capital expenditures. These future cash flows are then discounted back to their present value using an appropriate discount rate, which reflects the time value of money and the operational risk management profile of the investment.

Best use: DCF is particularly useful for long-term real estate investments where growth potential, income stability, and sustainability are key factors. It is ideal for properties expected to generate cash flows over many years, such as commercial office buildings, multi-family complexes, or long-term rental assets.

Why it matters: By capturing the time value of money and incorporating risk through the discount rate, the DCF model provides a nuanced understanding of whether projected returns justify the current purchase price. It helps investors evaluate the intrinsic value of a property and make informed decisions based on expected performance rather than just historical data.

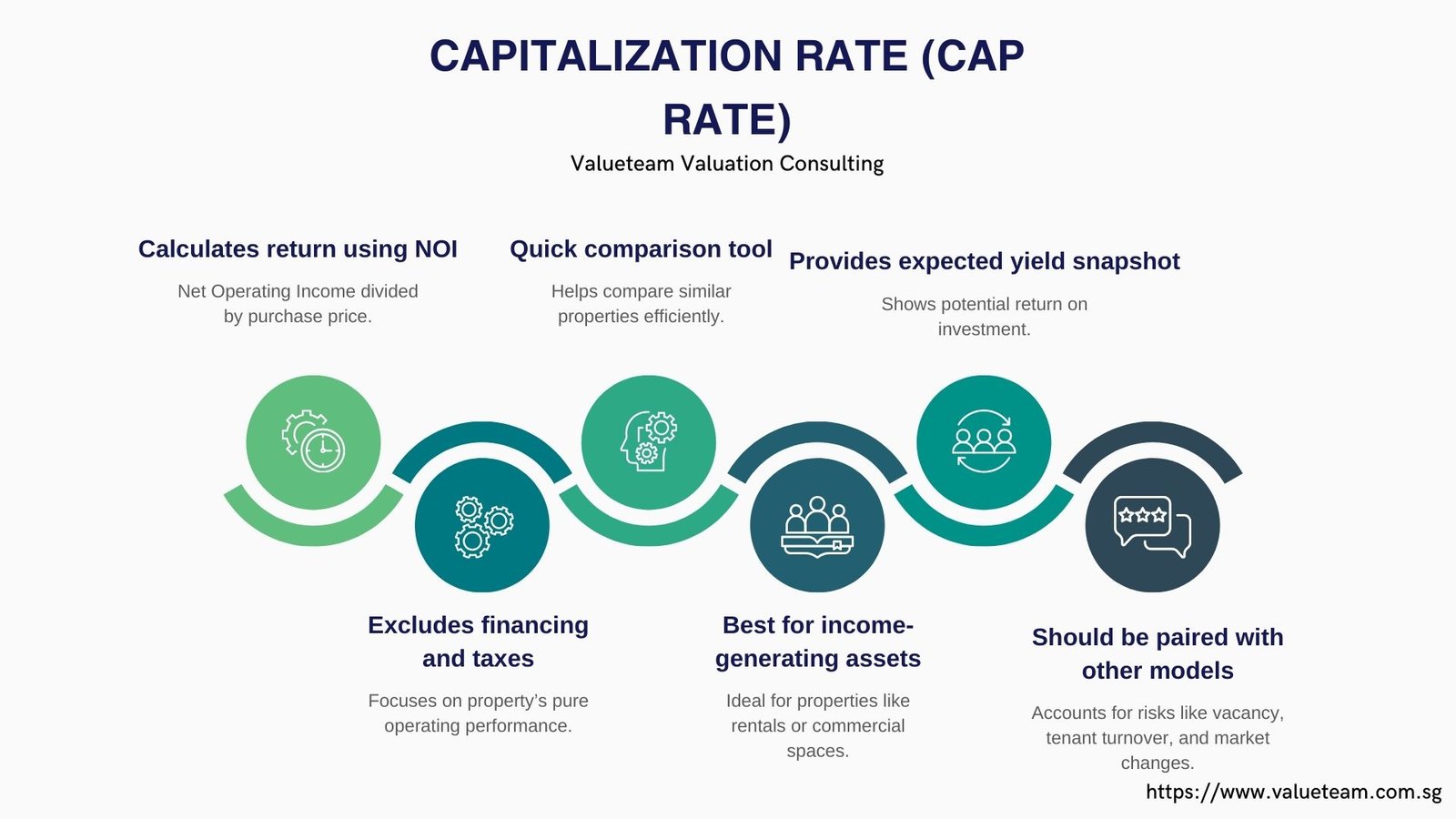

Capitalization Rate (Cap Rate)

How it works: The Cap Rate is calculated by dividing the property’s Net Operating Income (NOI) by its purchase price. NOI represents all income generated by the property minus operating expenses but before financing costs and taxes.

Best use: Cap Rate is a quick and efficient way to compare potential returns across different properties, particularly when evaluating similar asset types in comparable locations. It is often used by investors looking for a fast assessment of income-generating properties.

Why it matters: The Cap Rate provides a snapshot of the expected yield from an investment. While it’s useful for initial comparisons, it should always be paired with other models to account for risks such as tenant turnover, vacancy rates, rent growth potential, and local market dynamics.

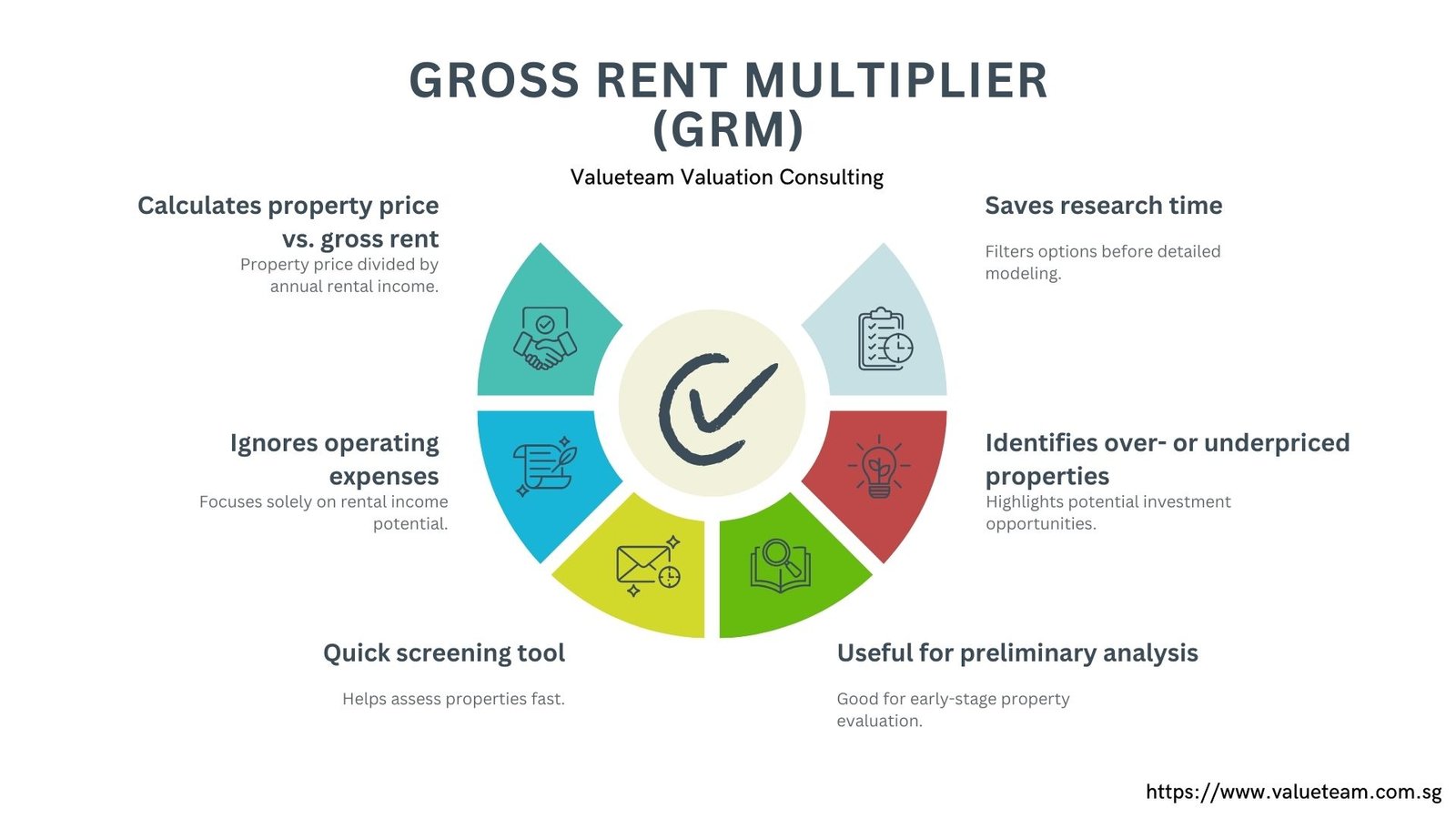

Gross Rent Multiplier (GRM)

How it works: GRM is calculated by dividing the property price by the gross annual rental income. Unlike Cap Rate, GRM does not consider operating expenses.

Best use: GRM is an effective screening tool for rental properties, helping investors quickly assess whether a property’s asking price aligns with potential rental income. It’s particularly useful for preliminary analysis before committing time to more detailed financial modeling.

Why it matters: This model helps investors identify properties that may be overpriced or undervalued at a glance. By quickly filtering opportunities, GRM allows for more efficient use of research and analysis resources.

Comparable Sales (Comps)

How it works: Comps analysis involves reviewing recent sales of similar properties in the same area to determine a market-aligned value. Factors such as property size, condition, age, location, and amenities are taken into account.

Best use: Comps are ideal for valuing residential or commercial properties in active and transparent markets. They are particularly useful for understanding local pricing trends and market expectations.

Why it matters: Using comps ensures that investors do not overpay relative to similar properties and helps validate valuations derived from other models. It also provides insight into market liquidity and buyer demand.

Sensitivity and Scenario Analysis

How it works: Sensitivity and scenario analysis test how changes in key assumptions—such as rent growth, interest rates, vacancy rates, or operating expenses—impact projected returns. Investors can model multiple “what-if” scenarios to see best-case, worst-case, and most likely outcomes.

Best use: These analyses are critical for stress-testing investment strategies under uncertain or volatile market conditions. They are especially useful for properties with higher risk factors or longer investment horizons.

Why it matters: Sensitivity and scenario analysis reveal vulnerabilities that may not be obvious in static models. They allow investors to prepare contingency plans, optimize financing structures, and make more resilient investment decisions.

Strategic Tip: Layer the Models

Instead of relying on a single model, investors should use multiple models together to gain a comprehensive view. For example:

- Start with GRM to quickly filter potential properties.

- Apply Cap Rate and Comps for market validation and a more refined income perspective.

- Use DCF to assess intrinsic value over the long term.

- Incorporate Sensitivity Analysis to evaluate risk and prepare for market volatility.

By layering models, investors minimize blind spots, increase confidence in their decisions, and ensure that both short-term yield and long-term growth potential are considered in their investment strategy.

Conclusion: Smarter Decisions Through Models

Using multiple financial models is not about making investing more complicated—it’s about gaining clarity. Each model provides a different lens, from quick overviews of cash flow to detailed forecasts of long-term returns. By integrating these perspectives, investors can better identify risks, uncover opportunities, and make decisions grounded in comprehensive analysis.

In real estate, relying on a single metric can be misleading. The most informed choices come from considering the full picture that multiple models provide, ensuring investments align with both short-term performance and long-term strategic goals.